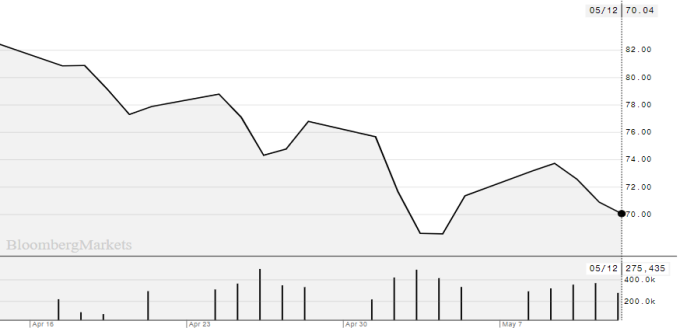

WTI prices fell below $70 per barrel on concerns about oil demand, as both the US and Chinese economies are in trouble.

Brent crude is currently trading at $73.8 a barrel. US WTI crude is down to $69.7.

This is the fourth consecutive decline for both types of oil. WTI alone has just recorded its fourth weekly loss – the longest since September 2022.

WTI crude oil price movements over the past month.

Negotiations to raise the debt ceiling to prevent the US from defaulting on its debt are still underway, with US Treasury Secretary Janet Yellen warning that the agency could run out of money as early as June 1.

Oil demand is very weak. Crude prices have fallen 13% this year on concerns about a recession in the United States, the world’s top oil consumer. These concerns have even outweighed the impact of supply cuts by the Organization of the Petroleum Exporting Countries and its allies (OPEC+).

China has yet to fully recover from the lifting of its Zero Covid policy. Inflation is at a two-year low, factory activity is shrinking, and the real estate sector remains depressed.

Refinery margins are also low. Hedge funds and asset managers are bearish on Brent crude at their highest level since July 2021. Investors are awaiting more key economic data from China this week to gauge the pace of its recovery. The International Energy Agency (IEA) will also release its monthly report on May 16.

"The sentiment in the oil market remains negative. The demand outlook is uncertain. Concerns about the US debt ceiling remain. The market is probably waiting for the IEA's assessment of the demand outlook," said Warren Patterson, head of commodity strategy at ING Groep.

Ha Thu (according to Bloomberg)

Source link

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)