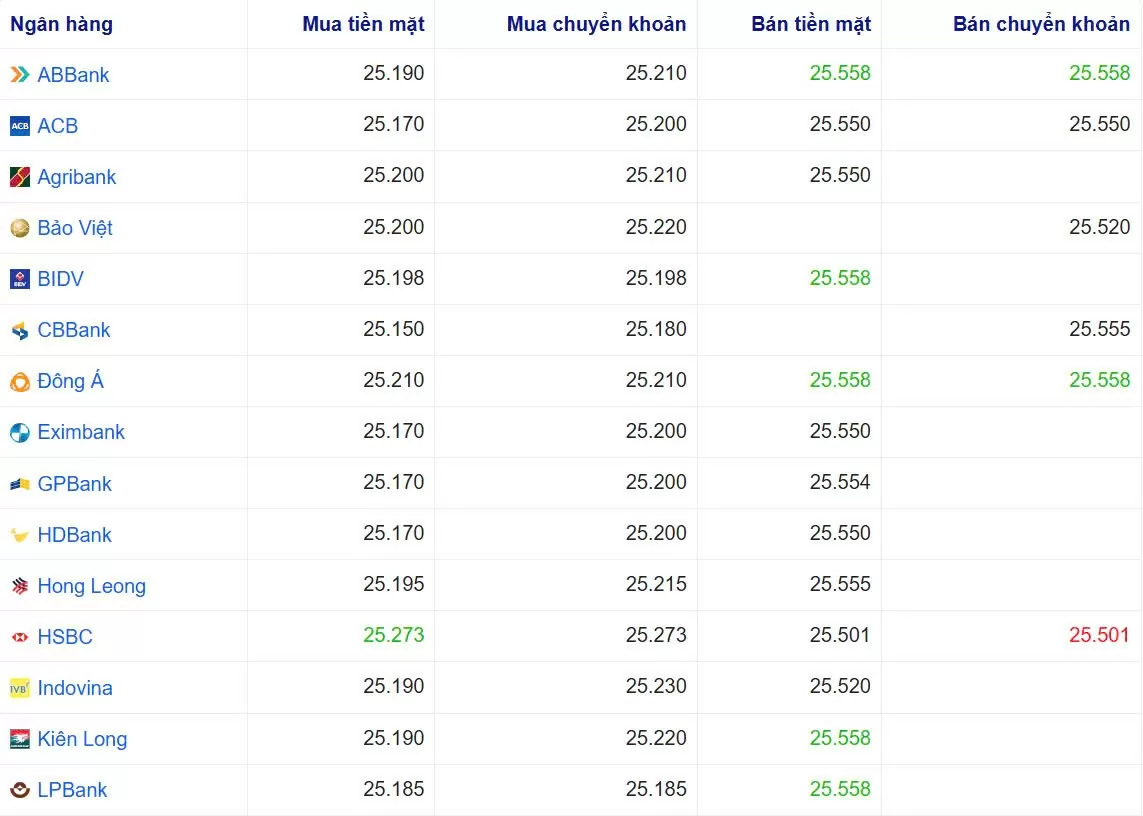

USD exchange rate today 11/01/2025

At the time of survey at 5:00 a.m. on January 11, the central exchange rate at the State Bank was currently 24,341 VND/USD, an increase of 3 VND compared to the previous trading session.

Specifically, at Vietcombank, the USD exchange rate is 25,168 - 25,558 VND/USD, an increase of 4 VND for buying and selling.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 25,273 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,558 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 25,501 VND

ABBank, BIDV, Dong A, Kien Long, LPBank, MSB, OceanBank, PGBank, PublicBank, PVcomBank, Sacombank, Saigonbank, SeABank, UOB, Vietcombank, VRB are selling USD cash at the highest price: 1 USD = 25,558 VND

ABBank, Dong A, MSB, NCB, PublicBank, Sacombank, SeABank, VietBank are selling USD transfers at the highest price: 1 USD = 25,558 VND

|

| USD exchange rate at some banks today. Source Webgia.com |

| 1. Agribank – Updated: 11/01/2025 05:00 – Time of the source website | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,200 | 25,210 | 25,550 |

| EUR | EUR | 25,613 | 25,716 | 26,830 |

| GBP | GBP | 30,616 | 30,739 | 31,716 |

| HKD | HKD | 3,197 | 3,210 | 3,317 |

| CHF | CHF | 27,304 | 27,414 | 28,282 |

| JPY | JPY | 156.94 | 157.57 | 164.43 |

| AUD | AUD | 15,409 | 15,471 | 15,987 |

| SGD | SGD | 18,221 | 18,294 | 18,813 |

| THB | THB | 716 | 719 | 750 |

| CAD | CAD | 17,312 | 17,382 | 17,888 |

| NZD | NZD | 13,959 | 14,454 | |

| KRW | KRW | 16.66 | 18.37 | |

| 2. Sacombank – Updated: June 15, 2006 07:16 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25176 | 25176 | 25558 |

