Gold price hits new record high

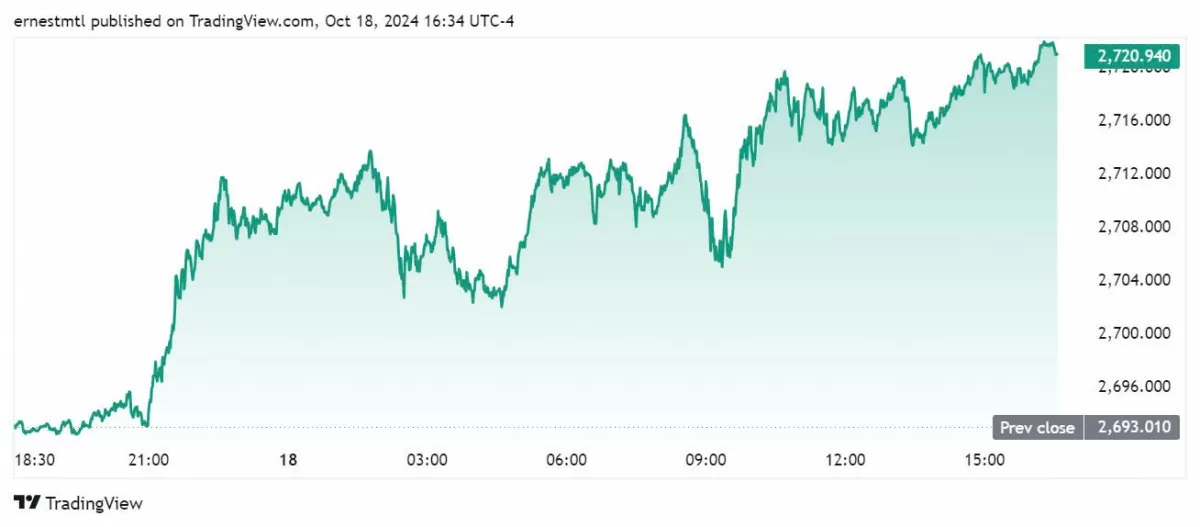

Gold prices saw their biggest increase this week since the beginning of the year, closing the trading week at $2,721.9 an ounce. The new record price reflects the turmoil in both domestic and foreign markets.

Gold prices started the week at $2,650, then spiked to $2,665. After a day of slight fluctuations, gold prices fell to a weekly low of under $2,640 an ounce early Tuesday morning.

However, prices quickly recovered and continued to rise sharply in the following days. Gold prices surpassed the $2,670 mark early Wednesday morning and closed the trading session at a new record of $2,684.

|

| World gold price developments last week. Photo Kitco News |

Gold traded in a narrow range between $2,674 and $2,684 an ounce on Wednesday before rising to $2,687 an ounce early Thursday morning. Spot gold continued to rise in the remaining trading sessions, closing the week on a breakout and hitting an all-time high of $2,721.9 an ounce.

In the domestic market, on the morning of October 20, Saigon Jewelry Company (SJC) listed the buying price of gold at VND84 million/tael; the selling price was VND86 million/tael, unchanged for both buying and selling. The difference between the buying and selling price of SJC gold is currently VND2 million/tael.

At the same time, DOJI Group listed the buying and selling price of gold at 84 - 86 million VND/tael, unchanged in both buying and selling prices. The difference between DOJI gold buying and selling prices is 2 million VND/tael.

While the price of gold bars remains stable, the price of gold rings continues to increase sharply. The price of gold rings is listed by SJC at 84 - 85.3 million VND/tael, unchanged from the previous closing price.

Converting world gold price according to foreign exchange rate at Vietcombank on October 20: 1 USD = 25,380 VND, world gold price is equivalent to 83.23 million VND/tael, 2.77 million VND/tael lower than SJC gold selling price at the same time.

