|

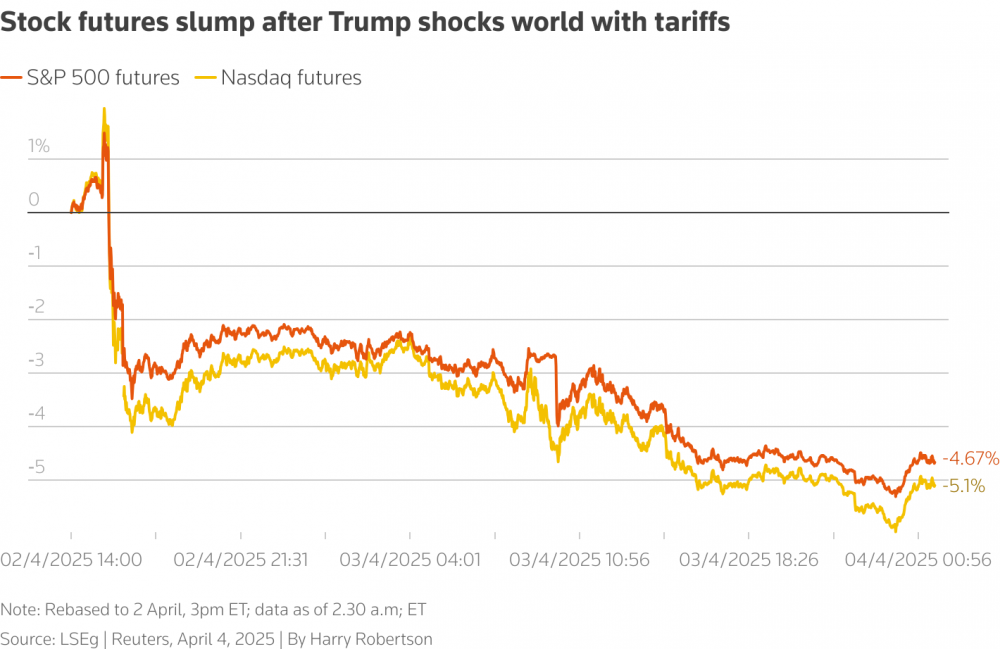

| S&P500 futures and Nasdaq futures both fell sharply |

U.S. bank stocks also fell sharply as investors worried about growth and priced in more central bank rate cuts. The jitters also pushed the yield on the benchmark 10-year U.S. Treasury note to its lowest since October, after Trump imposed a 10% tariff on most imports to the U.S. and much higher tariffs on dozens of countries.

“If the current list of tariffs is maintained, a recession in Q2 or Q3 is very likely, as is a bear market,” said David Bahnsen, chief investment officer at The Bahnsen Group. “The question is whether President Trump will seek some sort of exit from these policies if and when we see a bear market in the stock market.”

Europe's STOXX 600 index fell 1.1% in early trading on Friday after falling 2.6% in the previous session. Japan's Nikkei 225 index fell 2.8% overnight for a second straight session.

Futures for the US S&P 500 fell 0.4% on Friday, a more controlled drop at the open than on Thursday; while Nasdaq futures fell 0.3% after the index fell 5.4% on Thursday; US stock futures also fell 5% following Trump's tariff announcement.

After years of massive capital inflows into the US market and a booming economy in the world’s largest economy, investors are suddenly worried about a reversal in growth. JP Morgan said the risk of a US and global recession this year has increased to 60% from 40% after Mr Trump’s tariff announcement.

