Unable to increase capital to 700 billion VND, and the real estate sector continuing to face difficulties, Binh Duong Construction and Transport Joint Stock Company (Becamex BCE, code BCE) is facing cash flow difficulties when entering a new field.

|

Three consecutive years of not paying dividends when entering the real estate sector

In the past 3-5 years, companies related to the Industrial Development and Investment Corporation - JSC (Becamex, code BCM) in Binh Duong have attracted special attention from investors on the stock exchange because of their attractive, regular annual cash dividend policy for shareholders.

However, in 2022-2023, the cash dividend policy of the group of enterprises related to Becamex has changed. From paying dividends regularly, these enterprises have begun to delay paying dividends to shareholders.

At Becamex BCE, in the content presented to shareholders at the general meeting of shareholders on April 12, this unit plans not to pay dividends in 2023 (and will also not pay dividends to shareholders in 2022).

Previously, on April 26, 2022, Becamex BCE approved the payment of 2021 dividends at a rate of 5%, equivalent to a total payment of VND 17.5 billion to shareholders and approved the plan to issue shares to increase charter capital from VND 350 billion to VND 700 billion to supplement capital for production and business activities.

However, on April 19, 2023, the Company agreed to postpone the 2021 dividend payment and not pay the 2022 dividend to focus capital on business activities, and at the same time approved not to implement the plan to issue shares to increase capital.

Previously, the Company continuously maintained attractive cash dividends for shareholders, such as paying dividends at a rate of 8% in 2016, 8% in 2017, 10% in 2018, 12% in 2019 and 9% in 2020.

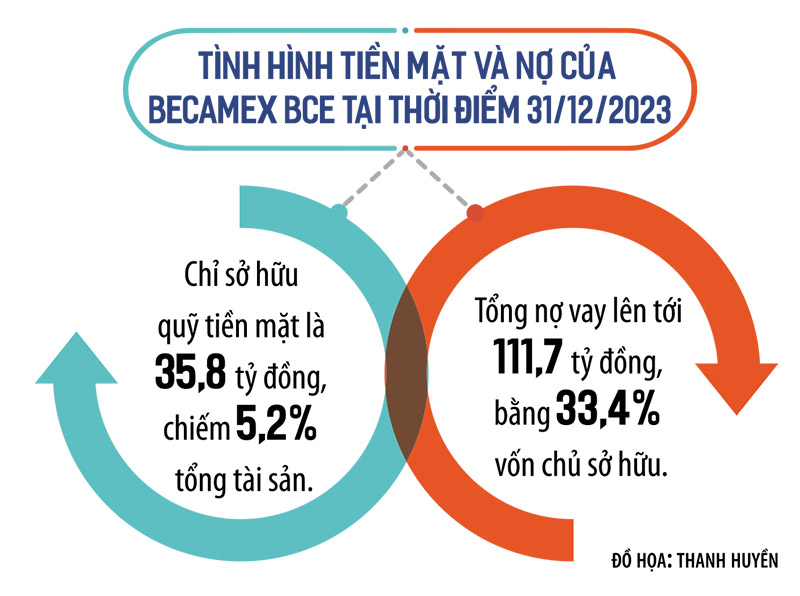

In fact, as of December 31, 2023, Becamex BCE only had a cash fund of VND 35.8 billion, accounting for 5.2% of total assets. Meanwhile, total debt was up to VND 111.7 billion, equal to 33.4% of equity.

In addition to limited cash, also at the end of 2023, Becamex BCE's assets were VND 529.7 billion, including short-term and long-term receivables from third parties, accounting for 77% of total assets; inventories and long-term unfinished assets recorded only VND 49.5 billion, accounting for 7.2% of total assets...

Thus, limited cash funds and assets mainly located in third parties are causing cash flow difficulties for Becamex BCE.

Real estate contributes revenue, but not significantly

Becamex BCE was established in 2002 to meet the construction needs of internal and external projects of Becamex with initial charter capital of 7 billion VND, the main business area is concentrated in Binh Duong province.

By 2021, Becamex BCE had offered an additional 5 million BCE shares to the outside to increase its charter capital from VND 300 billion to VND 350 billion. Of which, the mobilized amount was used to pay for the construction costs of the Resettlement - Residential Area in Hamlet 4 (Minh Thanh Commune, Chon Thanh District, Binh Phuoc Province) and the 5F Residential Area Project (Hamlet 5, Lai Uyen, Bau Bang District, Binh Duong Province).

It is worth noting that after the issuance of shares, Becamex's ownership ratio at Becamex BCE decreased from 51.82% to 44.42% and has maintained this ownership ratio until now. Although it no longer owns more than 51%, Becamex is still considered the parent company of Becamex BCE, as it still controls the operations at Becamex BCE.

Regarding business activities, after many years of implementing construction projects for units related to the parent company Becamex, in the past few years, Becamex BCE has become the investor implementing the construction of a commercial housing project - worker service in Bau Bang Industrial and Urban Area (Binh Duong), a commercial housing project - worker service in Chon Thanh district (Binh Phuoc).

In particular, in terms of the contribution structure of the real estate sector in revenue, in 2021, it recorded 9.51 billion VND, accounting for 8.93% of total revenue; in 2022, it recorded no revenue; in 2023, it recorded about 29.4 billion VND, accounting for 23.96% of total revenue.

In 2024, Becamex BCE plans to continue expanding and developing real estate projects, promoting the issuance of land use and housing certificates for customers, and implementing debt collection solutions.

In particular, the Company will continue to construct projects that have been implemented in 2023 and start new projects, such as the commercial housing - service project for workers in Becamex Industrial Park - Binh Phuoc; R2A Ecolakes infrastructure project; construction of Bau Bang commercial housing - service for workers in Binh Duong.

In fact, due to entering the real estate sector during a difficult period and the capital increase from VND 350 billion to VND 700 billion to supplement capital for project implementation not being continued, Becamex BCE is showing signs of difficulty in capital mobilization, leading to the inability to ensure cash flow to pay dividends, as well as arising dividend debt.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)