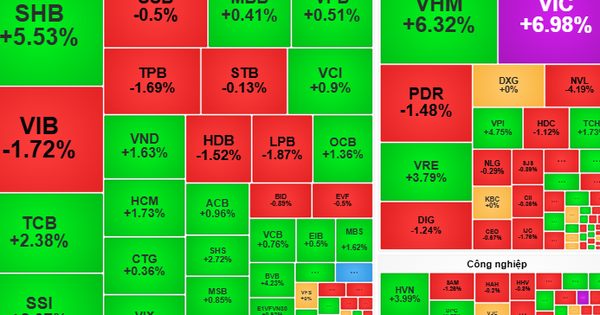

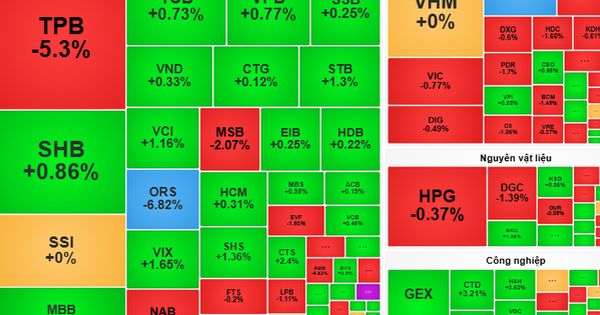

VN-Index increased by more than 10 points, focusing on banking, securities, and steel groups.

A series of stocks in the banking, securities and steel groups increased sharply, contributing to pulling the VN-Index closer to the 1,300 point mark.

|

| Vietcombank shares increased sharply after the Government proposed to invest additional state capital to maintain the state capital contribution ratio at Vietcombank with an amount of more than VND 20,695 billion. |

After a session of increasing points with the increase spreading across many sectors, the stock indices were pulled above the reference level right from the beginning of the session with a series of sectors increasing in price. Although selling pressure sometimes increased, buying power immediately returned and helped the indices stay in the green. VN-Index and HNX-Index both closed at the session's highest level.

The focus of attention was on banking, securities and steel stocks. In particular, the securities group stood out from the beginning of the session and mostly maintained its positivity until the close. MBS was the leading stock in this industry group when it broke out from the beginning of the trading session. MBS continued to increase by 5.76% and matched 7.6 million units. Following that, VIX also increased by 5.26%, SHS increased by 2%, VDS increased by 2.35%. Top securities codes such as SSI, VCI or HCM also increased well in today's session. SSI increased by 3.2%, VCI increased by 3.19%, HCM increased by 1.63%.

In the steel group, codes such as NKG, HSG, TLH, VGS or HPG... all increased in price. NKG increased by 2.8%, HSG increased by 2.7%, VGS increased by 4.1%... It is known that the positive performance of the steel group appeared right after the People's Bank of China (PBOC) announced a plan to launch the largest and most important monetary stimulus package since the Covid pandemic to prevent the housing market from plummeting. This move caused the price of steel rebar futures to skyrocket to over 3,130 CNY/ton (session 24/9), the highest level in the past three weeks.

In the banking group, VCB, BID, MBB, VPB, ACB and TCB are all on the list of stocks that have the most positive impact on the VN-Index. VCB contributed 2.16 points when it increased by 1.75%. Information that the National Assembly Standing Committee has considered additional state capital investment at Vietcombank through the form of stock dividends is the driving force for VCB shares to increase in price . Specifically, the Government proposed to invest additional state capital to maintain the state capital contribution ratio at Vietcombank with an amount of more than VND 20,695 billion.

|

| Vietcombank shares lead the increase of VN-Index |

Meanwhile, in the opposite direction, VNM, GVR, VHM, CTG... were the stocks that "ran out of breath" in today's session despite the positive developments of the general market. VNM decreased by 1% and took away 0.36 points from the VN-Index. GVR also decreased by 0.41%, taking away 0.15 points. In the group of pharmaceutical stocks, IMP and DVN both decreased quite sharply. IMP decreased by 2.9% and DVN decreased by 2.81%.

At the end of the trading session, VN-Index increased by 10.49 points (0.82%) to 1,287.48 points. The entire floor had 276 stocks increasing, 127 stocks decreasing and 71 stocks remaining unchanged. HNX-Index increased by 1.52 points (0.65%) to 235.84 points. The entire floor had 94 stocks increasing, 61 stocks decreasing and 65 stocks remaining unchanged. UPCoM-Index went against the trend when it decreased by 0.31 points (-0.33%) to 93.5 points. Pressure causing UPCoM-Index to decrease came from stocks such as VGI, ACV, MCH... VGI decreased by 0.89%, ACV decreased by 0.19%, MCH decreased by 0.1%.

The total trading volume on HoSE reached 993 million shares, equivalent to a value of VND22,791 billion, up 27% compared to the previous session, of which the negotiated value accounted for VND2,207 billion. The trading value on HNX and UPCoM reached VND1,567 billion and VND796 billion, respectively.

HPG ranked first in terms of total market trading value with VND1,076 billion. The following codes in the banking group were STB (VND920 billion), VPB (VND892 billion) and MBB (VND822 billion).

|

| Foreign investors return to net buying, focusing mostly on Vietcap Securities stocks |

During the entire session, foreign investors net bought more than 500 billion VND on the HoSE. Of which, this capital flow net bought the most shares of Vietcap Securities (VCI) with 90 billion VND. MWG and TCB were net bought with 84 billion VND and 79 billion VND respectively. On the other hand, HPG was net sold the most with 66 billion VND. STB and VNM were net sold with 61 billion VND and 33 billion VND respectively.

In the previous session, foreign investors had a net selling session of VND2,425 billion. However, VIB shares alone were sold by agreement for more than VND2,600 billion. If excluding VIB shares' agreement transactions, in the past nearly 2 weeks, buying power has been dominating foreign investors' trading movements.

Source: https://baodautu.vn/vn-index-tang-hon-10-diem-tam-diem-o-nhom-ngan-hang-chung-khoan-thep-d225827.html

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)