Domestic gold price today 4/3/2025

At the time of survey at 4:30 a.m. on April 3, 2025, domestic gold prices fell across the board, losing the 102 million VND/tael mark. Specifically:

DOJI Group listed the price of SJC gold bars at 99.1-101.8 million VND/tael (buy - sell), a decrease of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 99.1-101.8 million VND/tael (buy - sell), down 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 99.1-100.5 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 900 thousand VND/tael for buying and 1 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 99.1-101.8 million VND/tael (buying - selling), down 300 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 98.7-101.7 million VND/tael (buy - sell), gold price decreased by 700 thousand VND/tael for buying - decreased by 200 thousand VND/tael for selling compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.7-101.4 million VND/tael (buy - sell); down 900,000 VND/tael for buying - down 700,000 VND/tael for selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 98.8-101.8 million VND/tael (buy - sell); down 1 million VND/tael for buying - down 500 thousand VND/tael for selling.

The latest gold price list today, April 3, 2025 is as follows:

| Gold price today | April 3, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 99.1 | 101.8 | -300 | -300 |

| DOJI Group | 99.1 | 101.8 | -300 | -300 |

| Red Eyelashes | 100 | 101.5 | -900 | -1000 |

| PNJ | 99.1 | 101.8 | -300 | -300 |

| Vietinbank Gold | 101.8 | -300 | ||

| Bao Tin Minh Chau | 99.1 | 101.8 | -300 | -300 |

| Phu Quy | 98.7 | 101.7 | -700 | -400 |

| 1. DOJI - Updated: April 3, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 99,100 ▼300K | 101,800 ▼300K |

| AVPL/SJC HCM | 99,100 ▼300K | 101,800 ▼300K |

| AVPL/SJC DN | 99,100 ▼300K | 101,800 ▼300K |

| Raw material 9999 - HN | 98,500 ▼900K | 100,500 ▼700K |

| Raw material 999 - HN | 98,400 ▼900K | 100,400 ▼700K |

| 2. PNJ - Updated: April 3, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| HCMC - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Hanoi - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Hanoi - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Da Nang - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Da Nang - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Western Region - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Western Region - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - Southeast | PNJ | 99,100 ▼300K |

| Jewelry gold price - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,100 ▼300K |

| Jewelry gold price - Jewelry gold 999.9 | 99,100 ▼300K | 101,600 ▼300K |

| Jewelry gold price - Jewelry gold 999 | 99,000 ▼300K | 101,500 ▼300K |

| Jewelry gold price - Jewelry gold 99 | 98,180 ▼300K | 100,680 ▼300K |

| Jewelry gold price - 916 gold (22K) | 90,670 ▼270K | 93,170 ▼270K |

| Jewelry gold price - 750 gold (18K) | 73,850 ▼230K | 76,350 ▼230K |

| Jewelry gold price - 680 gold (16.3K) | 66,740 ▼200K | 69,240 ▼200K |

| Jewelry gold price - 650 gold (15.6K) | 63,690 ▼200K | 66,190 ▼200K |

| Jewelry gold price - 610 gold (14.6K) | 59,630 ▼180K | 62,130 ▼180K |

| Jewelry gold price - 585 gold (14K) | 57,090 ▼170K | 59,590 ▼170K |

| Jewelry gold price - 416 gold (10K) | 39,920 ▼120K | 42,420 ▼120K |

| Jewelry gold price - 375 gold (9K) | 35,750 ▼110K | 38,250 ▼110K |

| Jewelry gold price - 333 gold (8K) | 31,180 ▼100K | 33,680 ▼100K |

| 3. SJC - Updated: 4/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 99,100 ▼300K | 101,800 ▼300K |

| SJC gold 5 chi | 99,100 ▼300K | 101,820 ▼300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 99,100 ▼300K | 101,830 ▼300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,900 ▼300K | 101,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,900 ▼300K | 101,600 |

