Lower interest rate than savings

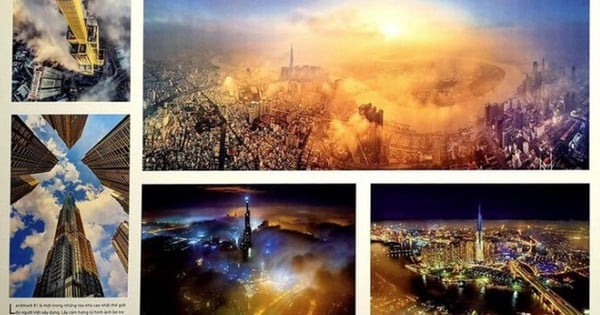

During the year-end period, many apartments in the city center are left empty due to the lack of tenants during the low season. In addition, the rent in some central areas is high compared to the majority, so the lack of customers still occurs regularly.

According to Mr. Nguyen Quang Anh, the owner of a 2-bedroom apartment in Tan Binh district, the rental price of this 2-bedroom apartment is advertised at 13-14 million VND/month. Thus, if rented out for the whole year, Mr. Quang Anh will earn about 156 million VND/year, not including other expenses.

Many apartments are invested with basic furniture for the purpose of renting, waiting for the property to increase in value.

This income level when compared to depositing money in the bank to earn interest is actually only at the same level. At some times, the profit from renting a house is not even equal to the bank interest.

“Currently, if I sell this apartment, I will get about 4 billion VND. If I deposit it in the bank, I will earn about 200 million VND/year with an interest rate of 5%. Not to mention that in the past, there were times when the bank interest rate was up to 10%. However, keeping the property for rent still has some advantages such as having additional monthly cash flow, while keeping an accumulated asset that increases in value over time,” said Mr. Quang Anh.

It is known that Mr. Quang Anh's apartment has increased in price by 25% after 4 years of purchase, along with the cash flow from renting, the profit margin here is still about 300 million/year. However, the condition is that there must be long-term tenants to ensure uninterrupted cash flow, and the landlord must also find tenants himself to save on brokerage costs.

Similarly, the 2-bedroom apartment for rent of Ms. Dang Ngoc Tram (Binh Duong) in Di An City is only recording a profit margin of 4%/year, with a rental price of 6 million VND/month. However, this profit level has not yet accounted for the costs of asset depreciation, interior investment, renovation costs and finding customers.

“Because I bought it mainly for long-term investment, renting it out is a way to avoid the property being left vacant and not generating cash flow. This area is still in the process of development, so the price increase of the property in the future is certain, so the profit margin from renting is not too important,” said Ms. Tram.

Profit margin is affected by many factors

However, investing in apartments for rent at the present stage is still chosen by many people. Partly because the preferential policies on interest rates, discounts, and gifts of many projects are still very attractive. At the same time, the market is also showing many positive signs to start recovering in the next few years. Therefore, investing for rent is the best way to take advantage of this stage.

In addition, the profit margin of investing in rental apartments has decreased sharply due to the impact of many factors such as continuously increasing housing prices, limited sources of tenants with high-end products, and difficulties in short-term rentals...

Some apartments far from the center with cheap rent even have a profit margin significantly lower than savings interest.

For many of the above reasons, the profit margin has continuously decreased, especially in difficult times. Batdongsan.com.vn's report also shows that in the period of 2017-2018, the profit margin of rental apartments was always at a high level of 6-8%, the decline started to appear in 2019 with a profit margin of 5.2% and "free-fall" in the period of 2020-2021 when the pandemic hit, respectively falling back to 4.3-4.5% in 2020-2021 and 4-4.3% in 2022-2023.

Mr. Le Bao Long, Strategy Director of Batdongsan.com.vn, said that the apartment price level is increasing rapidly. In the third quarter of 2023 alone, the average selling price of apartments in Ho Chi Minh City is from 45.5 million VND/m2 (including primary and secondary prices), but the apartment rental price has not increased accordingly. Even compared to the peak period of 2018-2019, the rental price of apartments in Ho Chi Minh City has decreased sharply.

However, although profits are not as high as before, in the current difficult context, apartments are still the least affected type compared to the rest because this type of housing meets real needs.

Source

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)