At the end of yesterday's trading session, Arabica coffee prices increased by 2.8% to nearly 6,700 USD/ton, Robusta coffee prices increased by more than 3% to 4,770 USD/ton.

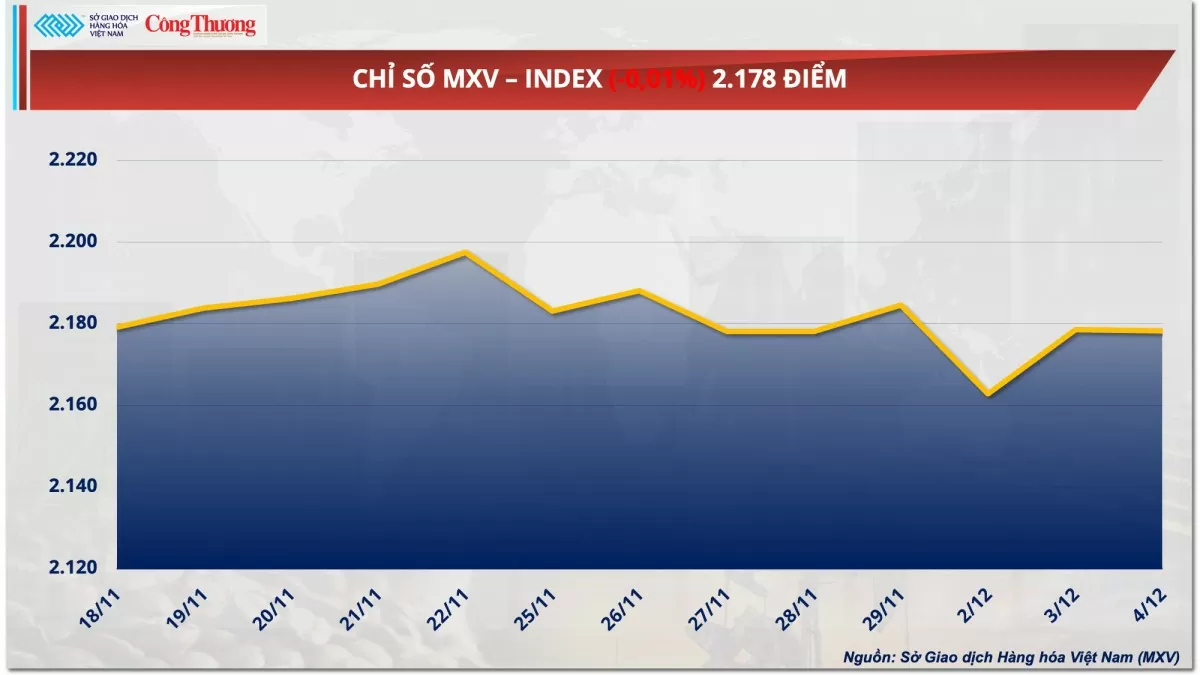

The Vietnam Commodity Exchange (MXV) said that the world raw material market had mixed developments in yesterday's trading session (December 4). At the close, the MXV-Index remained almost unchanged, still standing at 2,178 points. Two coffee products continued to attract attention in the industrial raw material market when they turned around and increased by 3% after three previous sessions of decline. On the contrary, in the energy market, after receiving not-so-positive information about the US economy, the prices of similar crude oil products weakened.

