Pursuant to Decision No. 06/QD-TTg dated January 6, 2022 of the Prime Minister approving the Project on developing applications of population data, identification and electronic authentication to serve national digital transformation in the period of 2022 - 2025, with a vision to 2030, the Provincial Social Insurance (PSI) is currently promoting the implementation of cashless social insurance payments in the province.

Department of Collection Management - Books and Cards (Provincial Social Insurance) performs operations on the software.

Payment in this form has brought many benefits to beneficiaries and agencies implementing the settlement of regimes and policies. Beneficiaries receive the exact amount of monthly pension and social insurance benefits, ensuring cash safety sooner than those who receive money at the direct payment point; are proactive in the time and place of withdrawal, not depending on the time and place of payment of the social insurance agency. When necessary, they can ask someone to withdraw their monthly pension and social insurance benefits via ATM without authorization. Beneficiaries can register online to receive monthly pension and social insurance benefits via ATM accounts on the VssID - Social Insurance Number application; are supported with free account opening, ATM card issuance, E-banking service registration, payment, and non-cash online money transfer.

In particular, in the event of an epidemic, the risk of infection for recipients of money via ATMs will be reduced because they do not have to gather in crowded places. With the above conveniences, instead of having to go to direct payment points to receive monthly pensions and social insurance benefits, many beneficiaries have proactively registered to receive monthly pensions and social insurance benefits via personal accounts, ensuring safety, speed, saving time and effort, avoiding risks in cash storage, and reducing the risk of unsafe contact. The Social Insurance industry is implementing social insurance payments via non-cash payment methods with the following regimes: Pensions, monthly social insurance benefits, one-time payments and unemployment benefits.

In order to increase the rate of people receiving monthly pensions and social insurance benefits through non-cash payment methods in the coming time, the provincial Social Insurance continues to synchronously deploy solutions to mobilize beneficiaries to receive benefits through non-cash payment methods in paying pensions and social insurance benefits. Promote propaganda on mass media and social media (facebook fanpage, zalo OA...) about the superiority of non-cash payment for monthly pension and social insurance benefits recipients. The provincial Social Insurance coordinates with the provincial Post Office to include the rate of people receiving social insurance benefits and social insurance benefits through non-cash payment methods in the content of the contract authorizing the payment of social insurance benefits, unemployment benefits and beneficiary management.

In particular, focus on directing the district-level Social Insurance to coordinate with the Police force and the Post Office, advise the District People's Committee to establish commune-level working groups to proactively review and verify the status of beneficiaries, update and clean up data of beneficiaries of social security policies within the scope of payment of the Social Insurance agency, and mobilize to change the form of receiving social security regimes through personal accounts (The working group includes the core of the Commune-level Police force/local police; Social Insurance officers; Commune-level cultural and social officials; Post Office and Bank officers). The Social Insurance agency has a separate implementation method for each group of beneficiaries. For those receiving pensions and social insurance benefits, the Social Insurance agency coordinates with the District, City and Town Police to develop a plan to propagate and mobilize beneficiaries in communes, wards and towns, combining verification, review and authentication of information and status of beneficiaries to ensure management and payment to the right beneficiaries and the right regime.

