China's spending on chipmaking equipment is forecast to fall an average of 4% annually through 2027, signaling the country's semiconductor industry is facing a glut crisis.

International chip industry group SEMI forecasts spending on chip manufacturing equipment in China will fall by an average of 4% between 2023 and 2027.

According to the organization, spending on chip manufacturing equipment in China will exceed $40 billion this year, then decrease to 2023 levels from next year.

“In 2025, the mainland China market is expected to shrink by 5-10% year-on-year,” an executive at the China branch of an international chip manufacturing equipment supplier told Nikkei Asia .

“The utilization rate of equipment delivered to semiconductor factories in China is falling, and the previous rush to buy is partly leading to a shrinking market in 2025 and beyond,” the executive added.

At ASML Holding, a major Dutch chipmaking equipment supplier, China accounted for about 50% of sales by value in the July-September quarter. However, ASML expects China's market share to fall to about 20% by 2025.

According to SEMI, spending on chip manufacturing equipment in mainland China will decline by an average of 4% from 2023 to 2027 in terms of compound annual growth rate.

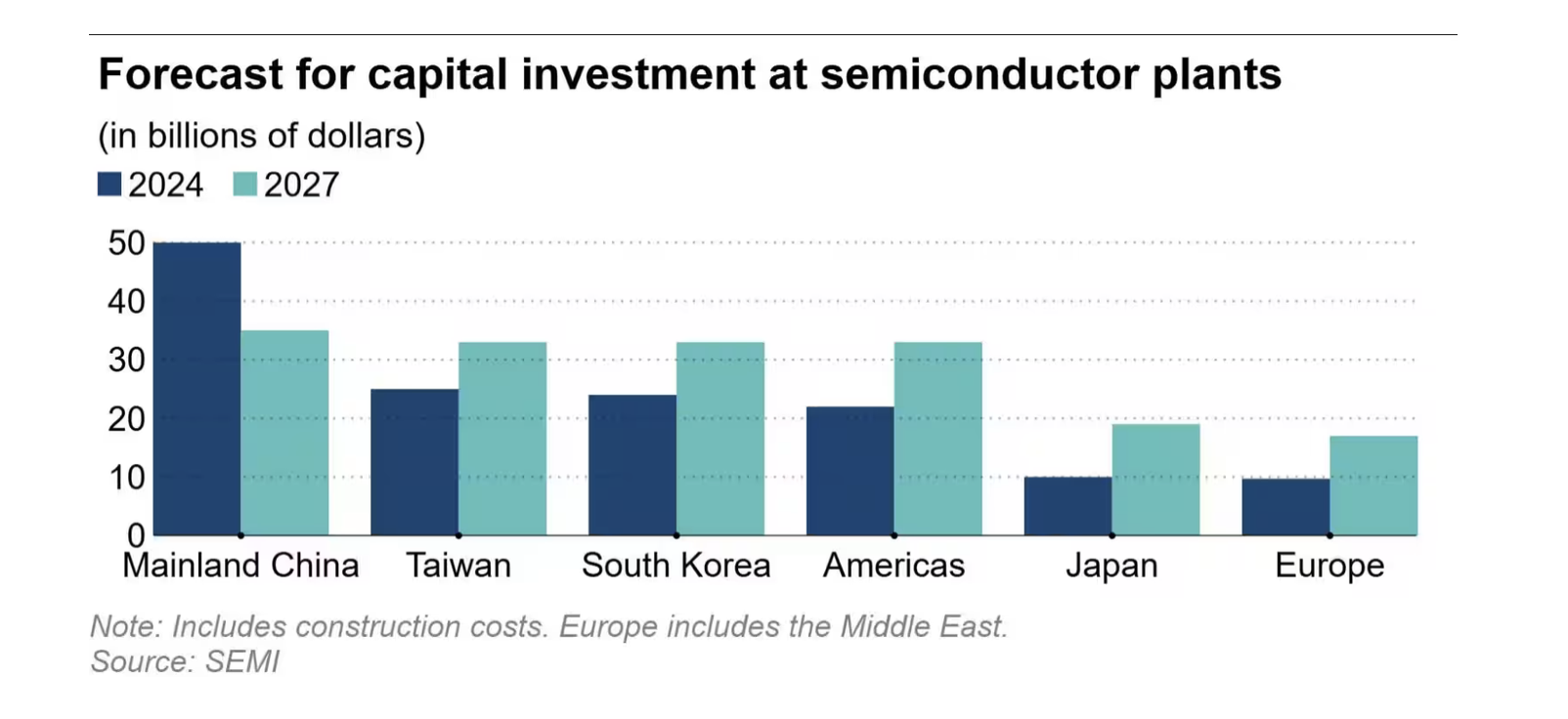

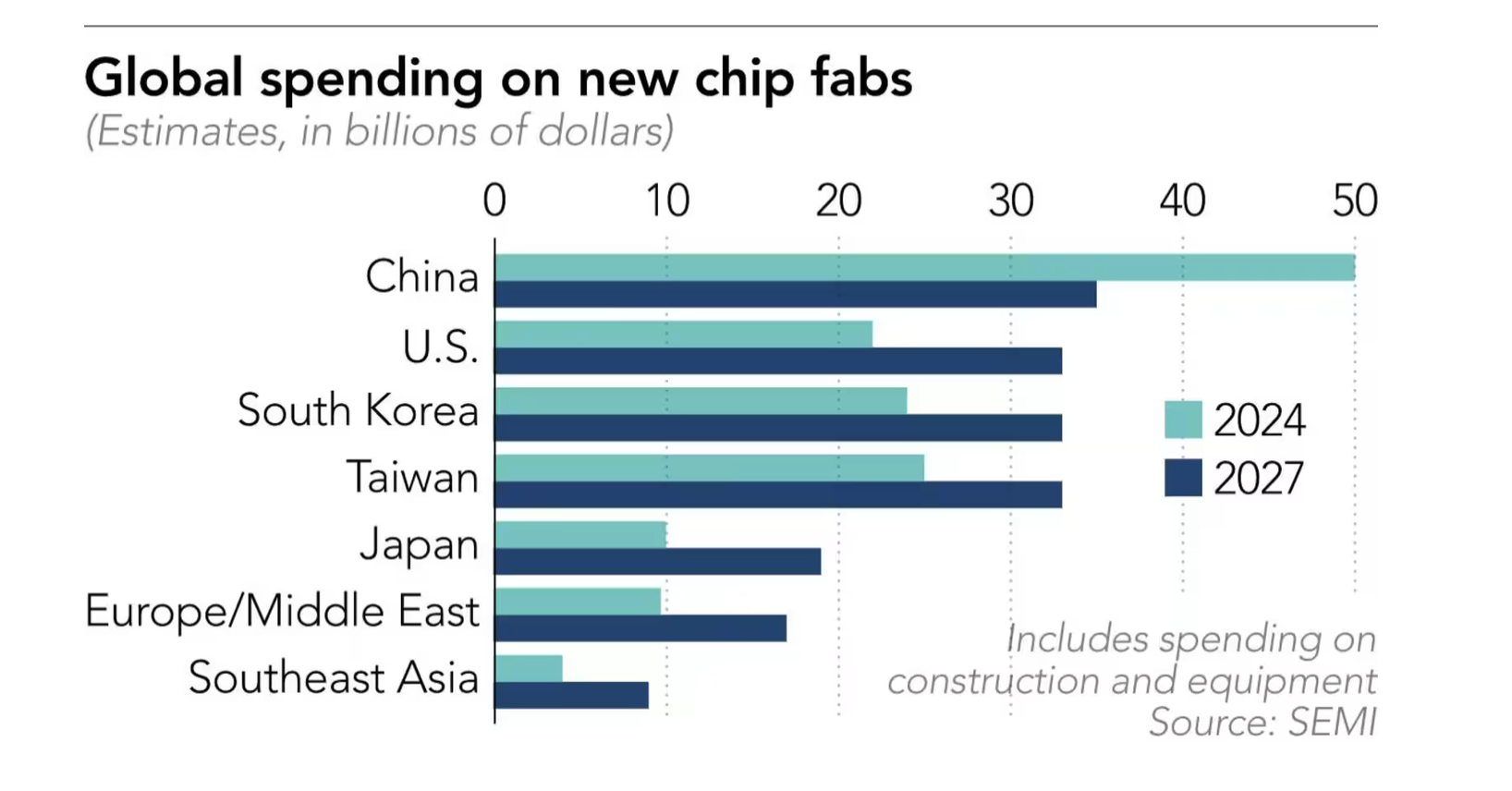

In contrast, spending in the Americas will increase by 22% annually over the same period, 19% in Europe and the Middle East, and 18% in Japan.

Still, mainland China remains the world’s largest market for chipmaking equipment, with the country expected to spend $144.4 billion on semiconductor factory equipment between 2024 and 2027.

This cost is larger than South Korea's $108 billion, Taiwan's $103.2 billion, America's $77.5 billion and Japan's $45.1 billion.

Supply exceeds demand due to massive spending

