Not only groups familiar with using leverage such as real estate and construction, many businesses in other industries also have their profits eroded due to high interest costs.

Large financial debt and interest have long been an important indicator in the business results of real estate enterprises. Novaland (NVL) has nearly 59,000 billion VND in financial debt, and in the first 9 months of the year, it spent nearly 530 billion VND on interest expenses, equivalent to 2 billion VND per day.

If we consider the interest paid on the cash flow statement, the actual figure increases significantly. Accordingly, Novaland paid more than VND3,350 billion in interest in 9 months. This is also one of the reasons why this enterprise lost VND958 billion after 3 quarters.

Other businesses such as Khang Dien (KDH), Nam Long (NLG), and Dat Xanh (DXG) also spent hundreds of billions of dong to pay interest in the first 9 months of the year, causing profits to shrink.

The story of having to pay billions of dong in interest every day also appeared in the construction group. Vinaconex (VCG) spent 638 billion dong on this cost in 9 months, while Hoa Binh (HBG) had to spend more than 418 billion dong, both increasing by double digits compared to the same period in 2022. Ricons' interest expense was lower, about 31 billion dong, but it increased 2.6 times compared to the same period last year.

Transaction at a bank in Ho Chi Minh City, November 2022. Photo: Thanh Tung

Even in industries with favorable business conditions, profits are heavily affected by interest expenses. Despite good exports and peak rice prices, Loc Troi Group (LTG) reported a negative profit of VND327 billion in the third quarter. The reason is thin profit margins combined with increased costs. Of which, interest expenses were VND164 billion, up nearly 2.5 times compared to the same period in 2022. In the first 9 months, LTG spent VND438 billion on interest payments.

Recording revenue of more than VND 7,300 billion - the highest since equitization in 2018, after deducting expenses - Vinafood II (VSF) only brought in VND 10 billion in profit after tax. In the group of fixed costs, financial expenses accounted for VND 165 billion, an increase of 3.5 times compared to the third quarter of 2022.

Similarly, livestock businesses are also affected by interest rates. BAF Agriculture recorded a sharp increase in financial costs in the first 9 months from VND162 million to VND109 billion, mainly due to interest rates increasing more than 15 times. Meanwhile, Dabaco (DBC) had to pay VND199 billion in interest in the first 9 months of the year, an increase of half compared to the same period last year.

In addition, the market also recorded many businesses with sudden increases in interest expenses such as Yeah1 Group (YEG) spending 4 times more to pay interest on financial debts, this figure for Song Da Corporation (SJG) and Petrolimex (PLX) is about 1.5 times...

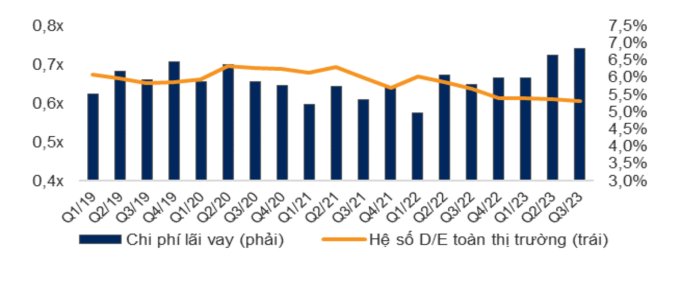

Interest expense and D/E ratio (debt to equity) of the whole market. Source: VNDirect

According to statistics from WiGroup, a unit specializing in providing economic and financial data, interest expenses in the third quarter decreased by VND 1,552 billion compared to the second quarter, a decrease of 11.2%. However, this figure is still at a high level in the period from 2021 to now, second only to the previous quarter. If calculated by percentage, in the third quarter, VNDirect recorded interest expenses at 6.8% of total profits, continuing to increase by 0.2 percentage points compared to the second quarter. This is also the highest level since the beginning of 2019. This analysis group commented that the total operating profit of enterprises is still being eroded by financial costs.

Since March, the State Bank has cut operating interest rates many times, and deposit interest rates have also dropped to pre-pandemic levels. However, lending interest rates are lagging and remain high. VnExpress 's records at many banks show that low interest rates of 7-9% are only for new loans, while old loans remain around 10-13% per year.

The reason is believed to be that banks have not yet escaped the situation of bearing a part of the high mobilization costs since the end of last year. In addition, the interest rate reduction depends on the policy of each bank, but it is necessary to take into account the delay in adjusting the cost of capital in operations.

In the National Assembly session in early November, State Bank Governor Nguyen Thi Hong said that the interest rate level for new loans had decreased by 2% compared to last year. If including outstanding balances of old and new loans, the loan interest rate decreased by about 1% compared to the end of 2022. The State Bank requested banks to continue reviewing, reducing administrative procedures, and shortening the loan application review process, in order to create conditions for credit support for businesses and people.

Siddhartha

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)