| Jewelry 99.99% | 98,900 ▼300K | 101,200 |

| Jewelry 99% | 97,198 | 100,198 |

| Jewelry 68% | 65,972 | 68,972 |

| Jewelry 41.7% | 39,354 | 42,354 |

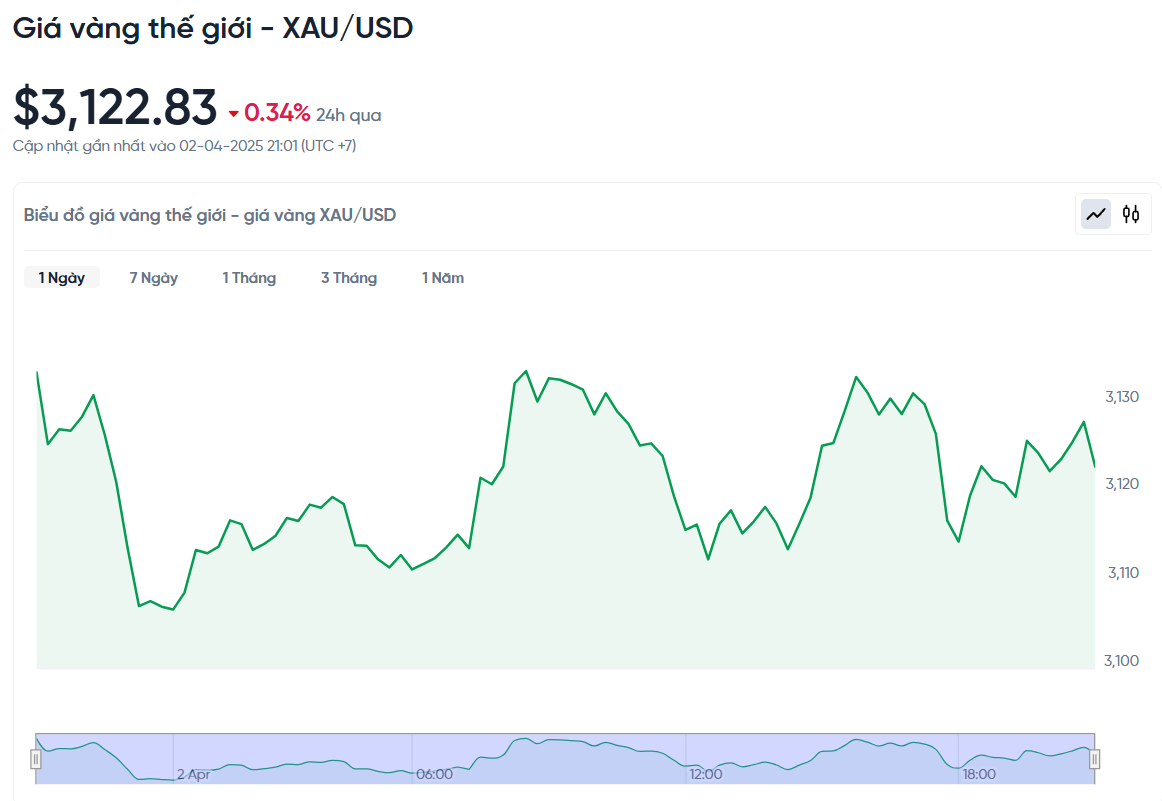

World gold price today April 3, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,122.83 USD/ounce. Today's gold price decreased by 10.74 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,910 VND/USD), the world gold price is about 99.28 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 2.52 million VND/tael higher than the international gold price.

The world gold price, although slightly down, is still above 3,100 USD, thanks to the demand for investment in safe assets. The world market is waiting for important information about the new tax policy that the US is about to announce. President Donald Trump is expected to make a decision on the reciprocal tax on April 2, or around 2:00 a.m. on April 3, Vietnam time. This event has made many investors worried and looking for ways to protect their assets.

According to Tim Waterer, an expert from KCM Trade, trade tensions may not be over after the US is about to impose new tariffs on imported cars. He commented: "In the context of global economic growth, investors will continue to favor gold, even if the market corrects down."

