Authorities will apply many solutions to combat tax losses in e-commerce, especially with livestream sales.

|

| E-commerce is growing very rapidly and the question is how to effectively manage this activity. Photo: D.T |

E-commerce tax increased, but not enough

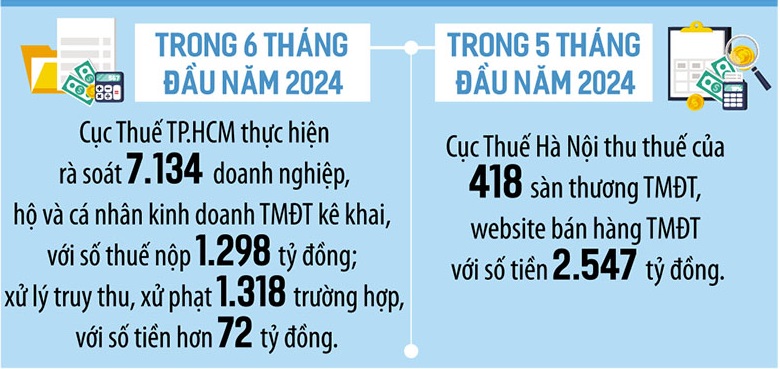

According to the General Department of Taxation (Ministry of Finance), in the first 6 months of 2024, tax management revenue from organizations and individuals with e-commerce business activities was 1.98 million billion VND; the amount of tax paid was nearly 55,000 billion VND, an increase of 23% compared to the average tax amount in the first 6 months of 2023; there were 26 new foreign suppliers registered, declared and paid taxes in Vietnam.

Also in the first 6 months of the year, nearly 43,000 online sellers subject to review declared and paid taxes of VND9,980 billion, an increase of VND3,480 billion and 2.8 times higher than the same period last year. The tax authority also handled 4,560 violations, collecting and imposing fines of nearly VND300 billion.

However, although the tax authority is reviewing the information provided by the e-commerce portal, so far, only 18/361 platforms have provided the information again, ensuring it is correct and sufficient according to regulations.

On the other hand, recently, livestream sales have emerged in e-commerce activities. According to the Vietnam E-commerce Association, there are an average of 2.5 million livestream sales sessions per month, with more than 50,000 sellers participating. Livestream sales is doing business by broadcasting videos online on media such as social networking platforms, trading floors, e-commerce websites, and television channels.

“There are still some cases where organizations and individuals generating revenue from e-commerce and livestream sales have not voluntarily fulfilled their obligations to declare, register and pay taxes fully and promptly,” said Ms. Nguyen Thi Lan Anh, Director of the Department of Tax Management for Small and Medium Enterprises, Business Households and Individuals (General Department of Taxation).

|

How to prevent tax loss?

To prevent tax losses and ensure fairness for organizations and individuals doing e-commerce business in fulfilling tax obligations, the General Department of Taxation is studying and proposing to strengthen tax management for this activity. Accordingly, the General Department of Taxation proposes to collect value added tax at source for e-commerce transactions. Specifically, value added tax will be directly deducted from the payment cash flow and transferred to the tax authority's specialized collection account opened at the treasury; the remainder will be transferred to the seller.

In addition, the General Department of Taxation will continue to upgrade the infrastructure of the tax management system to support and facilitate taxpayers; carry out inspection and examination work, focusing on foreign suppliers without fixed business establishments in Vietnam...

Ms. Nguyen Thi Lan Anh said that in the coming time, the General Department of Taxation will put into operation an electronic information portal for individuals and business households engaged in e-commerce activities to conveniently fulfill their tax obligations. The tax sector will build a risk management model for organizations and individuals doing e-commerce business. Accordingly, artificial intelligence (AI) will be applied to process big data, giving warnings in cases of tax risks; continuing to carry out inspections and examinations of organizations and individuals doing e-commerce business, enterprises that are owners of e-commerce trading floors, shipping units, and payment intermediaries.

In particular, the Ministry of Public Security shall preside over and coordinate with the Ministry of Industry and Trade, the Ministry of Information and Communications and relevant agencies to develop solutions and roadmaps for cleaning up accounts for e-commerce sites and social networking sites conducting business and advertising activities; issue guiding documents on standards and techniques for using electronic identification and authentication services to meet the management goals of e-commerce activities; coordinate with ministries and branches to strictly handle violations in e-commerce activities in general and livestream sales in particular, especially acts of selling counterfeit goods, goods of unknown origin, poor quality goods, tax evasion, tax fraud, etc.

Ms. Nguyen Thi Cuc, President of the Vietnam Tax Consulting Association, recommends that in cases where organizations and individuals doing e-commerce business have not paid taxes in the past, while tax authorities have not yet discovered the collection, the seller should voluntarily contact the tax department where they reside (temporary residence, permanent residence) to pay taxes and calculate the late payment fee of 0.03% based on the amount of tax payable and the number of days of late payment.

In case the tax authority discovers that the seller has not declared taxes, the tax amount is large, in addition to handling the violation, collecting and fining the tax, individuals/organizations are also at risk of being prosecuted criminally.

From the e-commerce platform, Mr. Nguyen Lam Thanh, representative of TikTok Vietnam, said that according to regulations, TikTok Shop does not have the right and responsibility to deduct taxes from sellers, so it will not declare and pay taxes on behalf of sellers. However, depending on each specific case, TikTok Shop will work with tax authorities when requested based on current regulations.

According to Mr. Phan Vu Hoang, Deputy General Director of Deloitte Vietnam, after developing new technology tools, a significant increase in digital data sources and closer connections between tax authorities and other agencies, tax management will be more flexible and easier. At that time, just through smartphones, when taxpayers consume any goods or services, the phone will automatically connect and pay that tax to the tax authority.

It is known that the Ministry of Finance is seeking comments on the Draft Circular guiding tax registration, which adds a provision that individuals doing e-commerce business on digital platforms must register directly with the tax authority. These individuals will be subject to the same regulations as households and individuals who produce and trade goods and services, but are not required to register their business according to the Government's regulations on business households. The draft also maintains the tax registration regulation for overseas suppliers, including organizations and individuals without a permanent residence but doing e-commerce business on digital platforms in Vietnam.

Source: https://baodautu.vn/cao-diem-chong-that-thu-thue-thuong-mai-dien-tu-d221938.html

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

Comment (0)