Gloom still enveloped the stock market, although the decline during the session narrowed significantly at the close. The market recorded its third consecutive decline.

The stock market on September 11 had a time when VN-Index dropped 10 points, then tried to turn around and increase nearly 3 points, but due to selling pressure, it closed the session still down nearly 2 points.

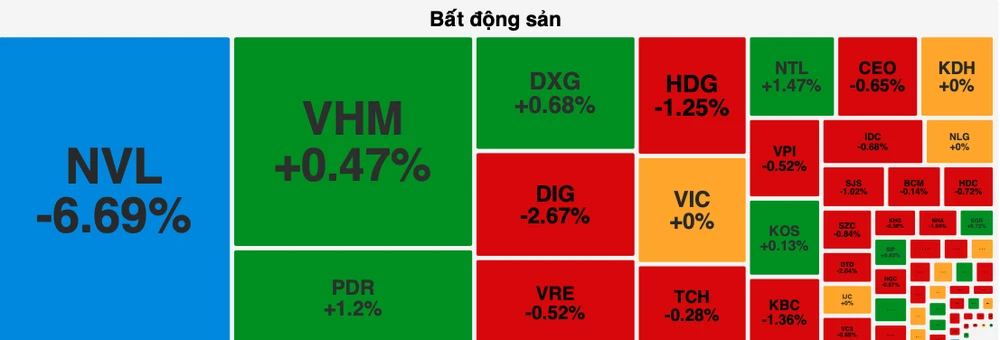

Real estate stocks continued to be sold off heavily, so red dominated. In particular, NVL was sold off after HOSE put it on the list of ineligible stocks for margin trading due to late announcement of the 2024 semi-annual financial report, falling to the floor price of VND11,850/share and having over 3.1 million shares sold at the floor price, with no buyers. In addition, HDG decreased by 1.25%, DIG decreased by 2.67%, KBC decreased by 1.36%, SJS decreased by 1.02%; VRE, TCH, CEO, BCM, HDC, SZC decreased by nearly 1%; a few stocks remained green: PDR increased by 1.2%, NTL increased by 1.47%; DXG and VHM increased by nearly 1%.

Banking group is differentiated: SSB decreased by 5.88%; TCB, BID, VCB, ACB, MSB, LPB, VIB decreased by nearly 1%. On the contrary: STB increased by 1.37%; HDB, VPB, EIB, MBB, TPB increased by nearly 1%.

The stock group leaned towards green: FTS increased by 2.14%, MBS increased by 3.82%, BVS increased by 1.03%; SSI, HCM, CTS, BSI increased by nearly 1%.

In addition, steel stocks also increased: HSG increased by 1.25%, NKG increased by 1.66%; HPG increased by nearly 1%.

In addition, contributing to the index's recovery during the session were Blue-chip stocks: HVN increased by 2.21%, VGC increased by 1.5%; FPT, VJC increased by nearly 1%...

At the end of the trading session, VN-Index decreased by 1.96 points (0.16%) to 1,253.27 points with 218 stocks decreasing, 170 stocks increasing and 82 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also decreased by 0.24 points (0.51%) to 231.45 points with 84 stocks decreasing, 53 stocks increasing and 61 stocks remaining unchanged. Liquidity decreased sharply, the total trading value on the HOSE floor was just over 12,800 billion VND, down 2,800 billion VND compared to the previous session.

Foreign investors continued to net sell for the third consecutive session on the HOSE, but the selling pressure decreased, with a total net selling value of nearly VND 72 billion. The top 3 stocks with the strongest net selling on the market were MSN with nearly VND 51 billion, HPG with VND 43 billion and MWG with nearly VND 32 billion.

Nhung Nguyen

Source: https://www.sggp.org.vn/chung-khoan-tiep-tuc-giam-nvl-bi-ban-thao-giam-kich-san-post758397.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)