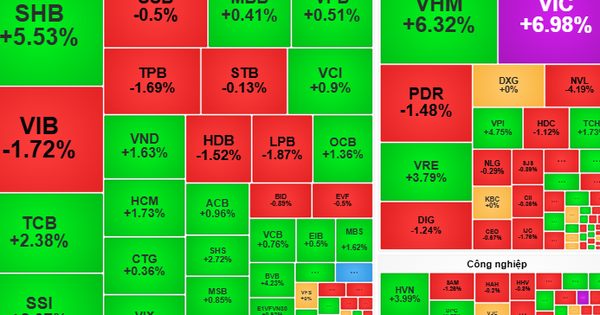

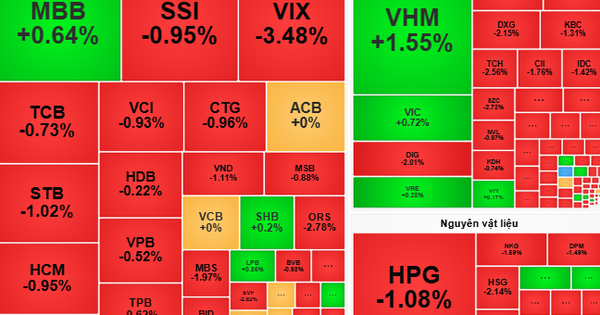

VN-Index slightly decreased by 1.54 points in the session on July 30, down to 1,245 points due to selling pressure appearing in many pillar stock groups such as banking, securities, real estate and steel.

The stock market fluctuated within a wide range today as the index at one point rose to nearly 1,249 points, but then fell under pressure to fall deeply to 1,236 points. In the final minutes of the session, the index gradually narrowed its decline before closing at 1,245.06 points, down more than 1.5 points from the reference and breaking the streak of two consecutive sessions of increases.

Market breadth was skewed to the downside with 267 stocks closing below the reference, while the number of stocks increasing was only 154. VN30 fell into a state of “green on the outside, red on the inside” when the index representing this basket increased by more than 2 points but there were 16 stocks decreasing and only 11 stocks closing in the green.

Most real estate stocks closed the session in negative territory. VHM was the stock that weighed down the VN-Index the most, falling 1.08% to VND36,700. In addition, PDR fell 2.8% to VND19,000, IJC fell 2% to VND14,950, DXG fell 1.8% to VND13,700 and VRE fell 1.1% to VND18,750.

The banking group has 4 representatives in the list of stocks with the most negative impact on the market. Specifically, BID decreased by 0.64% to 46,800 VND, LPB decreased by 1.01% to 29,500 VND, VIB decreased by 1.44% to 20,600 VND and CTG decreased by 0.31% to 32,000 VND.

The securities group also faced fierce selling pressure when VIX decreased by 5% to VND13,200, VDS decreased by 2.1% to VND20,900 and VCI decreased by 1.5% to VND44,500.

Similarly, the steel group also put great pressure on the index after a short recovery. Specifically, HSG and TLH both decreased by 1.7% to VND22,900 and VND7,340, respectively, while NKG decreased by 0.4% to VND23,500.

On the other hand, VIC became the market's pillar in today's session when it increased by 1.44% to VND42,200. NVL is a rare real estate stock on the list of the most positive impacts on the market when it increased by 3.64% to VND11,400. Similarly, QCG reversed the market trend when it increased to the ceiling for the second session to VND7,240.

Ho Chi Minh City Stock Exchange today recorded more than 653 million shares successfully transferred, an increase of 156 million units compared to the first session of the week. The transaction value accordingly reached VND13,739 billion, an increase of VND2,359 billion compared to yesterday's session and extending the 6th session with a transaction value of less than VND20,000 billion. The large-cap basket contributed to liquidity of more than VND5,765 billion, equivalent to more than 187 million shares successfully transferred.

VIX leads in liquidity with over VND535 billion (equivalent to nearly 40 million shares). This figure far exceeds the following stocks, MBB with approximately VND472 billion (equivalent to about 19.6 million shares) and HPG with over VND435 billion (equivalent to nearly 15.5 million shares).

Foreign investors continued to be net sellers in today's session. Specifically, this group sold more than 57 million shares, equivalent to a transaction value of VND1,590 billion, while only disbursing about VND1,285 billion to buy about 40 million shares. The net selling value accordingly reached nearly VND305 billion.

Foreign investors massively sold HVN shares with a net selling value of more than VND40 billion, followed by HAH with nearly VND36 billion, PDR with nearly VND32 billion. On the other hand, foreign investors strongly bought VNM shares with a net value of VND124 billion. MSN ranked next with a net absorption of about VND67 billion, followed by MWG with VND30 billion.

Source: https://baodautu.vn/vn-index-quay-dau-giam-nhe-sau-2-phien-tang-lien-tiep-d221161.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)