| Commodity market today, March 25: World raw material prices fluctuate strongly Commodity market today, March 26: Commodity market receives positive buying force |

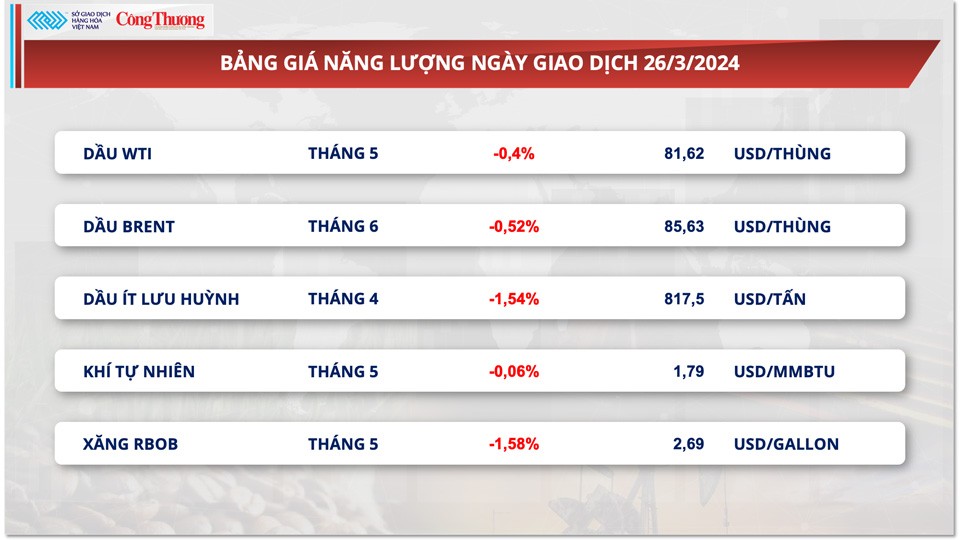

At the end of the day, the MXV-Index of 3/4 commodity groups in red pulled the MXV-Index down 0.58% to 2,223 points. The total transaction value of the entire Exchange was over VND5,200 billion.

Wheat prices plunge more than 2%

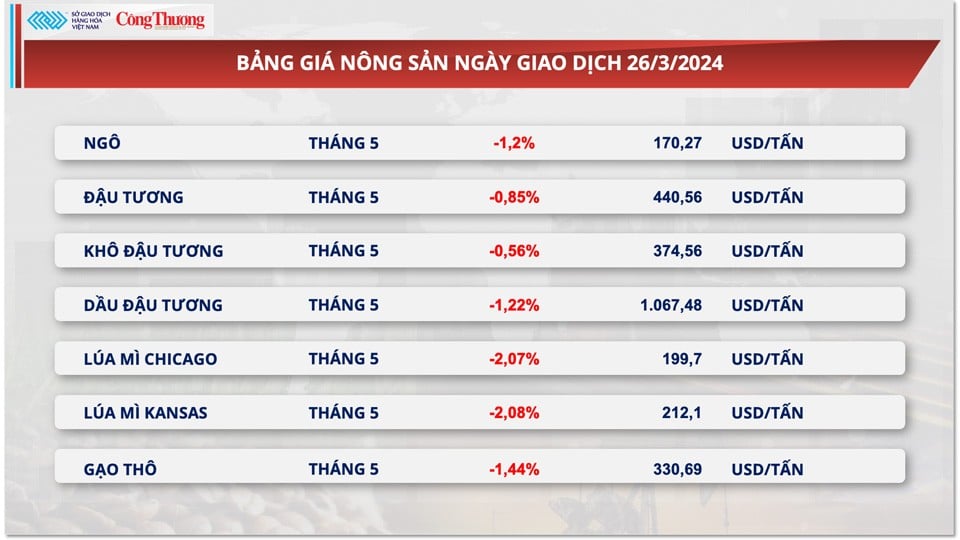

At the close of trading on March 26, the prices of all 7 agricultural products were under selling pressure. Of which, wheat was the leading commodity in the decline when it plunged more than 2%. According to MXV, in addition to the market's profit-taking pressure, prices continued to face strong competitive pressure from abundant supply in the Black Sea region. Specifically, SovEcon said that Russia exported 1.14 million tons of wheat last week, up from 0.93 million tons a week earlier. SovEcon also forecast that the country's wheat exports in March could reach a record 5 million tons, compared to 4.8 million tons in the same period in 2023.

