Many brokers in the eastern part of Ho Chi Minh City said that recently, although the real estate market in general has some positive signs, the situation of selling apartments at a loss is still quite common.

The reason is that the landlord cannot bear the pressure of paying off the bank loan. In a large urban area in the old District 9 (now Thu Duc City), many people accept a loss of 15%-25% on completed apartments but still have difficulty finding buyers.

Sell at a loss to pay off debt

According to Mr. Hoang, an apartment broker in this area, many apartments after being handed over, the owners cannot rent them out but still have to pay bank interest of 13%-15%/year so they are forced to sell at a loss to reduce the pressure.

For example, a 3-bedroom luxury apartment previously cost around 5 billion VND, but now someone is selling it for just over 4 billion VND; and a 2-bedroom apartment costs 2.3-2.4 billion VND instead of 2.6-2.7 billion VND as before, but it is still difficult to find a buyer.

"The situation of cutting losses on apartments that have been or are about to be handed over has slowed down but has not ended because at the end of the year, many people often face financial pressure. In fact, not only this area has the situation of reducing prices of handed over apartments but many other areas as well, while the market is still lacking in new apartment supply, especially affordable apartments" - Mr. Hoang acknowledged.

Specifically, another project also in the old District 9, Centum Wealth, has an average secondary price of 40 million VND/m2, down 12% compared to 1 year ago, or 4S Linh Dong apartment is being advertised for sale at 24-27 million VND/m2.

Opal Boulevard apartment building located on Pham Van Dong Street but in Di An City, Binh Duong Province has a secondary selling price of 30-34 million VND/m2, down 14% compared to the selling price a year ago.

An apartment project is being implemented in Ho Chi Minh City.

Even completed apartment projects with bustling residents, where prices usually increase by 5%-10% per year, have slowed down. Many people who need money and want to sell quickly are willing to reduce prices. For example, a 2-bedroom apartment, 85-90 m2 in the Saigon Pearl area, right on Nguyen Huu Canh Street, Binh Thanh District, Ho Chi Minh City, is being offered for sale for around 5 billion VND, while 2 years ago it was 5.3-5.4 billion VND/apartment. Or The Art apartment (Phuoc Long B Ward, Thu Duc City) that has been handed over for many years is being offered for sale for around 37 million VND/m2, 10% lower than the same period last year.

Big data from Batdongsan.com.vn shows that in November 2023, the price of luxury apartments in Ho Chi Minh City remained the same, but mid-range and affordable apartments decreased by 1% to 4% compared to the previous month, and compared to the previous year, the decrease was much stronger.

Specifically, the average apartment price in Thu Duc City is 42 million VND/m2 in 2023, down 16.5% compared to 2022; apartments in Tan Phu district are 39 million VND/m2, down 20% compared to 49 million VND/m2 in 2022; or apartments in Binh Tan district are about 43.9 million VND/m2, down 14.6% compared to the selling price in 2021...