| AUD | AUD | 15339 | 15439 | 16002 |

| CAD | CAD | 17255 | 17355 | 17909 |

| CHF | CHF | 27366 | 27396 | 28278 |

| CNY | CNY | 0 | 3424.4 | 0 |

| CZK | CZK | 0 | 990 | 0 |

| DKK | DKK | 0 | 3500 | 0 |

| EUR | EUR | 25678 | 25778 | 26651 |

| GBP | GBP | 30684 | 30734 | 31851 |

| HKD | HKD | 0 | 3271 | 0 |

| JPY | JPY | 157.63 | 158.13 | 164.66 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 17.1 | 0 |

| LAK | LAK | 0 | 1.122 | 0 |

| MYR | MYR | 0 | 5820 | 0 |

| NOK | NOK | 0 | 2229 | 0 |

| NZD | NZD | 0 | 13947 | 0 |

| PHP | PHP | 0 | 412 | 0 |

| SEK | SEK | 0 | 2280 | 0 |

| SGD | SGD | 18159 | 18289 | 19010 |

| THB | THB | 0 | 677.9 | 0 |

| TWD | TWD | 0 | 770 | 0 |

| XAU | XAU | 8450000 | 8450000 | 8620000 |

| XBJ | XBJ | 7900000 | 7900000 | 8620000 |

|

| USD exchange rate today January 11, 2025. Illustration photo |

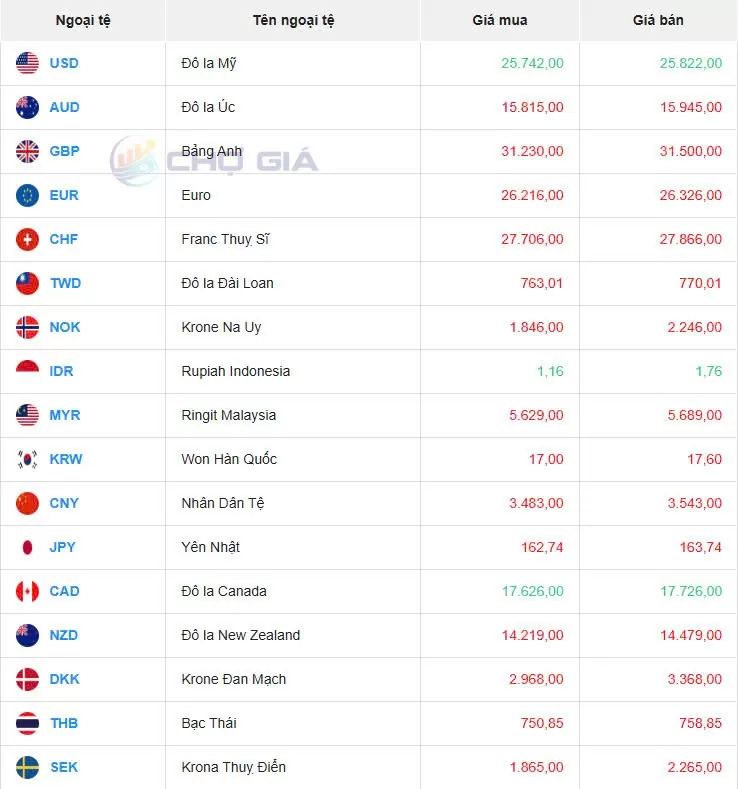

In the "black market", the black market USD exchange rate as of 5:00 a.m. on January 11, 2025 is as follows:

