Cashless shopping is growing strongly from cities to rural areas, from shopping malls, supermarkets to traditional markets and retail stores in the province. Not only bringing benefits to people and businesses, this form also contributes to promoting digital transformation activities in the province, creating transparency in spending and transactions.

People pay by scanning QR Code when buying vegetables and tubers at a stall in the market area of Khu Pho 2, Ward 5, Dong Ha City - Photo: HT

Buy anything with "QR code scanning"

In recent years, Ms. Thanh Nhan, in Ward 5, Dong Ha City, has withdrawn cash from an ATM on her fingers. “At the market, from the onion seller to the meat seller, they all accept money transfers and scan codes,” Ms. Nhan said. In the past, after receiving their salary, she and her husband would keep a portion in their account to pay their children’s tuition, pay for electricity and water, and withdraw the rest in cash for spending because most breakfast shops and market vendors shook their heads when they heard about money transfers. “But now it’s different, when buying something that only costs a few thousand dong, vendors also accept money transfers, so I don’t need to keep a lot of cash, and I don’t have to worry about losing it, losing it, or making a mistake,” Ms. Nhan shared.

During the last days of the year, walking around the main roads of Dong Ha City such as Hung Vuong, Le Quy Don, Tran Hung Dao, we noticed that the number of people coming to withdraw money at ATMs was quite sparse compared to previous years.

Ms. Nguyen Thi Thanh Ha, in Dong Luong Ward, Dong Ha City, was withdrawing money at an ATM on Tran Hung Dao Street and said: In the past, at the end of the year, I went to the ATM early in the morning to withdraw cash for personal expenses or Tet shopping. Many times I had to wait in line for hours, not to mention when the ATM ran out of money or had problems.

Since the beginning of 2023, I have switched to using internet banking applications and Momo e-wallet, everything has become more convenient and less risky. “I still go to ATMs to withdraw money, but now I only withdraw occasionally, not as often as before.

I only use cash for snacks, lucky money for adults and children during Tet holidays... Since using e-wallet for payment, I don't have to wait, push, or jostle at ATMs, and I don't have to worry about pickpockets when going to the market, especially at the end of the year when markets, supermarkets, and stores are always crowded," said Ms. Ha.

In early 2022, Dong Ha market deployed the model of "Technology market - market 4.0". With the advantages of fast, convenient, and accurate cashless payment via internet banking applications, the model received support from traders in the market as well as consumers. Up to now, most businesses in the market accept cashless payment via internet banking or QR codes provided by banks.

Cashless payment brings many conveniences to Dong Ha City residents when shopping and using services - Photo: HT

Having sold household electrical and electronic goods at Dong Ha market for more than 10 years, Ms. Tran Minh Chau, a trader at stall number 50-51, Dong Ha market, shared: “Because most payments are made through digital banking applications, people are reluctant to carry a lot of cash.

Just a phone and a bank account are enough to make quick and convenient payments. For the convenience of customers, I also prepare 2 QR codes from 2 different bank accounts. When I receive the goods, I no longer have to worry about transferring money to the distributors, just transfer the money and it's done."

The implementation and replication of the 4.0 market model has formed consumer habits and contributed to the completion of the goal of the Quang Tri Province Digital Transformation Project by 2025, with a vision to 2030. Making digital payments the main payment tool for people from small transactions to large-value transactions in daily life.

Promote cashless payments

Cashless payment is an inevitable trend in the era of technology 4.0 because this form brings many obvious benefits to both people and the economy. When paying without cash, it will first reduce a lot of costs for the financial sector, preventing tax losses for the State from illegal or non-transparent transactions.

For people, this payment brings convenience when shopping such as: saving time and effort for the payer and the payee, reducing waiting time for payment... From changes in people's consumption habits, businesses, retail stores, restaurants, and hotels in the province also quickly adapted, installed and used payment applications and cashless.

In addition, many banks have deployed online services, multi-function ATMs... with simple operations to help people have more conditions to use digital banking services more easily and conveniently.

Non-cash payment applications and services, such as QR codes, mobile banking, e-wallets, etc., are appearing more and more, not only for transferring money and asking for information, but people can also use a variety of utilities such as paying bills, e-commerce, buying movie tickets, airline tickets, booking tours, etc. On the contrary, people can also indirectly use banking services through other product and service providers such as installment purchases, buying now - paying later, etc.

Co.opmart Dong Ha supermarket applies cashless payment method - Photo: HT

Currently, the province has 119 ATMs (including 13 multi-function ATMs, an increase of 3 compared to 2023); 916 POS machines, POS payment turnover reached 855.51 billion VND. The QR Code network covers all districts, towns and cities with more than 45,000 QR Code payment acceptance points located at businesses, retail stores, restaurants, hotels, medical facilities, hospitals, schools... helping people pay conveniently, quickly and effectively.

