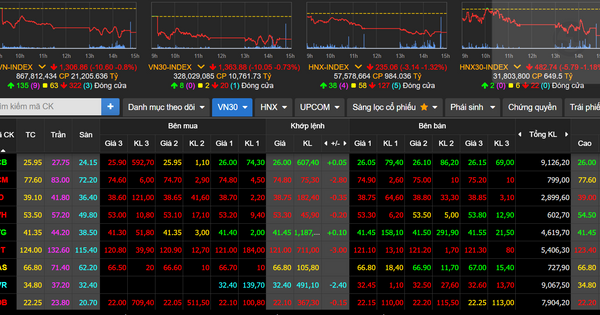

According to data compiled by the Vietnam Bond Market Association (VBMA) from HNX and SSC, as of the end of October 2023, there were 18 individual corporate bond issuances recorded in October with a total value of VND 20,826 billion. The issuances had an average interest rate of 8.9%/year, with a term ranging from 3.6 years.

Accumulated from the beginning of the year until now, in the market, the total value of corporate bond issuance recorded is VND 209,150 billion, including 25 public issuances worth VND 23,768 billion (accounting for 11.4% of the total issuance value) and 171 private issuances worth VND 185,382 billion (accounting for 88.6% of the total).

Of which, the banking sector dominated with VND99,023 billion (accounting for 47.3% of the total) of issued bonds, followed by the real estate group with VND68,256 billion (accounting for 32.6%).

According to VBMA data compiled from HNX, enterprises bought back VND15,741 billion worth of bonds in October 2023. The total value of bonds bought back by enterprises before maturity accumulated from the beginning of the year to date reached VND195,701 billion (equivalent to an increase of 23.4% over the same period in 2022 and equivalent to 91% of the issuance value).

Banking still maintains its position as the leading industry group in terms of repurchase value, accounting for 47.8% of the total early repurchase value (equivalent to VND 93,490 billion).

In the remaining 2 months of 2023, the total value of bonds due to mature according to VBMA statistics is 39,309 billion VND. The structure of maturing bonds includes 40% of the value of bonds about to mature in the real estate group with more than 15,631 billion VND, followed by the banking enterprise group with 7,530 billion VND (accounting for 19%).

In the coming time, there are 2 bond lots planned to be issued by the Bank for Investment and Development of Vietnam (BIDV) and the Ho Chi Minh City Development Joint Stock Commercial Bank (HD Bank).

Specifically, BIDV has approved a private issuance plan in the fourth quarter of 2023 with a maximum total issuance value of VND 5,500 billion to increase Tier 2 capital. These are non-convertible bonds, without warrants, with secured assets, interest rates determined by BIDV for each issuance, with a term of 5 years or more.

As for HD Bank, this bank plans to issue private bonds for the second time with a maximum total issuance value of VND8,000 billion. Specific terms of the bonds such as term and interest rate will be decided upon issuance .

Source

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)