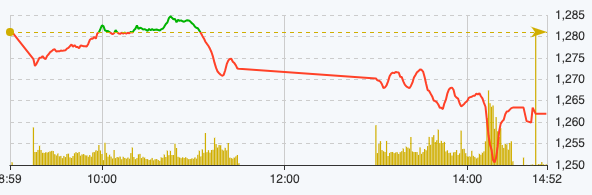

Selling pressure increased as soon as the market opened, causing the market to be submerged in red and the VN-Index retreated to near the 1,270-point mark. Although there was a time when good demand helped the index recover, it quickly turned around and fell.

Most industry groups were in the red at the end of this morning's session, with the banking sector also being affected despite a good increase at the beginning of the session. Large-cap industry groups such as retail, real estate, securities and construction materials declined even more negatively. In particular, the wholesale and plastics-chemical manufacturing group, although maintaining good growth from the beginning of the session, kept its proportion at a fairly low level.

At the end of the morning session on May 24, VN-Index decreased by 8.5 points, equivalent to 0.2% to 1,272.47 points. The entire floor had 116 stocks increasing and 310 stocks decreasing.

VN-Index performance on May 24 (Source: FireAnt).

In the afternoon session, the market faced widespread selling pressure, causing the index to plummet, at times falling close to the 1,250 point mark before narrowing the decline towards the end of the session. Meanwhile, liquidity was at its highest level in a month.

At the end of trading on May 24, VN-Index decreased by 19.1 points, equivalent to 1.49% to 1,261.93 points. The entire floor had 93 stocks increasing, 364 stocks decreasing, and 43 stocks remaining unchanged.

HNX-Index decreased by 5.19 points to 241.72 points. The entire floor had 51 stocks increasing, 139 stocks decreasing and 56 stocks remaining unchanged. UPCoM-Index decreased by 0.77 points to 94.4 points.

After a long increase, investors gradually took profits from FPT shares, causing this code to lead the market's decline by taking away 1.8 points. Liquidity was much higher than in recent sessions at 13.4 million units, while the average trading volume of this code was only about 2 million units/session. Other codes in the technology industry also cooled down after the hot increase such as CMG, VGI, ELC, SAM, ST8, VTK, SGT.

The three banking giants VCB, CTG, VPB were also among the top drags on the market, taking away a total of 3.1 points. HPG, MSN, VHM, VCM, VIC, MWG followed suit.

Securities was the most negative sector with a decrease of 3.72%, most stocks were in red. Only TVB went against the trend, increasing 3.81% to VND9,000/share and there were some reference codes such as TCI, MBS, HAC, HBS, ART.

On the positive side, chemical giant GVR still increased by 2.54% to VND34,250/share and led the market's increase in today's session, contributing more than 0.8 points. Following in turn were codes ACB, HVN, PLX, LPB, ITA, STB, SBT, PET, DHG.

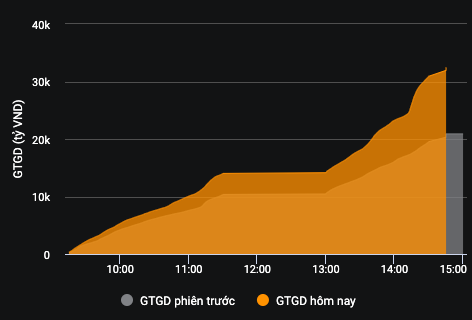

Liquidity today compared to previous session

The total order matching value in today's session was VND40,720 billion, up 48% compared to yesterday, of which the order matching value on the HoSE floor reached VND35,530 billion. In the VN30 group, liquidity reached VND14,568 billion.

After only one session of net buying, foreign investors turned to net selling with a value of 1,524 billion VND today, of which this group disbursed 1,745 billion VND and sold 3,269 billion VND.

The codes that were sold strongly were FPT 355 billion VND, MWG 131 billion VND, MBB 112 billion VND, VHM 102 billion VND, SSI 99 billion VND,... On the contrary, the codes that were mainly bought by the FUEVFVND fund were 92 billion VND, IDC 48 billion VND, DBC 34 billion VND, TCB 33 billion VND, CSV 27 billion VND,... .

Source: https://www.nguoiduatin.vn/vn-index-roi-19-diem-thanh-khoan-cao-dot-bien-a665135.html

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)