The LME fell and jumped after China is considering approving the issuance of more than 10 trillion yuan ($1.4 trillion) of additional debt over the next few years to revive its fragile economy next week.

Three-month copper on the London Metal Exchange (LME) CMCU3 was little changed at $9,531.50 a tonne, having earlier gained as much as 1.3%.

U.S. Comex copper futures HGc1 rose 0.4% to $4.35 a lb.

"The market has been waiting for the announcement of the fiscal stimulus package and it looks like it's a big number. That raises hopes and helps improve market sentiment," said Amelia Xiao Fu, head of commodity market strategy at Bank of China International.

The package includes 6 trillion yuan to address local government debt risks and 4 trillion for purchasing idle land and real estate.

“I don’t think anyone knows the exact numbers, but if they announce a big package, then maybe that’s a sign of their real determination to support the economy,” Fu said.

The most-traded December copper contract on the Shanghai Futures Exchange (SHFE) SCFcv1 fell 0.2 percent to 76,500 yuan ($10,711.14) a tonne.

The package is expected to be approved by China's top legislature on the final day of its meeting, which will be held from November 4 to 8.

Copper demand has been hit by slowing global growth, particularly in China, although some consumption sectors remain strong, such as solar and wind power.

“While people are still talking about a copper concentrate shortage next year, it is still a problem of overcapacity globally. Demand will slow down in the long term,” said one trader, who sees a potential peak price of $10,500 in 2025.

Among other metals, LME aluminium CMAL3 rose 0.5% to $2,658.50 a tonne while zinc CMZN3 fell 1.1% to $3,105, nickel CMNI3 fell 0.8% to $15,880, lead CMPB3 fell 1.5% to $1,999.50 and tin CMSN3 fell 0.7% to $31,225.

Source: https://kinhtedothi.vn/gia-kim-loai-dong-ngay-30-10-tang-tro-lai.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

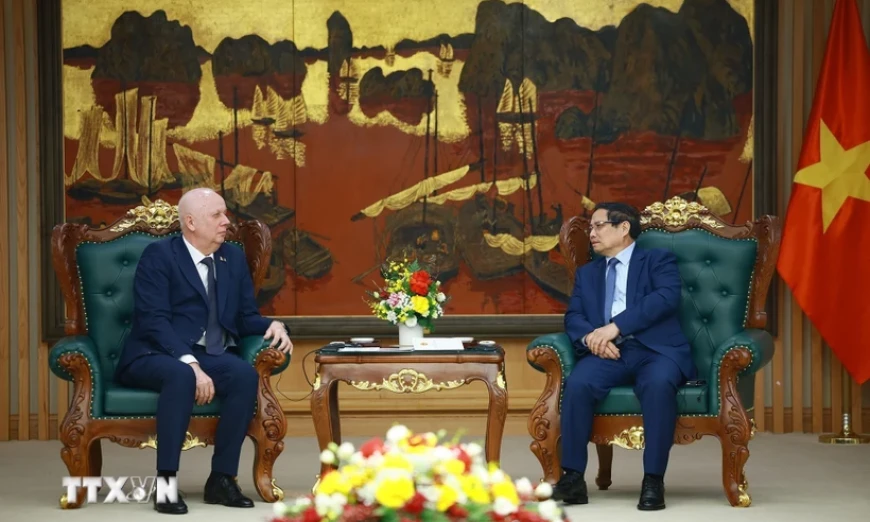

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Podcast] News on March 26, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/c3d9c3c48b624fd9af79c13ff9e5c97a)

Comment (0)