|

| MXV-Index |

Coffee prices reverse and recover after a series of declines

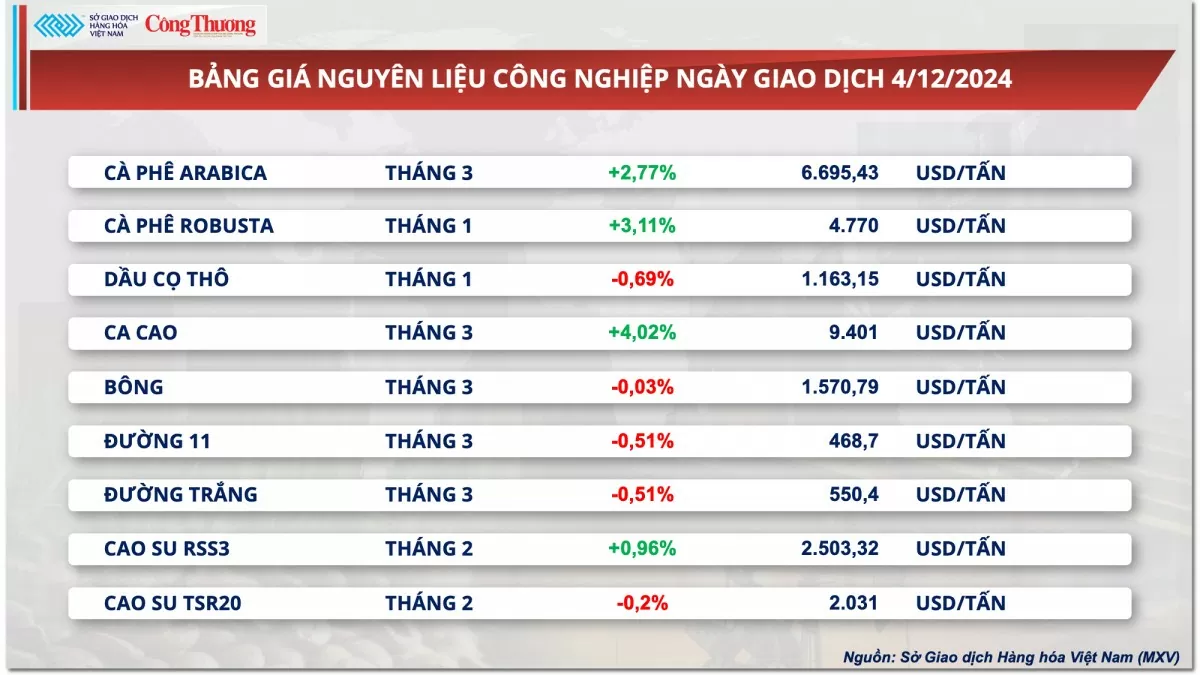

At the end of yesterday's trading session, the price list of industrial raw materials was clearly differentiated. In particular, two coffee products stood out with green when prices simultaneously increased after three consecutive sessions of decline. Specifically, Arabica coffee prices increased by 2.8% to nearly 6,700 USD/ton, Robusta coffee prices increased by more than 3% to 4,770 USD/ton. The increase was supported by concerns about supply in major producing countries.

|

| Industrial raw material price list |

In Brazil, below-average rainfall since April in the main coffee-producing region has continued to worry about coffee production in the world’s largest coffee exporter. Somar Meteorologia reported that rainfall in Minas Gerais, Brazil’s largest Arabica coffee-growing state, was 17.8 mm last week, or 31% of the historical average.

Previously, consulting firm Hedgepoint in its global market report predicted Brazil's coffee output for the 2025-2026 crop year to be around 65.2 million bags. Of which, Arabica coffee output is expected to be at 42.6 million 60kg bags, down slightly by 1.4% compared to the previous crop due to unsuitable weather conditions for crop growth.

In Vietnam, rains are still occurring in some areas of the Central Highlands, disrupting farmers' coffee harvesting activities. This concern has prompted investors to participate in the derivatives market with large purchasing power. Especially when La Nina is forecast to operate during the main harvest season, it can cause heavy rains in Vietnam's key coffee growing areas. Adverse weather not only affects harvesting activities but also causes problems in the logistics chain, leading to the possibility that the supply of new coffee crops from Vietnam to the international market will be lower and slower than usual.

In the domestic market, coffee prices in the Central Highlands and Southeast this morning (December 5) were recorded at 108,000 - 109,500 VND/kg, an increase of 2,500 - 3,000 VND/kg compared to December 4. However, compared to the same period last year, coffee prices have now doubled.

Early yesterday morning (December 4) Vietnam time, European Union (EU) negotiators rejected a proposal to relax the EUDR, only agreeing to keep the plan to postpone the implementation period for another year. This decision goes against the proposal by EU parliamentarians last month to create a "zero risk" category for some countries, which would significantly reduce inspection requirements.