Gold price forecast next week

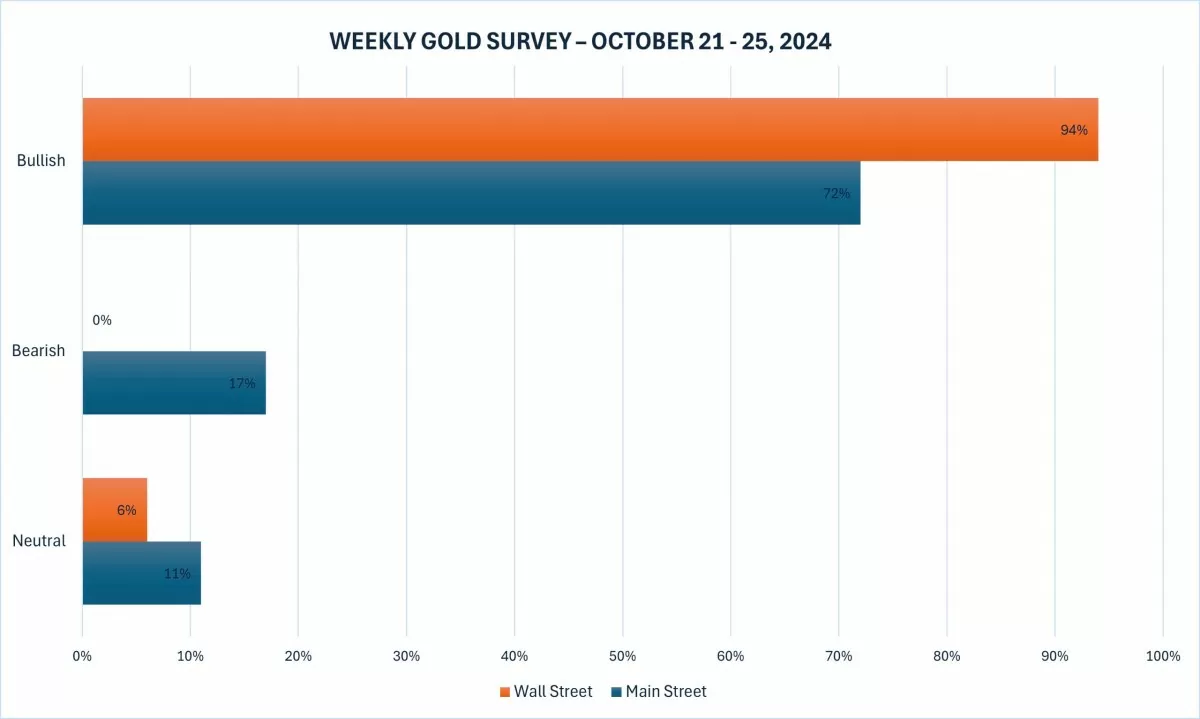

A new Kitco News survey shows that industry experts are almost unanimous in their belief that gold prices will continue to rise next week. Retail sentiment is also bullish, with a majority of individual investors predicting higher gold prices.

“ I am bullish on gold next week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “The current rally is relentless and with prices hitting new highs, it is understandable that gold prices are bullish .”

|

| Experts and investors predict gold prices next week. Photo Kitco News |

According to Marc Chandler, CEO of Bannockburn Global Forex, the price of gold is still on the rise. He said: " Gold prices reached a new high before the weekend of $ 2,721.9 / ounce. The recent price increase has occurred despite the high US dollar and high US interest rates ."

Sean Lusk, co-director of commercial hedging at Walsh Trading, said the gold rally was unstoppable. “ Whether it’s a drop in energy prices or a strong dollar, gold is going to keep going up. That shows that gold is very strong. Everyone is expecting gold to go up to around $2,770-$2,780, ” he said.

A recent Kitco News survey found that 15 out of 16 experts (94%) believe gold prices will rise next week, while 72% of retail investors surveyed online expect gold prices to continue rising.

Gold prices are likely to be driven by high-level economic meetings of several countries and organizations next week. The International Monetary Fund (IMF) will hold its biennial meeting in Washington, DC starting Monday.

Meanwhile, the BRICS+ nations will meet in Russia for their annual summit starting Tuesday. The trade bloc is expected to announce new members and a new payment system, both of which could impact the future price of the dollar and gold.

With ongoing geopolitical uncertainty in the Middle East and the looming U.S. election, markets will be looking ahead to the Bank of Canada’s monetary policy announcement and U.S. existing home sales on Wednesday. There will also be the S&P Global Flash PMI surveys on manufacturing and services, weekly jobless claims and U.S. new home sales on Thursday.

Kevin Grady, president of Phoenix Futures and Options, believes gold prices will continue to rise in the coming months. He expects interest rates to fall, making gold more attractive to investors. In addition, he believes the upcoming BRICS summit could boost gold prices by weakening the dollar.

Mr. Grady also emphasized the importance of analyzing who is driving the gold market. He believes that central banks are the main force behind the price increase, suggesting that this is a sustainable move.

Source: https://congthuong.vn/chuyen-gia-bat-ngo-du-bao-gia-vang-trong-tuan-toi-353628.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)