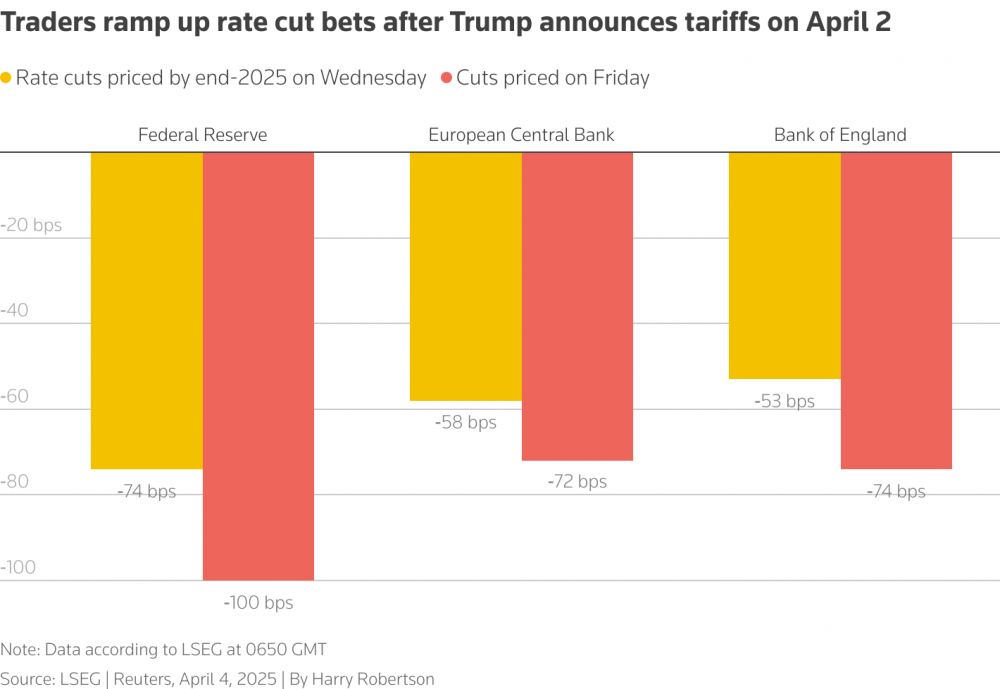

Traders on Friday priced in more than 100 basis points of interest rate cuts by the US Federal Reserve this year, up from around 75 basis points on Wednesday, and also increased bets on cuts by the Bank of England and the European Central Bank.

|

| Investors bet on more rate cuts from major central banks |

Lower interest rates - which squeeze banks' profit margins - and concerns about growth have weighed on bank stocks, with the STOXX 600 banking index down 4.2% in early trading on Friday.

HSBC fell 3.2%; UBS fell 2.5% and BNP Paribas fell 3.4%; Citigroup fell more than 12%; Bank of America fell 11% and a host of other major lenders suffered similar declines. That followed a sell-off that sent Japanese banks down 8% overnight and a sharp sell-off in Wall Street lenders on Thursday.

But some investors remain concerned about central banks’ ability to act if tariffs spur inflation. “Central banks are not well equipped to deal with stagflation,” said David Doyle, chief economist at Macquarie Group. “Stronger underlying inflation could limit the scope for any policy response.”

The clearest sign of concern about the health of the US economy and markets was the 1.9% drop in the dollar index on Thursday, its biggest drop since November 2022. However, the dollar rebounded on Friday, while the euro fell 0.5% after rising 1.9% on Thursday; the British pound fell 0.7%.

The Japanese yen, a traditional safe haven, held its ground after rising about 2% on Thursday. The Swiss franc, another safe haven, also rose about 0.6%.

“What might help the market a little bit is that we have data that suggests that the US economy will grow by 1% or more in the last quarter,” said Michael Metcalfe, chief macro strategist at State Street Global Markets.

The U.S. nonfarm payrolls report, due at 12:30 GMT on Friday (8:30 a.m. ET), is a key piece of data, and two weeks of retail sales data is another, according to Metcalfe. The jobs report is expected to show the U.S. economy added 135,000 jobs in March, down from 151,000 in February.

As investors continued to hunt for safe assets, the yield on the benchmark 10-year US government bond fell 11 basis points to 3.951%, after falling 14 basis points on Thursday (yields move inversely to prices).

Japan's 10-year government bond yield is also headed for its biggest weekly drop since 1990 and was last trading at 1.175%.

Source: https://thoibaonganhang.vn/chung-khoan-toan-cau-lao-doc-phien-thu-hai-lien-tiep-162294.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)