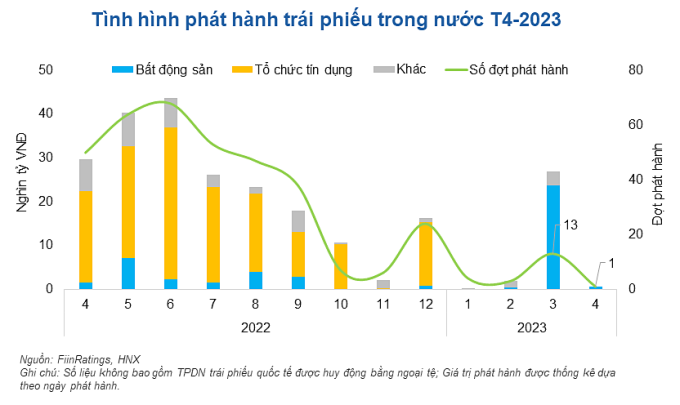

After a vibrant March, the corporate bond market in April fell sharply when only one lot was issued, according to FiinRatings.

This single bond lot belongs to the real estate sector, worth VND671 billion, issued by North Star Holdings Joint Stock Company. The bond has a term of 16 months, with an interest rate of 14% per year. This is also the highest nominal interest rate recorded since the beginning of 2023.

Thus, the issuance scale in April was only equivalent to 2.25% compared to the same period in 2022 and 2.5% compared to March - when the market rebounded with 13 bond lots issued with a total value of nearly 18,000 billion VND. Along with that, the scale of bonds bought back before maturity last month was nearly 11,300 billion VND, down 41.61% compared to March and down 10% compared to the same period.

As of May 4, the market recorded 98 issuers that were late in fulfilling their bond debt obligations with a total value of VND128,500 billion, up 13.6% compared to the last update. With these developments, FiinRatings, a credit rating unit of the financial data provider FiinGroup, believes that difficulties in the corporate bond market still lie ahead.

A recent bright spot is that the market has recorded some bond debt restructuring activities under Decree 08. On May 4, Phat Dat Real Estate extended a bond lot worth VND148 billion, along with increasing the interest rate to maturity. Or Sovico increased the term of 52 bond packages from 36 months to 60 months.

Circular 03 of the State Bank has temporarily removed the liquidity bottleneck in the market by allowing credit institutions to buy back bonds without having to wait for a year. This has somewhat stabilized sentiment, reduced the holdings of individual investors, and brought the market to a more balanced state, according to FiinRatings.

Last month, the repurchase activity mainly came from the banking group, accounting for 61% of the value. The value of repurchased bank bonds increased by 5.64 times compared to March and increased by 2.42 times compared to the same period last year, coming from large banks such as International Bank, Saigon Thuong Tin, Vietnam Prosperity Bank and BIDV. Most of the lots repurchased by banks had a term of 3 years and a remaining maturity of one or two years.

Di Tung

Source link

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)