One factor contributing to China’s overspending is the government’s goal of increasing self-sufficiency in the semiconductor industry. According to SEMI, China’s self-sufficiency rate by 2023 will be just 23%.

The Chinese government wants to continue supporting the semiconductor industry to promote technological self-sufficiency, so major foreign suppliers here face fierce competition from local companies.

Massive investment in chip manufacturing could lead to overcapacity, putting pressure on prices and profits for companies in the industry.

The world's second-largest economy's massive spending has pushed the country's chip industry's capital investment rate above 15% for four consecutive years since 2021.

Industry experts estimate that if this rate is above 15%, it could cause concerns about oversupply, leading to price reductions and affecting business profits.

SMIC recently warned that overcapacity with mature node chips will last until 2025 and they are cautiously considering new capacity expansion.

"The industry's utilization rate is hovering around 70%, far below the optimal level of 85%, indicating significant overcapacity. The situation is unlikely to improve, if not could worsen," said co-CEO Zhao Haijun.

State-owned Naura Technology Group is China’s largest chip manufacturing equipment supplier. Advanced Micro-Fabrication Equipment (AMEC) is the second largest. Both have improved their technological capabilities with government support.

SMIC and other manufacturers have also been required by Beijing to buy domestic chip foundry equipment.

In January, the US added AMEC to a list of Chinese companies with ties to the military. According to mainland media, two US executives have resigned from AMEC since September.

(Synthetic)

Source: https://vietnamnet.vn/dau-hieu-cong-nghiep-ban-dan-trung-quoc-truoc-cuoc-khung-hoang-thua-2340698.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)