Liquidity "frozen" due to difficulty in agreeing on price

According to some investors, the liquidity of this segment has not improved in recent times because many people have noticed that landowners have not really fallen into a state of "land suffocation". Especially in plots of land located in beautiful locations, with high profit potential in the medium term and landowners are not under too much financial pressure at the present time.

Mr. Pham Khai - a long-time land investor in the neighboring areas of Ho Chi Minh City such as Long An, Dong Nai, Binh Phuoc, Ba Ria - Vung Tau said that in the past, he and some friends have been hunting for land plots at reasonable prices. But most of the beautiful plots of land are often very difficult to close due to disagreement on price.

“Landowners still keep the price quite high compared to our assessment, some people even refuse to negotiate a lower price because they think the current price is suitable. In particular, many landowners think that the market will soon recover so they only cut losses at a very small level. For that reason, in the past 3 months, I have only been able to buy 1 more plot of land in Dat Do, Ba Ria - Vung Tau for more than 1 billion VND,” Mr. Khai shared.

This investor also said that even with some plots of land currently held in bank, the landowners have not yet brought the price back to a “good” level in their personal opinion. Many landowners have even raised the price by several hundred million higher than the valuation of the bank and some other valuation companies.

Project land is a favorite choice of many investors.

The fact that the landlord used the peak price of 2022 as a benchmark to set a loss cut has caused many people who want to buy for investment to not be able to close the deal. Even a 50% loss cut for many people who are investing for the long term is just a reduction in profit.

In addition, from the seller's perspective, some people enter the market at a time when the land is hot, and the land price can be pushed up to several hundred percent. Not to mention brokerage fees, legal fees, and even interest-bearing loans to invest in real estate. Therefore, after a year, even if they accept to sell at the original price, they will still have to suffer a heavy loss of several hundred million. Therefore, when faced with customers "squeezing the price", many landowners do not agree to the transaction, causing market liquidity to remain "frozen".

In addition, some investors commented that currently, only land and agricultural products in the provinces surrounding Ho Chi Minh City, especially in the market that has not yet experienced a land fever, have reasonable purchase prices. However, future risks are also higher due to the lack of development orientation. In areas that have passed the "wave", a price reduction of 30-40% is still a price that needs to be considered at the present time.

Can prices go further down?