World crude oil prices cool down

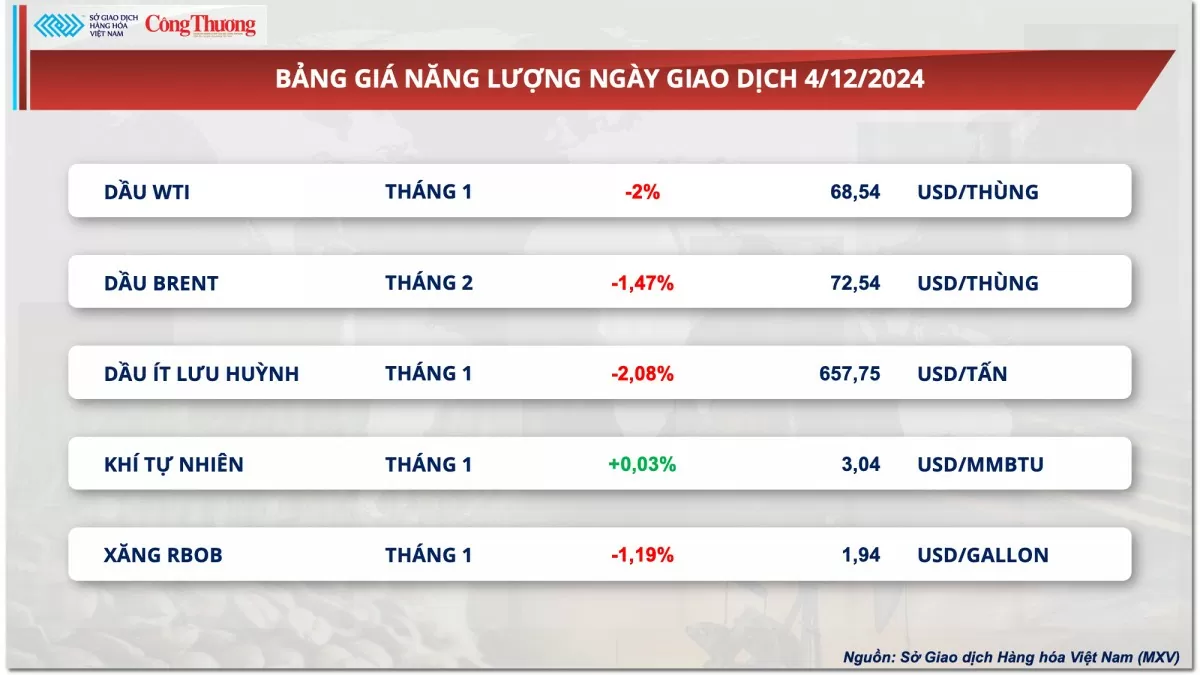

According to MXV, at the end of yesterday's trading session, crude oil prices reversed sharply after the market recorded negative economic data from the US.

|

| Energy price list |

Closing, WTI crude oil price decreased by 2% to 68.54 USD/barrel. Brent crude oil price decreased by 1.47% to 72.54 USD/barrel.

The Institute for Supply Management (ISM) said that the US non-manufacturing purchasing managers index (PMI) in November reached 52.1 points, down from 56 points in October and lower than the 55.5 points predicted by analysts. In addition, the ADP employment report showed that the US economy added 146,000 non-agricultural jobs in November, much lower than the market's expected increase of 166,000. Meanwhile, the number of new non-agricultural jobs in October was also revised down to 184,000, from the previously announced 233,000. The above reports painted a somewhat gloomy picture of the US economy in November and had a strong "bearish" impact on crude oil prices.

The US Energy Information Administration (EIA) weekly oil and gas report showed mixed data on crude oil and gasoline inventories. Specifically, US commercial crude oil inventories in the week ending November 29 reached 423.4 million barrels, down sharply by 5.07 million barrels compared to the previous week and far exceeding analysts' forecasts for a decrease of 1.6 million barrels. In contrast, gasoline inventories, an important indicator of energy demand, increased by 2.36 million barrels in the reporting week, marking the third consecutive week of increase. This mixed development is raising concerns about a weakening in short-term oil demand in the US.