Good opportunity for buyers

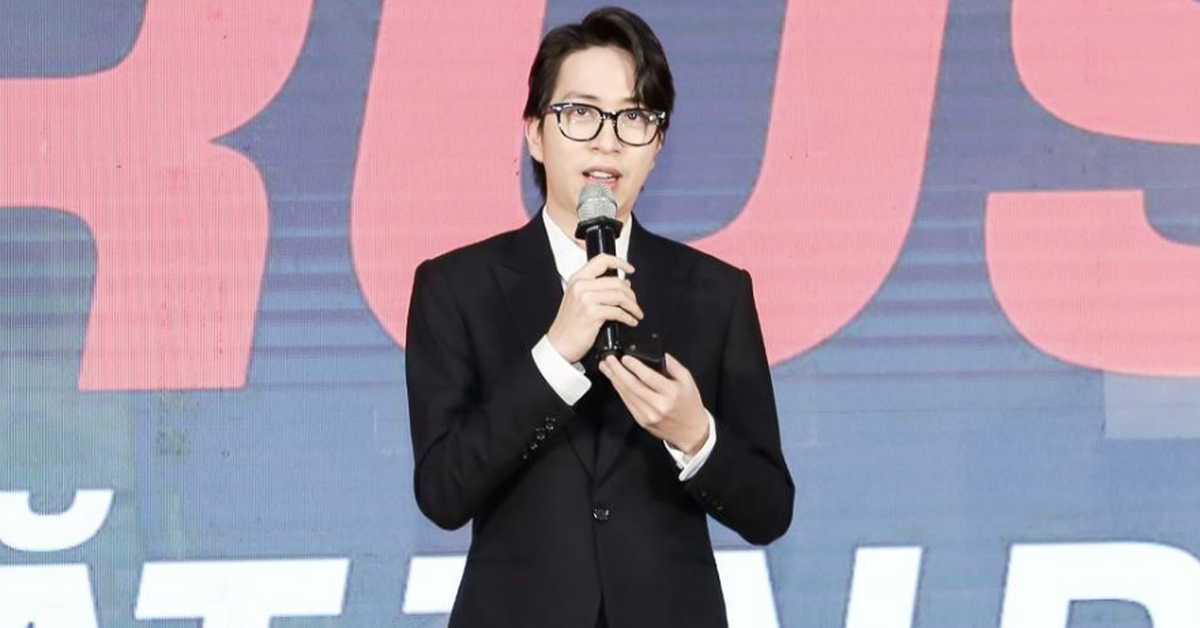

Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, commented that although apartment prices in some places have decreased, they are still quite high in general. The positive point is that people's ability to buy houses is increasing thanks to preferential policies from investors.

The real estate consumer sentiment report in early 2024 by Batdongsan.com.vn just released shows that 46% of respondents are satisfied with the current market situation because there are more good financial options.

Experts from Batdongsan.com.vn believe that the more positive psychology of real estate buyers and sellers will be an opportunity for the 2024 market to develop and overcome the remaining difficulties in 2023. Mr. Dinh Minh Tuan summarized the situation of the outstanding real estate types last year as follows: "Apartments are flexible and adaptable, townhouses are volatile, land is gloomy and waiting for the right time".

According to Mr. Tran Khanh Quang, General Director of Viet An Hoa Real Estate Investment Joint Stock Company, the real estate market at the end of the year usually goes in two directions. If the market is positive, real estate prices will increase well. If the market is not as positive as it is now, there will be a situation of cutting losses to solve the financial needs of homeowners. However, the possibility of this discounted supply is not high, only about 5% of the market.

Because those who have been able to hold out for the past time will try to wait for the market to recover. On the other hand, this is an opportunity for those who buy to live or those who do not have bank debt to use loans to buy, because the market is currently at the bottom, it will be difficult for prices to fall further.

According to Mr. Troy Griffiths, Deputy Managing Director of Savills Vietnam, although the general market is facing many difficulties, the apartment rental segment in Ho Chi Minh City still brings quite good efficiency with profits from 2.9% to 13.6%. Importantly, real estate is a long-term investment channel and should be measured over a long-term stable period of at least 5 to 10 years.

"In the long term, Vietnam's fundamentals such as average income growth, large population and urbanization will be the main drivers for residential real estate. Moreover, Vietnam has the region's leading infrastructure spending (6% of GDP), which will change the way real estate is used, so investors should keep a close eye on these important impacts," the expert analyzed.

A reversal is coming soon

Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, predicted that the turning point of the real estate market may appear from the second quarter to the fourth quarter of 2024. After that, the market will enter a new cycle with 4 stages: exploration, consolidation, prosperity and stability.

The exploration phase is expected to take place in the second half of 2024 with small liquidity coming from apartment products meeting real housing needs. Next is the consolidation phase, expected to fall from the fourth quarter of 2024 to the first quarter of 2025, under the condition that monetary tools and policies are widely promoted, helping to remove difficulties in money sources.

Source: https://nld.com.vn/can-ho-thu-cap-kho-ban-196240110212435805.htm

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

![[Photo] Quang Binh: Bright yellow vermicelli flowers in Le Thuy village](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/80efad70a1d8452581981f8bdccabc9d)

Comment (0)