In addition to tax policies, gold prices this year have been driven by many other factors. Central banks have been buying continuously, while the market expects the US Federal Reserve (Fed) to cut interest rates in the near future. In addition, geopolitical tensions in the Middle East and Europe, along with money flowing into gold ETFs, have also contributed to the price increase.

BMI experts stressed that gold will maintain its leading position among precious metals unless the Fed unexpectedly raises interest rates. This week, the market will also closely monitor a number of important US economic data, including the non-farm payrolls report on Friday. This information could have a strong impact on gold price trends in the coming days.

Meanwhile, the ADP private employment report showed signs of improvement in the US labor market in March, preventing gold prices from rising. Specifically, ADP recorded 155,000 new jobs created, far exceeding the previous forecast of 118,000. Nela Richardson, chief economist at ADP, commented: "Despite many policy uncertainties and cautious consumer sentiment, this result is still a positive signal for the economy and businesses."

Some analysts say the gold market has rallied quite strongly in recent times and may face profit-taking pressure if economic data continues to be optimistic. Although gold is considered a safe-haven asset, experts note that the price of this precious metal may be affected by the monetary policy of the US Federal Reserve (Fed).

While the ADP data helped ease concerns about the health of the U.S. economy, economists cautioned that the report did not fully reflect the labor market. The government’s official nonfarm payrolls data, due Friday, could be affected by public sector layoffs.

Besides gold price, silver price increased slightly to 33.76 USD/ounce, while platinum price decreased 0.4% to 975.51 USD. Palladium price also decreased 0.3% to 980.51 USD.

Gold Price Forecast

Peter Grant, vice president and metals strategist at Zaner Metals, said: "If gold prices break the resistance level of $3,147.41 - $3,149.84, there is a high possibility of further increases to $3,200, even opening the way for optimistic forecasts towards $3,300 - $3,500."

“The tariff concerns are making investors more cautious. They tend to turn to gold as a safe haven against unpredictable volatility,” said Yeap Jun Rong, a market analyst at IG. He also predicted that in the short term, gold prices could continue to rise and hit $3,200 an ounce thanks to this cautious sentiment.

Technically, bulls still hold a strong advantage in the June gold futures market. The next target for bulls is to push prices above solid resistance at $3,200. Meanwhile, bears are aiming to push prices below key technical support at $3,031.

The immediate resistance levels are seen at the record high of $3,177 and then at $3,200. On the support side, the overnight low of $3,135.70 and this week’s low of $3,112.40 will be the points to watch. The Wyckoff Market Rating Index currently stands at 9.5/10, indicating that the uptrend remains very strong.

At the PDAC 2025 conference in Toronto, Canada, Tavi Costa, partner and strategist at Crescat Capital, said that if history repeats itself, gold could be revalued at a very high level. He said that the US currently holds gold worth only about 2% of its total outstanding government bonds, which is about $36 trillion.

If the US were to reassess its gold-to-bond ratio, the potential for gold to rise would be huge. Costa estimates that if that ratio returned to the 17% level of the 1970s, gold could hit $25,000 an ounce. If it returned to the 40% level of the 1940s, gold could hit $55,000 an ounce. This is a signal that gold still has plenty of room to rise in the long term.

Some forecasts suggest that gold prices could reach $3,500 an ounce by the end of the year. However, rising too quickly also carries risks. A deep correction is entirely possible if current support factors change.

If the US reaches a ceasefire in Ukraine and the Trump administration does not continue to push ahead with its tax policies, gold prices could plummet. Some have even warned that gold prices could fall as much as 38% within five years, returning to $1,820 an ounce in 2022. However, history shows that gold rarely corrects by more than 15%.

Source: https://baonghean.vn/gia-vang-hom-nay-3-4-2025-gia-vang-trong-nuoc-va-the-gioi-giam-manh-dong-loat-do-chot-loi-10294314.html

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)