Gold rose nearly $50 an ounce and all three major Wall Street indexes hit new highs on the Fed's interest rate decision.

The world spot gold price on March 20 set a new record, reaching $2,210 an ounce at one point. The previous record on March 8 was $2,195.

Gold investors breathed a sigh of relief after the policy meeting, the US Federal Reserve (Fed) maintained its forecast of three interest rate cuts this year. Gold prices are sensitive to interest rates, as this instrument does not pay fixed interest.

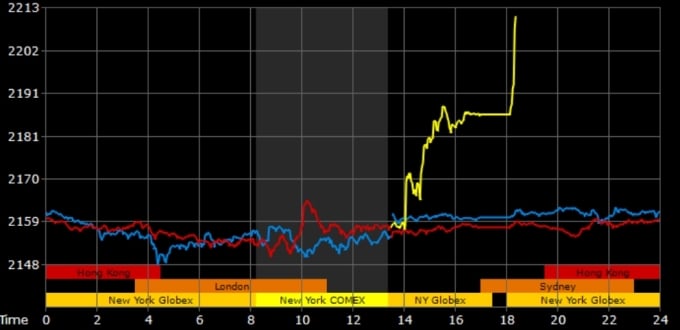

World gold prices skyrocketed in the session of March 20. Chart: Goldprice

The Fed's decision yesterday created fresh buying in the market. Prices jumped as investors began to expect the Fed to cut interest rates in June. The CME FedWatch tool shows the probability of a June rate cut is now 60%, up from just 50% before the Fed's press conference.

The US stock market also improved. At the end of the trading session on March 20, the S&P 500 index increased by 0.9%, reaching a new peak of 5,224 points. The DJIA increased by 1% to a record of 39,511 points. The Nasdaq Composite reached a historical peak of 16,369 points.

Nine of the 11 sectors in the S&P 500 index closed higher yesterday, with five up more than 1%. The consumer discretionary sector rose the most, up 1.5%.

US stocks surged late in the session as investors cheered the Fed's policy decision and economic forecasts. The agency kept its benchmark interest rate unchanged and forecast three more cuts this year. Before the meeting, many investors had feared the Fed would cut rates less than expected, given recent inflation data.

"The acceleration in inflation has us worried. But Powell is undeterred. Investors are relieved that the Fed still plans to cut interest rates three times this year. This has lifted markets and risk appetite," said David Russell, chief market strategist at TradeStation.

Financial stocks rose after the Fed's decision, on hopes that a rate cut this year will help the U.S. economy continue to grow. American Express shares rose 2.8%.

Tech giants also continued to lead the market as investors bet they would benefit most from lower interest rates. Alphabet, Amazon, Microsoft and Nvidia all rose more than 1%. Meta Platforms rose 1.9%. The biggest gainers were Apple and Tesla, up 1.5% and 2.5%, respectively.

Ha Thu (according to Reuters, Kitco)

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)