|

| Wheat prices plunge more than 2% |

Corn prices also extended their decline for the third consecutive session. After a tug-of-war in the early part of the session, selling pressure intensified in the evening session as the market reacted to positive signals about Brazil's production prospects. The May contract ended the session down a sharp 1.2%.

|

| Agricultural product price list |

According to CONAB, the first corn harvest in Brazil’s 23/24 crop year has reached 42.8% of the planned area, up from 41.9% at the same time last year. As for the second crop, planting is also nearing completion, with 96.8% of the area completed, compared to 91.1% at the same time last year. Overall, field work in the South American country is still going relatively smoothly, minimizing the risk of planting the second corn crop outside the ideal time frame.

In addition, Brazil's National Meteorological Institute (Inmet) said that the country received good rainfall across the country on March 26. According to Inmet, the rains will continue in the central-western region of Brazil throughout this week. Expectations of more favorable weather will help recover and support the development of crops in the region, while strengthening the country's supply outlook for this year. This was the main factor that had a "bearish" impact on corn prices last night.

In the US, the majority of the market is forecasting the MY24/25 corn acreage published in the Prospective Planting 2024 report at 91.78 million acres. This is higher than the 91 million acres given at the previous Ag Outlook conference, reflecting the market’s expectation that the US crop will be larger than expected this year. This information also contributed to the pressure in the last session.

In the domestic market, on the morning of March 26, the price of imported South American corn to our country's ports increased slightly. At Cai Lan port, South American corn futures for April delivery were at 6,500 - 6,550 VND/kg. For the May delivery period, the asking price fluctuated at 6,350 - 6,500 VND/kg. Meanwhile, the asking price of imported corn at Vung Tau port was recorded 100 VND/kg lower than the transaction price at Cai Lan port.

Red hot metal market

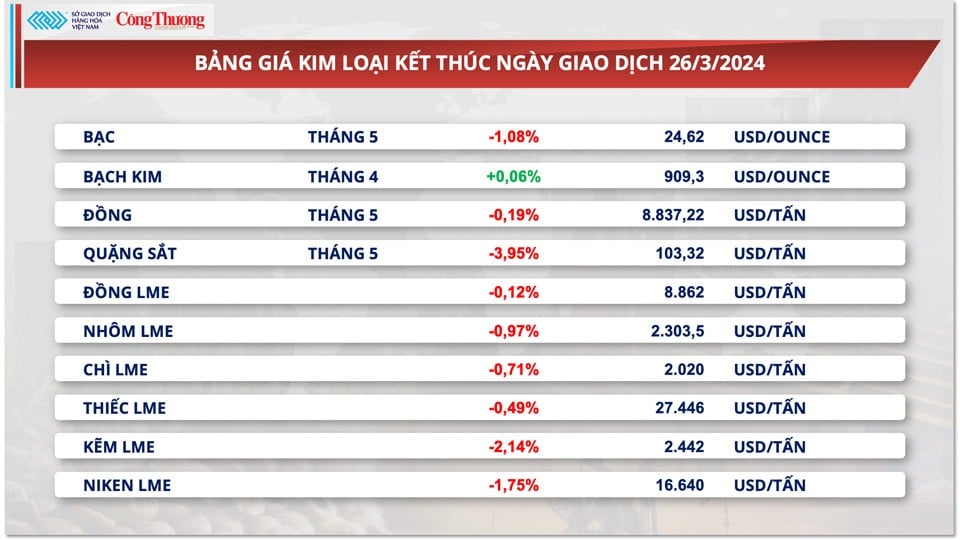

At the end of yesterday's trading day, the metal price chart was almost completely covered in red. For precious metals, silver prices fell 1.08%, stopping at 24.62 USD/ounce. In contrast, platinum prices increased for two consecutive sessions, closing at 909.3 USD/ounce thanks to a modest increase of 0.06%.

