Gold price today March 8, 2025 increased at the beginning of the trading session in the US market. Domestic gold price is stable, gold ring set a new record of 93.4 million VND/tael yesterday.

At the end of the session on March 7, the price of gold bars at SJC closed at 91.3-93.1 million VND/tael (buy - sell), an increase of 600 thousand VND/tael in both buying and selling compared to the previous trading session.

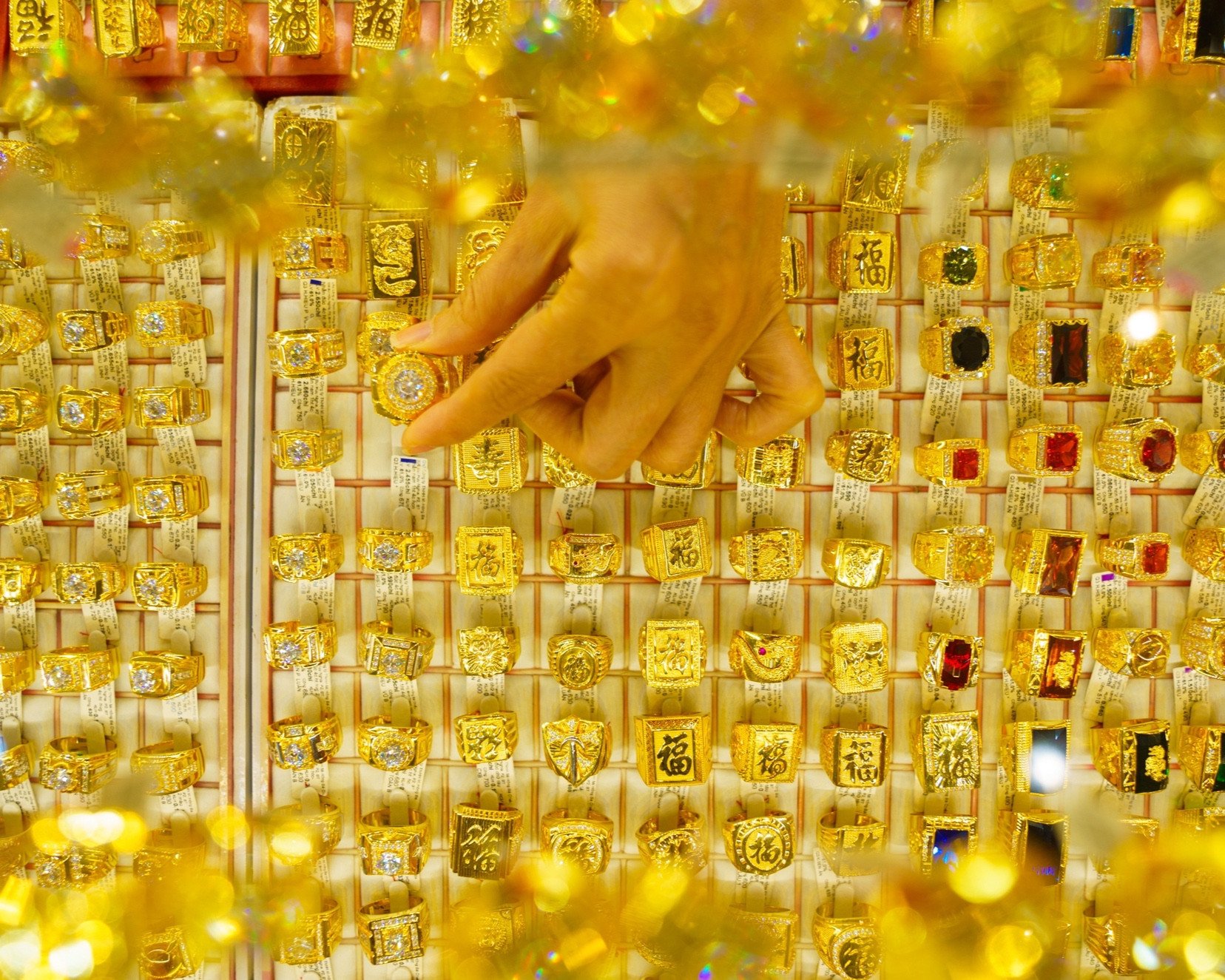

At the end of the session, the price of 1-5 chi SJC gold rings was listed at 91.1-93 million VND/tael (buy - sell), an increase of 400 thousand VND per tael in both buying and selling compared to the previous day's closing price.

The price of 9999 gold rings at Doji closed the session at 91.8-93.4 million VND/tael, an increase of 400,000 VND per tael in both buying and selling compared to the previous day's closing price.

Today's gold price on Kitco at 8:00 p.m. (March 7, Vietnam time) was trading at $2,914/ounce. Gold futures for April 2025 delivery on the Comex New York floor were trading at $2,928/ounce.

The US government is withdrawing from the international spotlight to focus on domestic development, while Europe is trying to attract investors. This will continue to support gold prices.

In an interview with Kitco News, Axel Merk, chief investment officer of Merk Investments, analyzed that the world is changing, new powers are emerging. Investors are concerned about the global trade war and potential currency war as capital begins to flow back to Europe.

The surge in European stocks came as Germany announced a historic deal to boost spending on defense and infrastructure. The European Union also plans to spend nearly €800 billion on defense. The British government said last week it would increase defense spending by £6 billion a year, taking it to 2.5% of GDP by 2027.

In other news of note, the European Central Bank cut its key interest rate by 0.25%, as expected.

While Europe has room to increase spending to boost its military and infrastructure, that doesn’t change the big picture, Merk added. Global deficit spending continues to rise, creating more uncertainty.

This expert commented that as risks increase, investors are looking for safe havens in gold. This demand ensures that gold has a positive outlook in the near future.

Despite the US adopting more domestic policies, Merk does not see the US dollar losing its reserve currency status. While a multipolar currency world will provide global support for gold, Merk expects domestic investment demand to continue to rise. Weak growth continues to support gold prices as the US Federal Reserve is forced to cut interest rates.

Markets have begun pricing in two rate cuts this year, as data from the Atlanta Fed showed economic growth contracted 2.4% in the first quarter.

The USD has experienced a sharp sell-off this week, falling more than 3% against major currencies as markets reacted to the sweeping new tariff policies implemented by the Trump administration.

The US Dollar Index (DXY), which measures the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stood at 103.76 points.

The yield on the 10-year US government bond hit its highest level in more than a week, reducing the appeal of gold.

Gold Price Forecast

The recovery of gold prices near historic highs shows that investors are seeking safety amid growing economic concerns, experts say.

Market participants increasingly see precious metals as a hedge against potential economic turmoil, as new tariffs accelerate inflation while slowing global economic growth.

Concerns about US tax policy pushed gold prices to a record high of $2,956.15 on February 24 and they have risen more than 11% so far this year, said Yeap Jun Rong, a market expert at IG. Gold is considered a tool to preserve assets against political instability and inflation.

This expert predicts that the price of $3,000/ounce for gold is increasingly feasible as the gold price continues its upward trend after the adjustment period.

Analyst Fawad Razaqzada said that the Fed is likely to cut interest rates more amid weak economic data. Accordingly, gold prices will remain near the high and may reach $ 3,000 / ounce in the near future.

Source: https://vietnamnet.vn/gia-vang-hom-nay-8-3-2025-dao-chieu-tang-vang-nhan-lap-ky-luc-moi-2378489.html

Comment (0)