|

| Black market on January 11, 2025. Photo: Chogia.vn |

USD exchange rate today January 11, 2025 on the world market

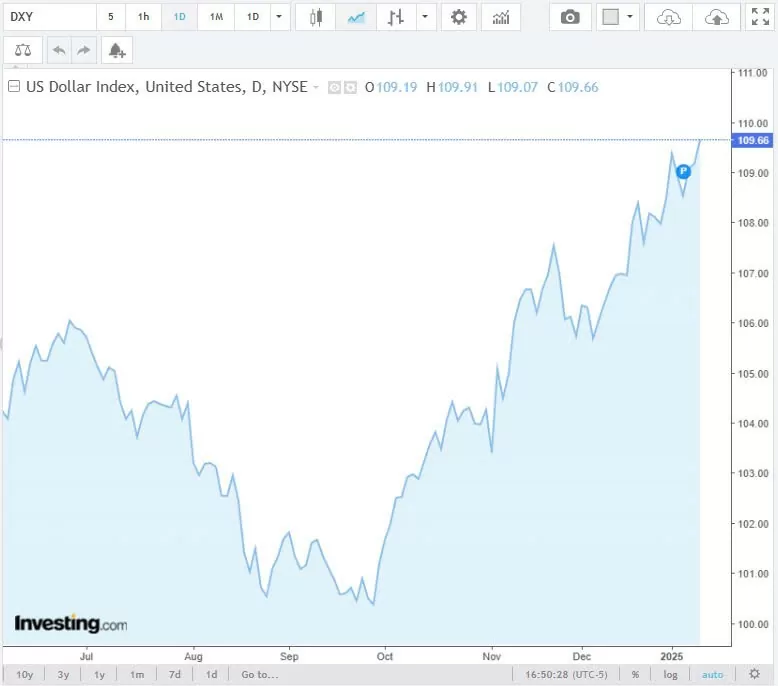

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 109.66 – up 0.49 points compared to the transaction on January 10, 2025.

|

| DXY index developments in recent times. Source Investing |

The dollar rose on Friday after data showed the world’s largest economy created more jobs than expected last month, bolstering expectations that the Federal Reserve will pause its rate-cutting cycle at its policy meeting later this month.

The greenback also extended gains after a report showed U.S. consumer inflation expectations for next year and beyond jumped in January.

The dollar rose to its highest since July against the yen after the data, before retreating later in the day. The dollar was last down 0.1% at 157.845 yen.

The euro, on the other hand, fell to its lowest level since November 2022 against the greenback. The euro zone’s common currency fell 0.5% to $1.0244, falling for a second straight week. A majority of foreign exchange forecasters expect the euro to reach parity with the dollar by 2025, a Reuters poll showed this week.

The greenback's rally began after the Labor Department reported that the U.S. economy added 256,000 jobs in December, well above economists' forecasts of 160,000. However, the November jobs figure was revised down to 212,000.

Meanwhile, the unemployment rate fell to 4.1%, compared with expectations of 4.2%, while average hourly earnings rose 0.3% last month after rising 0.4% in November. In the 12 months through December, wages rose 3.9% after rising 4.0% in November.

“The strength of December’s payrolls data has clearly eliminated any need for the Fed to cut rates urgently,” wrote Jane Foley, head of FX strategy at Rabobank in London. “ For some time, Rabobank’s main view has been that the Fed will only cut rates once this year. However, if Donald Trump wastes no time in initiating his policies, that window may be closed altogether.”

During his campaign, Trump vowed to impose tariffs, cut taxes and conduct mass deportations of undocumented immigrants, all of which are seen as inflationary. A University of Michigan consumer sentiment survey showed rising inflation expectations also supported the dollar.

The report showed one-year inflation expectations jumped to 3.3% in January, the highest since May, from 2.8% in December. That lifted 12-month inflation expectations above the 2.3%-3.0% range they had been in for two years before the COVID-19 pandemic.

The US interest rate futures market has fully priced in a pause in the Fed’s easing cycle at its January meeting, according to LSEG estimates. The market has also priced in just 27 basis points of easing by 2025, or just one rate cut, with the first rate move likely to come at the June meeting.

In other currencies, the pound fell to its weakest level since November 2023 against the dollar, last changing hands at $1.2208, down 0.8%. The pound also fell on Thursday, along with a sell-off in government bonds and concerns about the UK government's finances.

In Japan, the prospect of sustained wage growth and rising import costs due to a weak yen have prompted the central bank to pay closer attention to rising inflation pressures, which could lead to an upgrade in its price forecast this month, sources said.

The dollar ended the week up 0.4% against the yen. The U.S. currency has gained in five of the past six weeks against the Japanese unit.

Meanwhile, the dollar index rose to its highest level since November 2022 and is on track for a sixth straight weekly gain, its longest winning streak since an 11-week streak in 2023. The index was last up 0.4% at 109.68.

“The biggest risk to the bullish dollar view would be if participants look to take profits and cut risk early next week ahead of Trump’s inauguration,” said Michael Brown, senior research strategist at Pepperstone in London.

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop – No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts – No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Jewelry Store – No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company – No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store – No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones – No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store – No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store – No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store – No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange – 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop – 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop – 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center – 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store – Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop – No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop – No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop – No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-hom-nay-11012025-dong-usd-cao-nhat-6-thang-368988.html

![[Photo] Solemn Hung King's Death Anniversary in France](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/786a6458bc274de5abe24c2ea3587979)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Vietnamese rescue team shares the loss with people in Myanmar earthquake area](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/ae4b9ffa12e14861b77db38293ba1c1d)

Comment (0)