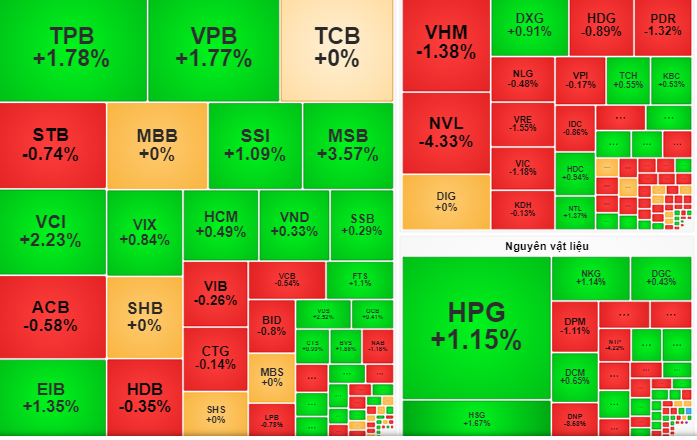

At the end of the session on September 30, the VN-Index closed at 1,287.9 points, down nearly 3 points, equivalent to 0.23%.

Following the correction session at the end of last week, investors traded sideways throughout the morning session. Liquidity slowed down as the number of stocks decreasing in price accounted for the majority. In that context, some stocks in the securities and steel industries, including HPG, VCI, VND... "swam" against the current to increase points.

Selling pressure increased in the afternoon session, causing the market index to decline. Investors traded cautiously as the VN-Index faced the resistance level of 1,300 points.

After a week of strong net buying, this session foreign investors net sold stocks with a total value of 487.66 billion VND, focusing on selling at HPG, STB, VRE... At the end of the session, the VN-Index closed at 1,287.9 points, down nearly 3 points, equivalent to 0.23%.

According to ACBS Securities Company, profit-taking continued, causing stocks to drop slightly on September 30. Market liquidity decreased significantly compared to previous sessions, showing that selling pressure is gradually weakening.

Vietcombank Securities Company said that extreme demand near the end of the session on September 30 in some stocks in the banking, securities, steel groups, etc., helped the VN-Index narrow its decline.

"Investors should maintain their weight in stocks that continue to maintain an upward trend in the three industry groups of banking, securities, and steel..." - VCBS recommends.

Accordingly, many investors expect these three groups of stocks to lead the market in the next session.

Meanwhile, ACBS Securities Company predicts that in the next few days, the VN-Index will likely fluctuate around the current level, then return to an upward trend to surpass the resistance level of 1,300 points.

Source: https://nld.com.vn/chung-khoan-ngay-mai-1-10-co-phieu-ngan-hang-chung-khoan-thep-co-tiep-tuc-do-thi-truong-196240930191041679.htm

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)