Precious metals prices were pressured as investors were cautious ahead of a key US inflation report, especially amid mixed signals about the Federal Reserve's interest rate outlook. Chicago Fed President Austan Goolsbee said he expected three rate cuts this year, while Fed Governor Lisa Cook warned the Fed needed to proceed carefully when deciding when to start cutting rates.

|

| Metal price list |

Still, platinum prices are rising amid concerns about supply disruptions in South Africa, the world’s largest platinum producer. South Africa’s state-owned utility Eskom plans to implement phase two of the load shedding, removing 2,000 megawatts from the grid, according to Bloomberg. The outage process is still underway and there has been no further announcement from Eskom.

For base metals, iron ore prices recorded the sharpest decline in the group, losing 3.95% to $103.32 a tonne, the lowest in a week. In the morning session, prices received positive buying pressure after Fitch Ratings raised its forecast for iron ore prices to $105 a tonne this year, $90 a tonne in 2025 and $85 a tonne in 2026, up from $95 a tonne, $80 a tonne and $75 a tonne, respectively.

However, prices quickly reversed course as investors remained skeptical about demand in China. Data from consultancy Mysteel showed that seaborne iron ore shipments into China fell 73.4% from last Friday to 380,000 tonnes on Monday.

In another development, COMEX copper prices had a rather choppy trading session, ending the session with a slight decrease of 0.19% to 4 USD/pound. On the one hand, the sluggish consumption factor still put pressure on prices. On the other hand, copper buying pressure was triggered by expectations that China will increase economic stimulus to achieve its ambitious growth target of about 5%.

Specifically, according to the median estimate in a Bloomberg survey, the People's Bank of China (PBOC) is expected to implement two more cuts to the reserve requirement ratio (RRR) this year, one more than the previous survey. In addition, the PBOC is likely to cut the medium-term lending rate and the loan prime rate starting in the second quarter.

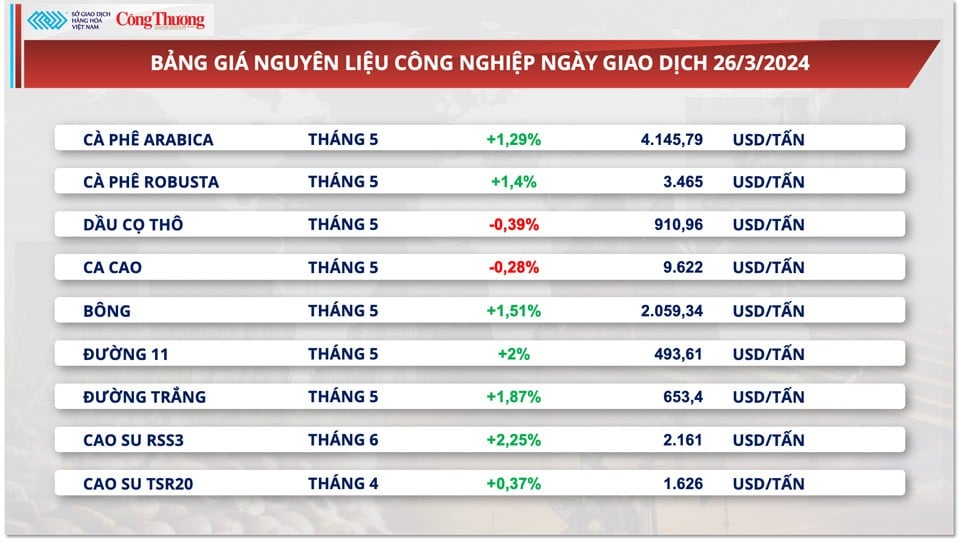

Prices of some other goods

|

| Industrial raw material price list |

|

| Energy price list |

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)