Lobster exports increased dramatically 70 times

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), in the first 5 months of 2024, shrimp exports reached 1.3 billion USD, up 7% over the same period in 2023. Of which, white-leg shrimp accounted for 72% with a value of nearly 935 million USD, up 21%, black tiger shrimp accounted for 12% reaching 155 million USD, up slightly 1% over the same period in 2023. Lobsters also accounted for a significant proportion, accounting for more than 8% reaching over 106 million USD, with a breakthrough increase of nearly 70 times over the same period in 2023. In addition, the export of iron shrimp, giant freshwater prawns, mantis shrimp, and striped shrimp also tended to increase positively in recent times.

|

| In the first 5 months of 2024, China increased its imports of green lobsters from the Vietnamese market by 112 times. |

In the first 5 months of this year, the export of processed shrimp products all tended to decrease. Of which, processed white-leg shrimp HS code 16 decreased by 31%, processed black tiger shrimp decreased by 72%, dried shrimp and other processed shrimp decreased by 41% and 99% respectively. Meanwhile, the export of live/fresh/chilled/frozen shrimp products increased, specifically: white-leg shrimp increased by 12%, black tiger shrimp increased dramatically by 158 times...

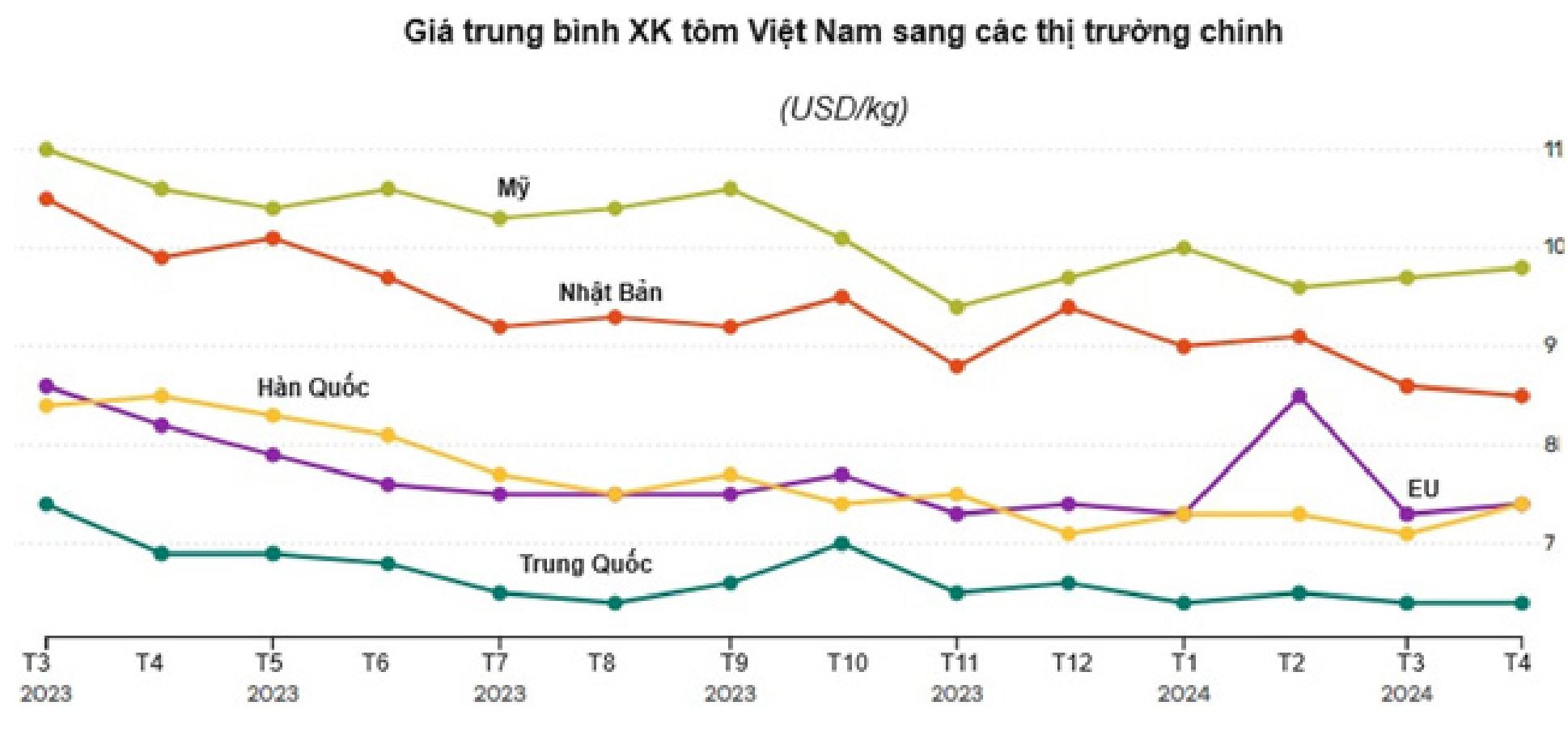

Notably, China has replaced the United States as Vietnam's number 1 shrimp import market, accounting for 20% of the total, mainly due to a sharp increase in imports of green lobster (112 times) and white-leg shrimp (+30%). Shrimp exports to the United States accounted for 17.4% of the total and increased only slightly by 4%. Although imports are gradually recovering, export prices to the US market are still low compared to the same period in 2023. Exports to Japan decreased slightly by 3%, while exports to the EU increased slightly by 1%. Shrimp exports to some markets have a more positive trend, including: Canada (+51%), UK (+15%), Russia (+332%)...

