Ms. Thu Thuy has been a freelance trader since she was young. She is now 40 years old and wants to have a stable pension when she retires, so she plans to participate in voluntary social insurance.

She asked: "If I join now, how long do I have to contribute before I can receive my pension and how much will my monthly pension be?"

Freelancers can participate in voluntary social insurance to receive a pension when they retire (Illustration: Nguyen Vy).

According to Vietnam Social Security, current social insurance laws stipulate that all Vietnamese citizens aged 15 and over who are not subject to compulsory social insurance can participate in voluntary social insurance.

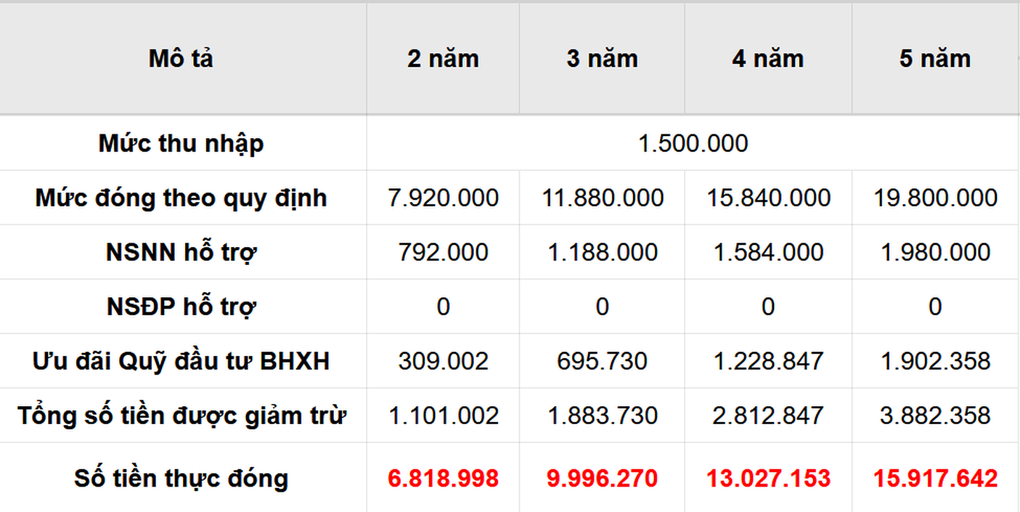

The monthly voluntary social insurance contribution of the participant is equal to 22% of the monthly income chosen by the participant. The lowest monthly income is equal to the poverty line in rural areas. The highest is equal to 20 times the basic salary at the time of contribution.

Unlike compulsory social insurance which requires monthly payments, voluntary social insurance participants can choose one of the following methods: monthly payment, 3-month payment, 6-month payment, 12-month payment and one-time payment for many years in the future (but not more than 5 years at a time).

In case a voluntary social insurance participant has reached the retirement age as prescribed but the remaining social insurance payment period is less than 10 years (120 months), he/she can pay once for the remaining years to reach 20 years to receive pension.

In addition, when participating in voluntary social insurance, participants are supported by the State with payment at a percentage (%) of the monthly social insurance payment according to the poverty line of rural areas.

Specifically, the state budget supports voluntary social insurance participants from poor households with 30% of the monthly social insurance contribution according to the poverty line in rural areas; near-poor households with 25%; the remaining people are supported with 10%.

The one-time payment for many years to come for employees is supported by 10% of the budget (Source: Vietnam Social Security).

Regarding pension conditions, Vietnam Social Security said: "Voluntary social insurance participants are entitled to pensions when they meet the age requirement and have paid social insurance for 20 years or more. In 2021, the retirement age for female workers in normal working conditions is 55 years and 4 months. After that, it will increase by 4 months each year until reaching 60 years old in 2035."

Regarding monthly pension, the monthly pension of female workers is calculated at 45% of the average monthly income for social insurance contributions for 15 years of social insurance contributions. Then, for each additional year, it is calculated at 2% until reaching the maximum level of 75%.

Thus, the monthly pension will be high or low depending on the monthly income for social insurance contributions that the participant chooses, the number of years of social insurance contributions and the inflation coefficient at the time the employee retires.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)