According to statistics, indicators related to non-cash payments such as transaction volume, payment value, infrastructure, etc. have grown strongly. Currently, this payment method is being implemented more strongly by the State Bank in coordination with relevant departments, agencies and branches.

It can be seen that cashless payment is gradually becoming a new consumption trend of many people and businesses in the area. Cashless payment is also an inevitable trend in the process of digital economic development. To facilitate customers in cashless payment, banks and businesses have implemented many solutions to encourage customers to do so.

Specifically, promotions for payment via QR Code, reduced service fees, free home delivery, constantly updating new technology to bring better experience on online payment applications.

Promoting non-cash payments is the goal of digital society, contributing to promoting national digital transformation targets. To promote this activity, the responsibility does not only belong to agencies, departments and sectors but also requires the cooperation of all people.

Autumn Summer

Source: https://baoquangtri.vn/di-cho-thoi-4-0-190797.htm

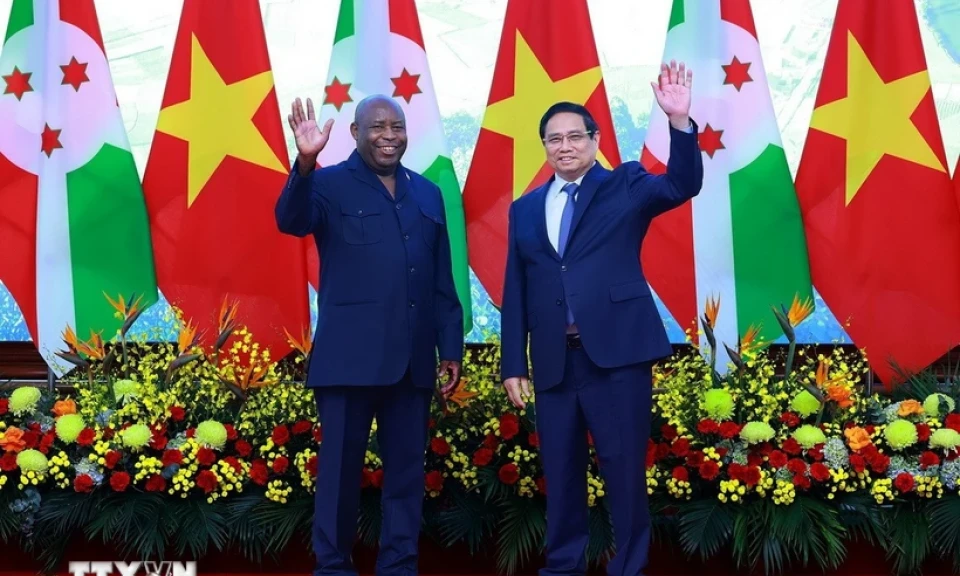

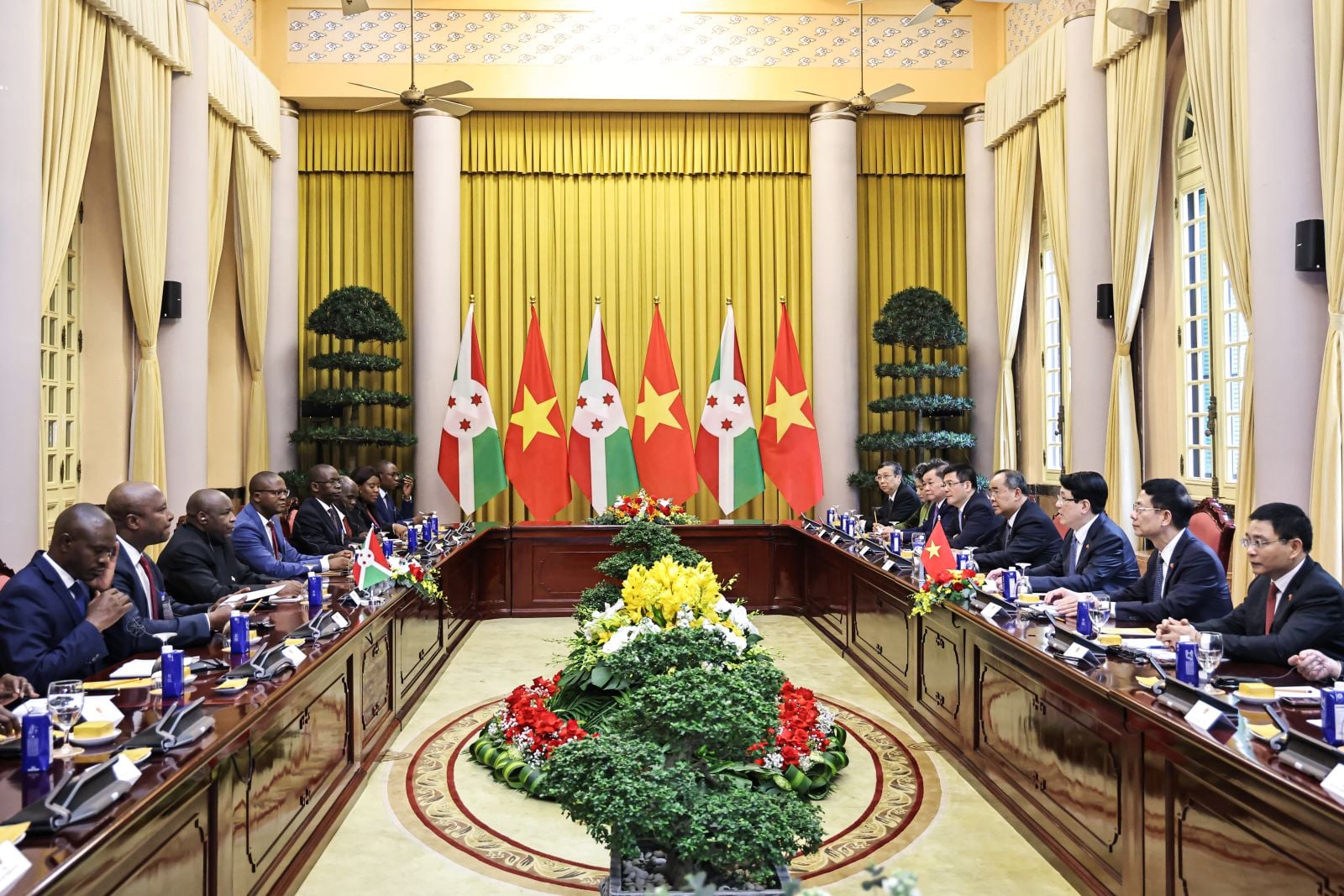

![[Photo] President Luong Cuong presides over the official welcoming ceremony for Burundian President Évariste Ndayishimiye](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/63ceadc486ff4138abe2e88e93c81c91)

![[Photo] Parade rehearsal on the training ground in preparation for the April 30 celebration in Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/e5645ddf85f647e6a25164d11de71592)

![[Photo] Workshop "Future for the Rising Generation" continues the profound value and strong message from the article of General Secretary To Lam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/ec974c5d9e8e44f2b01384038e183115)

![[Photo] General Secretary To Lam receives President of the Republic of Burundi Évariste Ndayishimiye](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/d6df4662ecde41ef9bf55f1648343454)

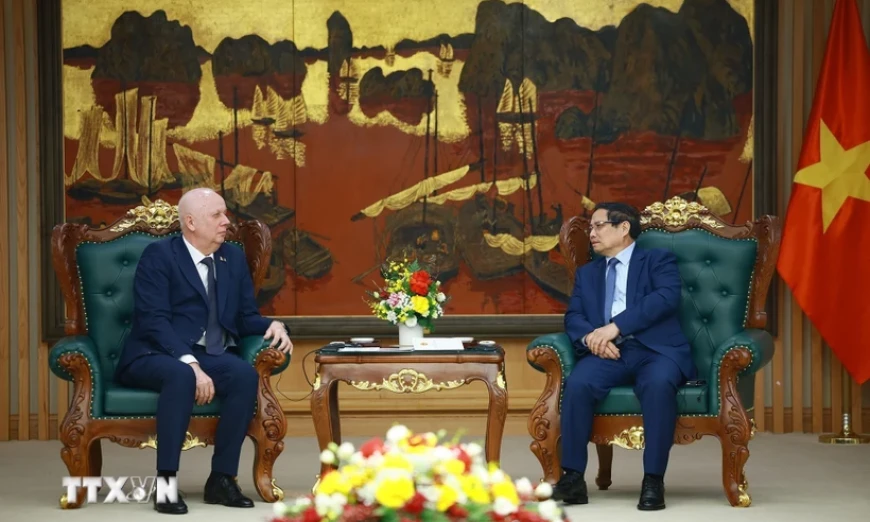

![[Photo] Prime Minister Pham Minh Chinh meets with President of the Republic of Burundi Evariste Ndayishimiye](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/4/979010f4c7634f6a82b8e01821170586)

Comment (0)