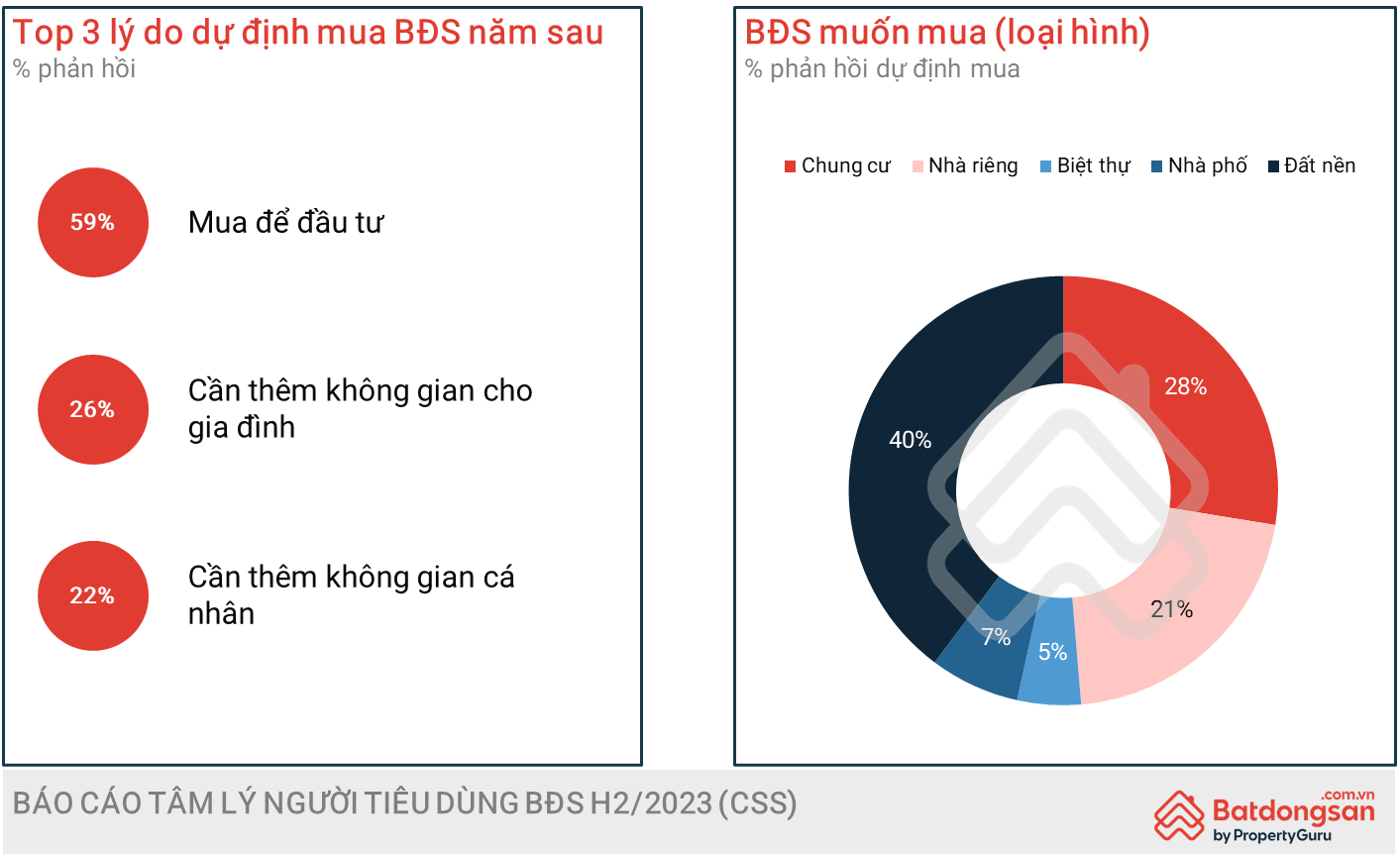

According to a report on the real estate market by Batdongsan.com.vn, land prices in 2023 tend to decrease sharply in speculative real estate, holding inventory waiting for price increases (not serving real housing needs, exploiting consumption), while land in general only decreased from 8-12%. Townhouses, villas and future apartment prices decreased the most, falling to about 15-30%, with only a few isolated cases falling to the floor price of 40% compared to the second quarter of 2022.

Meanwhile, segments suitable for buyers with real housing needs and immediate use are selling very little. Some projects still record price reductions due to the impact of the whole market's psychology, but only within a narrow range. There is no panic selling to cut losses.

According to a psychological survey conducted on homebuyers by Batdongsan.com.vn, about 56% predicted that house prices would continue to decrease in the last months of the year, only 23% said they would continue to increase. Accordingly, 54% of respondents said that interest rates would continue to increase in the coming time, about 20% said that from the third quarter onwards, interest rates may decrease but it is difficult to return to the 2020 - 2021 period.

Most of the people surveyed chose land as the type they want to buy in the near future.

In contrast, among sellers, survey data on the reasons for selling showed that 49% were to restructure their investment portfolio; 23% were selling because they had no need to use the property, and only 22% were financially stuck and had to transfer to solve economic problems. With the number of people cutting losses due to financial pressure not being high, most sellers are still at a level where they can hold out, expecting to sell at a profit.

Specifically, up to 42% of people holding assets want to sell at a profit of at least 10% higher than the purchase price, 38% accept to sell at a profit difference of less than 10%. Only about 16% accept a 5-20% price reduction to get rid of the goods. The percentage of investors accepting a price reduction of more than 20% is only about 3.

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, real estate transactions are at a low point, speculative demand has disappeared, investment has decreased and only real estate purchases remain. The market has lost a large number of investment buyers, leading to liquidity being affected and land prices in 2023 will also be affected.

Real estate transactions are difficult to succeed because the expectations between sellers and buyers are still far apart. At present, legal issues are being resolved by the Government and localities. Banks have also recorded many positive signals when interest rates have decreased. Consumer real estate serving real housing needs may soon recover.

Meanwhile, buyers are prioritizing real estate that meets the criteria of immediate use, good price retention, safety, and high liquidity. Therefore, this group of products will improve liquidity in the coming time. Meanwhile, the group of speculative real estate may continue to decline in price.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)