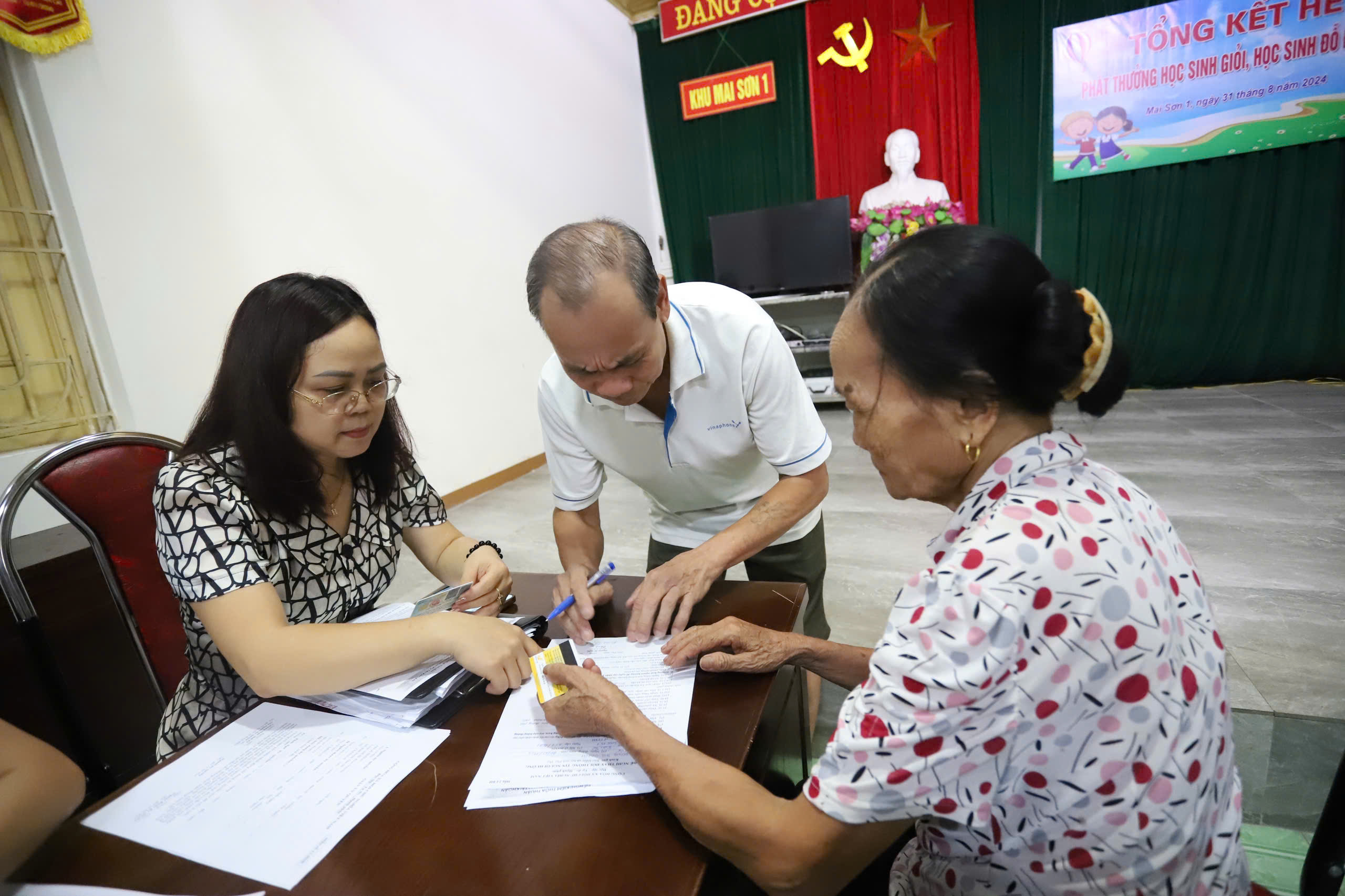

Provincial Social Insurance propagates to people about the benefits of cashless payments.

Provincial Social Insurance, District Social Insurance, and Town Social Insurance coordinate with People's Committees of communes, wards, commune-level police, and joint-stock commercial banks in the area to organize conferences to propagate non-cash pension payments in each residential area, thereby explaining to beneficiaries the benefits of receiving pensions and social insurance benefits through accounts, and providing instructions on how to register to open direct accounts for beneficiaries... With the method of taking the commune-level police force and local police as the core, social insurance officials coordinate with commercial banks in the area to directly survey information of beneficiaries, propagate, mobilize, and guide pension and social insurance benefits beneficiaries of residential areas in each commune and ward to register to receive payments through non-cash payment methods.

By the end of November 2024, Phu Tho province had 49,335 beneficiaries paid via bank accounts, reaching 54.7% of the total number of pensioners and monthly social insurance benefits, of which 34,039 beneficiaries in urban areas, reaching 67.11% of the total number of pensioners and monthly social insurance benefits in urban areas, an increase of 35.11% compared to the target assigned by Vietnam Social Security in 2024 (32%).

After each propaganda conference, with the information collected from pensioners and social insurance beneficiaries in the area, the Social Insurance agency and the Police will coordinate to review, verify and clean beneficiary data to serve the synchronization of pensioner and social insurance beneficiary data with national population data, creating favorable conditions for beneficiary management, serving the digital transformation in state management.

For those who are participating in social insurance and health insurance, the social insurance agency guides the employer (administrative agency, career agency, enterprise...) when preparing the profile to receive benefits for employees to declare the employee's personal account number so that the social insurance agency can make the payment. When completing the procedures for unemployment insurance settlement at the Center for Employment Services and Vocational Education, employees are instructed by the Center's staff to open an account to receive benefits. Therefore, most employees when receiving one-time social insurance benefits and unemployment benefits have chosen to receive the benefits through their accounts.

By synchronously implementing solutions, Phu Tho Social Insurance is determined to complete the plan assigned by Vietnam Social Insurance on the target of pensioners and social insurance benefits via non-cash payment methods, actively contributing to the completion of the Project on developing applications of population data, identification and electronic authentication to serve national digital transformation in the period of 2022-2025, with a vision to 2030 in the province.

Tran Xuan Long

Director of Provincial Social Insurance

Source: https://baophutho.vn/day-manh-chi-tra-luong-huu-tro-cap-bao-hiem-xa-hoi-khong-dung-tien-mat-225435.htm

Comment (0)