The market opened with an attempt to recover after yesterday's sharp decline. However, selling pressure increased, causing the VN-Index to reverse at the end of the morning session.

The highlight came from VRE hitting the ceiling early on, then the market fluctuated causing this code to not hold the ceiling but still increased by 6.3%. Strong selling pressure in the banking group and FPT also weighed down the index.

At the end of the morning session on June 25, VN-Index decreased by 2.16 points, equivalent to 0.17% to 1,251.96 points. The entire floor had 179 stocks increasing and 196 stocks decreasing.

VN-Index performance on June 21 (Source: FireAnt).

Entering the afternoon session, investor sentiment was less pessimistic, and buying power helped the VN-Index recover and increase slightly.

At the end of the trading session on June 25, VN-Index increased by 2.44 points, equivalent to 0.19% to 1,256.56 points. The entire floor had 238 stocks increasing, 161 stocks decreasing, and 81 stocks remaining unchanged.

HNX-Index increased 0.45 points to 240.19 points. The entire floor had 85 stocks increasing, 86 stocks decreasing and 67 stocks remaining unchanged. UPCoM-Index decreased 0.23 points to 98.83 points.

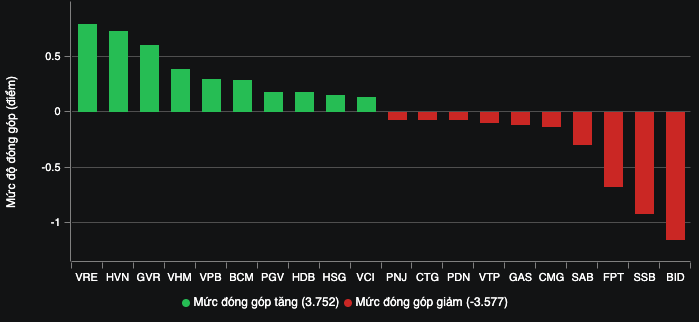

VRE regained its purple color and led the market's increase with a contribution of 0.8 points. Previously, this stock witnessed a series of 8 consecutive declines, bringing VRE's market price to a 4-year low. VHM also contributed nearly 0.4 points to the market. Thanks to the pull from Vingroup, the real estate group increased well with 1.02%, for example, codes TCH, NVL, DIG, HDG, KHG, HDC, NLG, KBC, KDH all ended the session in green.

After the floor price session, Vietnam Airlines' HVN increased by 3.98% to VND34,000/share and contributed more than 0.7 points to the market. This increase was supported by the information that Pacific Airlines will take off again on domestic routes with Airbus A321 fleet from June 26, 2024.

Although the green and red colors were quite balanced in the banking group, the sharp decline from large stocks caused the entire industry to lose 0.21%. In particular, BID led the market decline when it took away more than 1.1 points, in addition, SSB and CTG also took away a total of more than 1 point. The codes MBB, ACB, KLB, TIN, SGB also ended the session in red. The remaining banking stocks mostly increased points, with only a few reference points.

Codes that affect the market.

The total order matching value in today's session was VND24,028 billion, down 47% compared to yesterday, of which the order matching value on the HoSE floor reached VND546 billion. In the VN30 group, liquidity reached VND8,757 billion.

Foreign investors net sold for the 14th consecutive session with a value of 705 billion VND today, of which this group disbursed 2,791 billion VND and sold 3,496 billion VND.

The codes that were sold heavily were FUEVFVND fund 565 billion VND, FPT 265 VND, MWG 129 billion VND, HPG 44 VND, GAS 39 billion VND,... On the contrary, the codes that were mainly bought were VCI 86 billion VND, HAH 41 billion VND, MSN 37 billion VND, HVN 36 billion VND, TCB 35 billion VND,... .

Source: https://www.nguoiduatin.vn/vre-va-hvn-song-kiem-hop-bich-day-song-a669958.html

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)