| Commodity market today September 27: Oil prices fell after news of OPEC+ increasing production Commodity market today September 30: MXV-Index 'returned' to its highest level in more than two months |

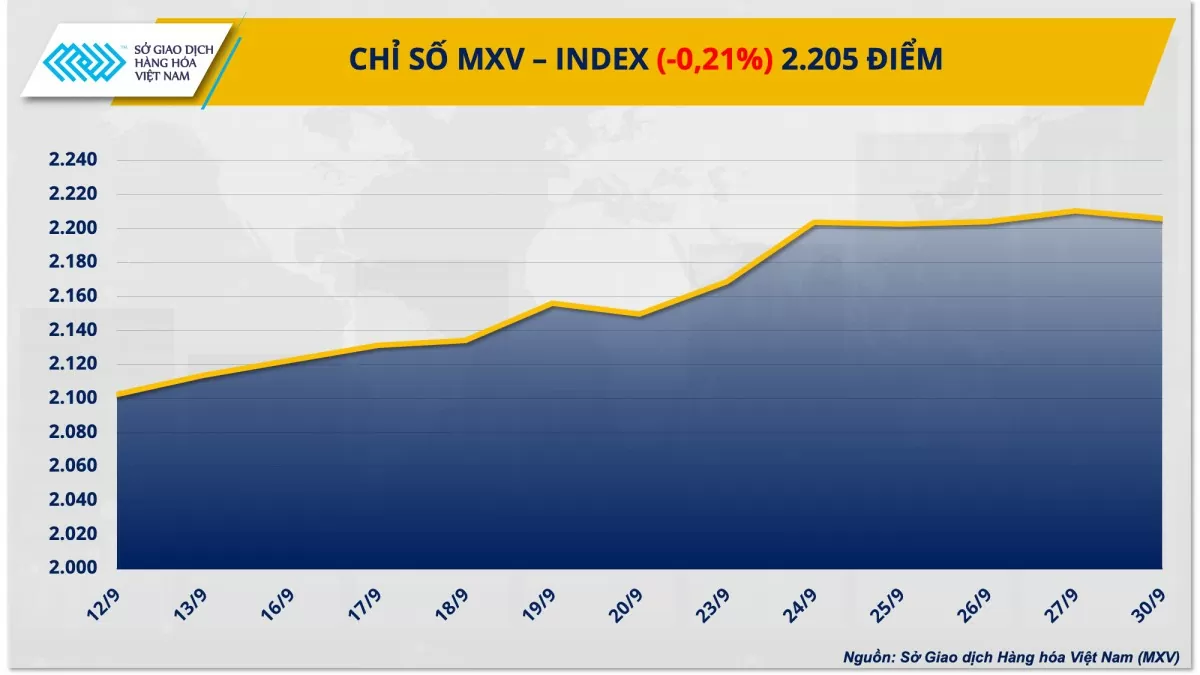

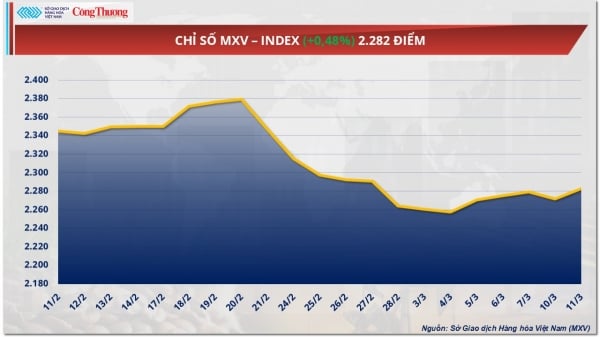

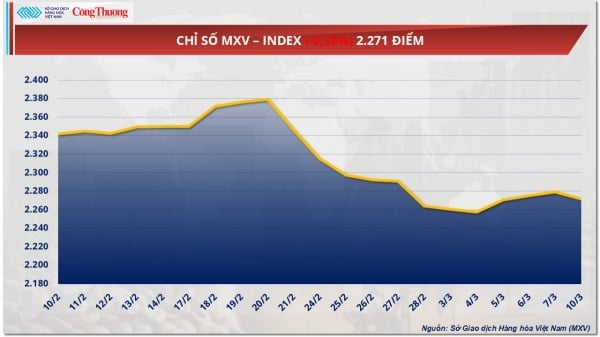

Notably, in the industrial raw materials market, cocoa prices plummeted and sugar prices continued to decline, causing the price index of the entire group to drop significantly. After the figures from the Grain Inventory Report were lower than expected, the agricultural market received strong buying power, with many commodities increasing in price. At the close, the MXV-Index fell slightly by 0.21% to 2,205 points.