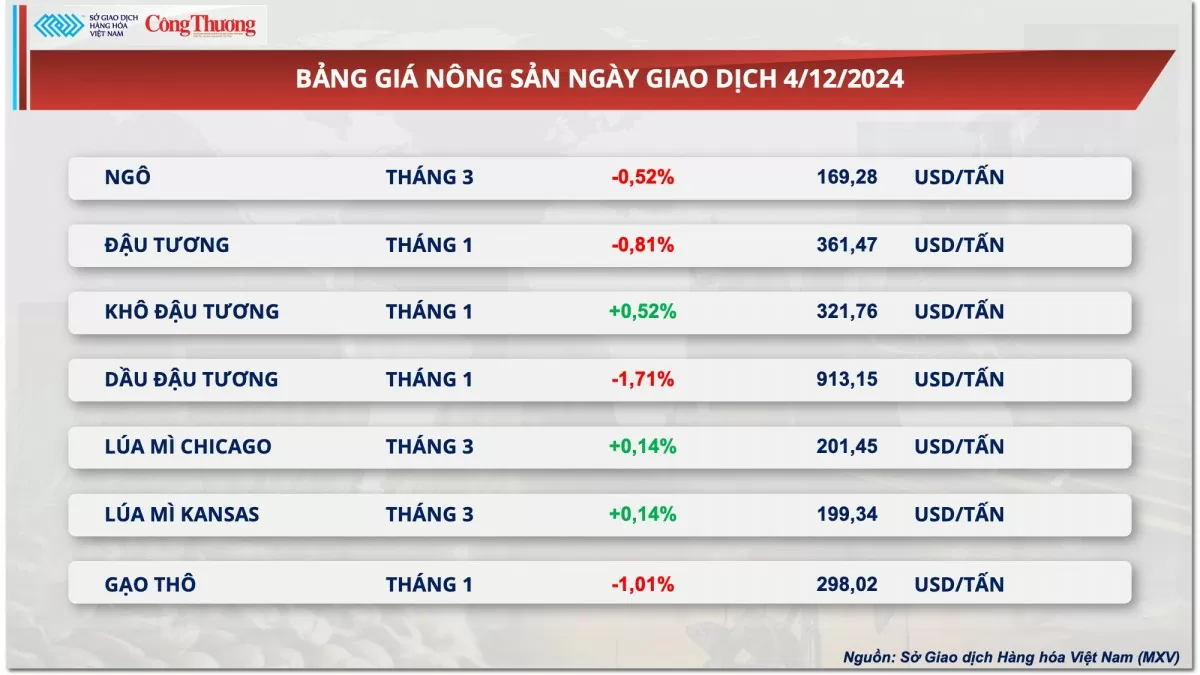

Prices of some other goods

|

| Agricultural product price list |

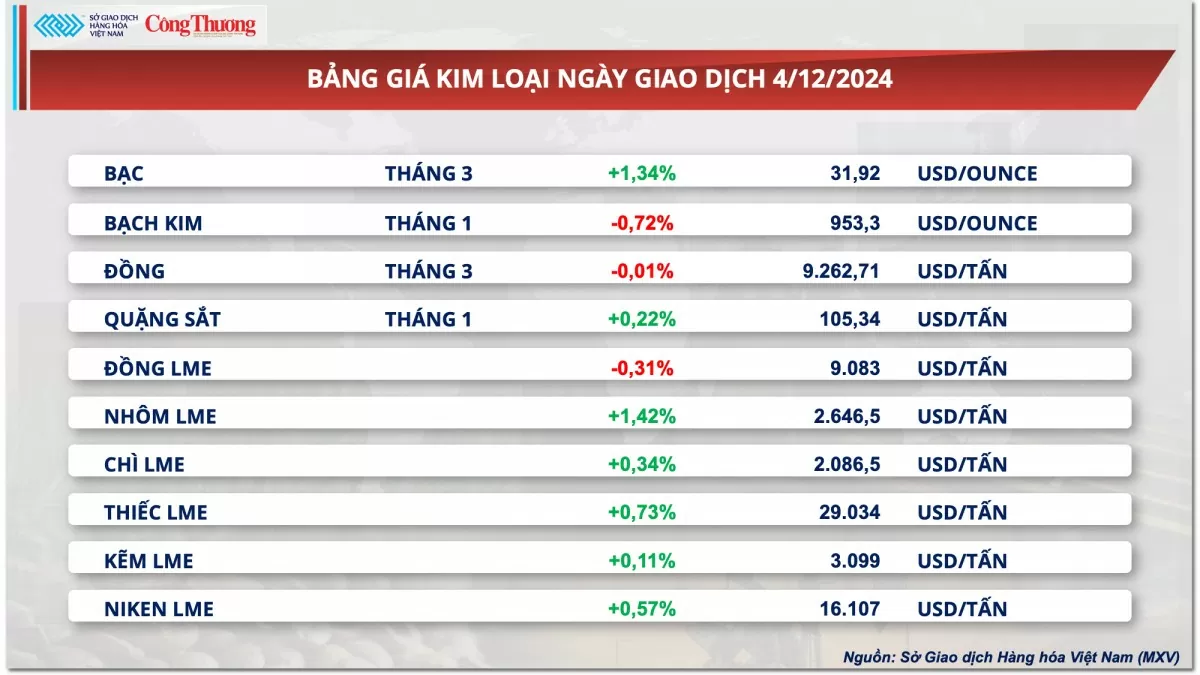

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-512-gia-ca-phe-dao-chieu-hoi-phuc-sau-chuoi-sut-giam-362587.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)