|

| MXV-Index |

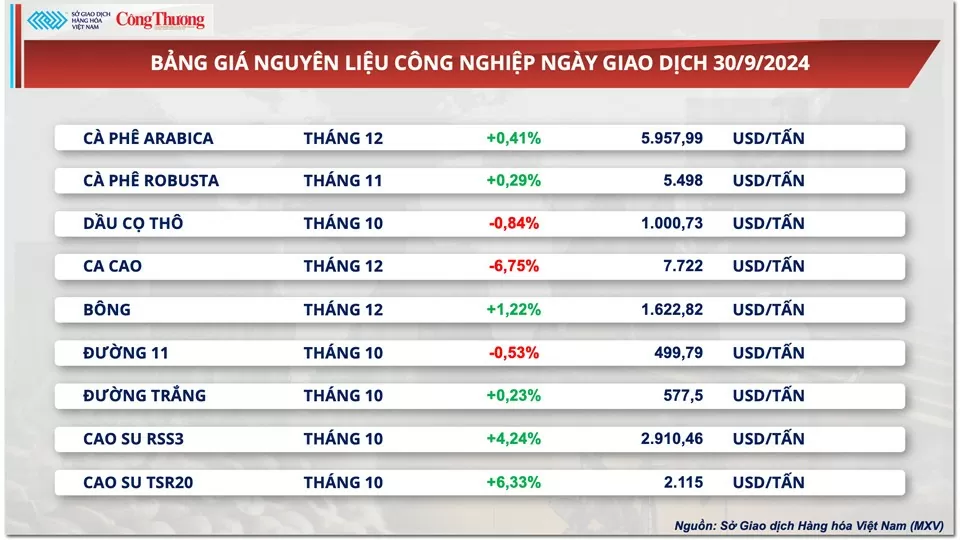

Cocoa prices plunge 7% as Ivory Coast weather improves

After five consecutive increases last week, cocoa prices started the new trading week with a sharp decline of nearly 7% compared to the reference. Favorable weather conditions for cocoa production in Ivory Coast, the world's largest producer, put pressure on prices yesterday.

According to many cocoa farmers in Ivory Coast, most of the country's main cocoa growing areas have had average but sufficient rain to promote the development of the main cocoa crop from October to March.

In another notable development on the industrial raw material price list, sugar prices fell another 0.5%, continuing the decline for the third consecutive session. Forecasts of more favorable weather for sugarcane production in October have put pressure on prices. According to the Brazilian climate forecasting agency, a cold air mass is expected to form from October 7 onwards, bringing rain to most of the Central-South region, Brazil's largest sugarcane growing region. This change in weather also leads to more positive expectations for sugarcane production as well as sugar output in Brazil.

|

| Industrial Raw Material Price List |

Corn, wheat prices extend gains after key reports

Corn prices closed the first trading session of the week up more than 1.5%, extending the upward momentum of last week. After a period of cautious volatility, the market received strong buying pressure when the figures in the Quarterly Grain Inventory Report were lower than expected.

|

| Agricultural product price list |

In this report, the US Department of Agriculture (USDA) said that total corn inventories as of September 1 reached 1.76 billion bushels, at the low end of market expectations, although still up 29% compared to the same period last year. This is a very important report because it determines the ending inventories of the 2023-2024 crop year as well as the beginning of the 2024-2025 crop year in the US. If there are no major changes, this figure will cause the USDA to reduce the beginning inventories of the 2024-2025 crop year by 52 million bushels in the October WASDE World Agricultural Supply and Demand Report. The prospect of lower inventories was the factor that drove strong buying in the market yesterday.

In addition, in the Export Inspections report, USDA said corn deliveries for the week ending September 26 were 1.14 million tons, almost unchanged from the previous week but nearly double the same period last year. Most of the corn was sold to traditional U.S. customers such as Mexico, Colombia and Japan. Less than a month into the 2024-2025 crop year, total U.S. corn exports have reached 3.33 million tons, up from 2.69 million tons last year. This brings a positive export outlook, supporting prices.

Similar to corn, wheat prices also rose slightly more than 0.5% yesterday. The market was mixed as the Small Grains Annual Summary report showed mixed figures.

The USDA said total U.S. wheat production is forecast at 1.971 billion bushels, slightly above the market average of 1.966 billion bushels but down from the latest estimate. Winter wheat production is forecast at 1.349 billion bushels, below the average. The mixed numbers are the reason prices have been choppy since the report was released.

In addition, consultancy IKAR said that the free-on-board price for wheat with 12.5% protein content at Russian Black Sea ports increased by $5 per tonne last week to $222 per tonne due to bad weather forecasts and increased shipping volumes.

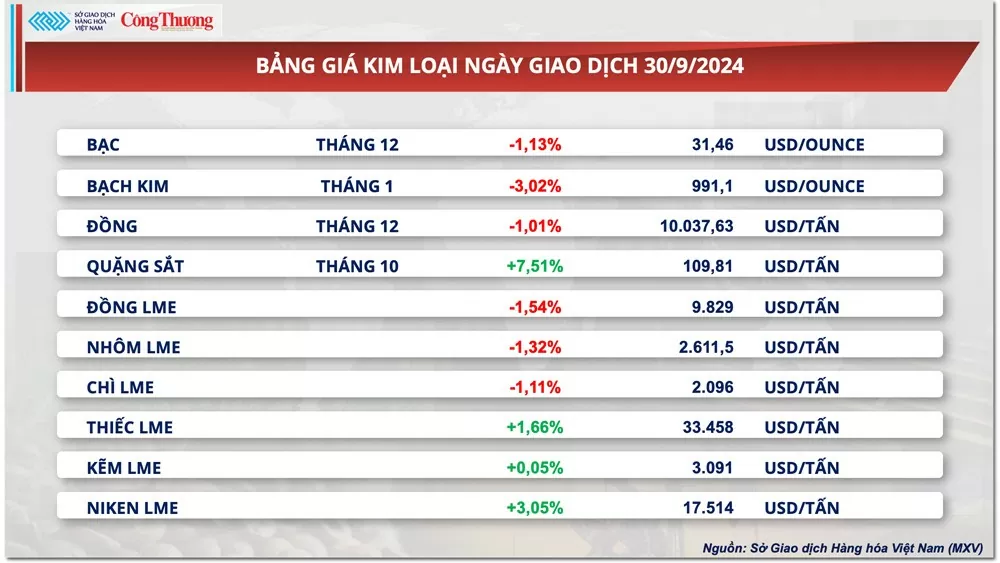

Prices of some other goods

|

| Energy price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-110-gia-ca-cao-giam-manh-gia-ngo-khoi-sac-sau-bao-cao-ton-kho-349422.html

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)