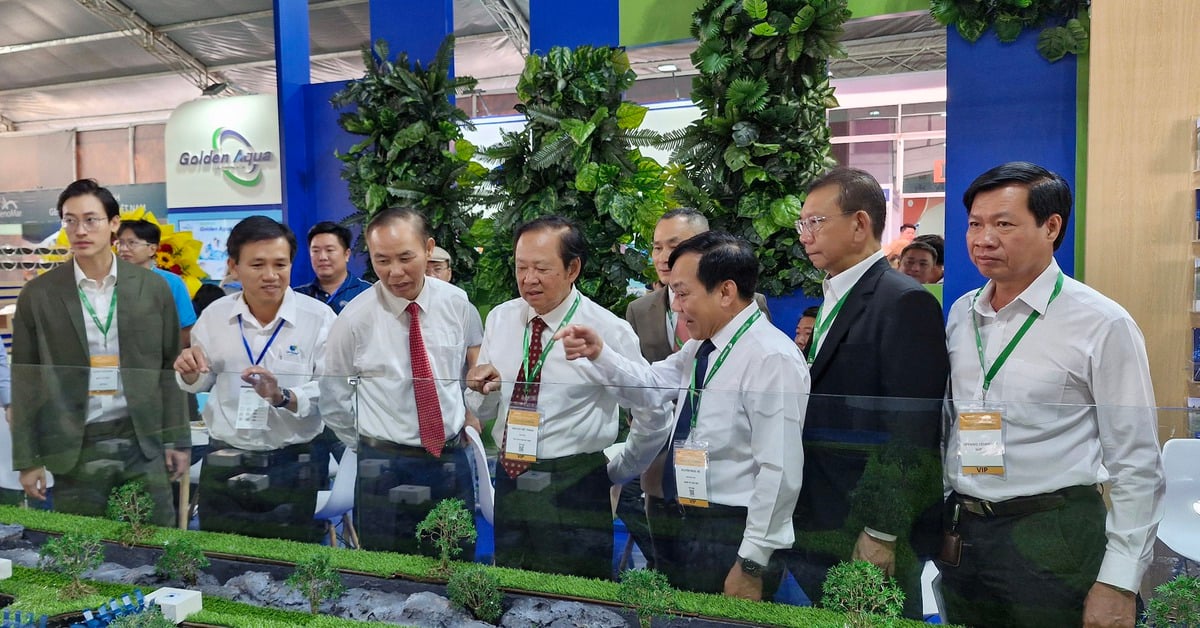

According to Mr. Do Ngoc Tai - General Director of Tai Kim Anh Seafood Processing Joint Stock Company - Chairman of VASEP Shrimp Committee, currently Vietnamese enterprises have exported shrimp to more than 100 markets, including 5 main export markets including the United States, EU, Japan, Korea, and China.

Opportunities and challenges go hand in hand

On March 25, 2024, the US Department of Commerce (DOC) issued a preliminary conclusion in the case of the US anti-subsidy investigation of frozen warm-water shrimp (HS codes: 0306.17, 1605.21 and 1605.29) originating from Vietnam. This case was initiated on November 14, 2023 and was investigated by DOC at the request of the American Shrimp Processors Association with an investigation period from January 1 to December 31, 2022.

|

DOC has determined the preliminary countervailing duty rate for Vietnamese enterprises. Specifically, 2.84% for the only mandatory respondent enterprise and for all remaining enterprises; 196.41% for the only respondent enterprise not participating in the case. The tax rate of 196.41% is determined based on available adverse facts that cause the tax rate to be higher than other enterprises.

After the Preliminary Determination is published in the Federal Register, the U.S. Customs and Border Protection (CBP) will request deposits for shipments exported to the United States at the above preliminary countervailing duty rates. Although there is no final conclusion, the preliminary conclusion will more or less affect the export and the choice of importers for shrimp from other countries.

According to Mr. Truong Dinh Hoe - General Secretary of VASEP, the anti-subsidy tax on Vietnamese shrimp was thought to be lower than that of India and Ecuador, but at the last minute, DOC adjusted and recognized Ecuador's tax rate to 2.89%, equivalent to Vietnam's. In addition, the anti-dumping lawsuit is entering the POR19 review phase with extremely complicated developments.

According to Mr. Truong Dinh Hoe, the Vietnamese shrimp industry must compete on price with shrimp from Ecuador. Currently, Ecuadorian shrimp exported to China accounts for 65% of total output. Currently, there are two potential markets for Vietnamese shrimp, the United States and China, both of which must compete with shrimp from Ecuador and India. Meanwhile, the EU market is stagnant due to sustainability certification issues such as ASC, and upcoming regulations on greenhouse gas emissions. India's shrimp exports are facing difficulties in the US market, so it will focus on other markets, including the EU. Therefore, shrimp exports to the EU are unlikely to grow in the near future.

In terms of production costs, the price of raw shrimp in Vietnam is still significantly higher than that of other countries such as India, Ecuador, and Thailand. For example, with white-leg shrimp of an average size of 70 pieces/kg in Vietnam's ponds this year, it is still about 15,000 - 20,000 VND/kg higher than that of shrimp of the same size in Thailand, 20,000 - 30,000 VND/kg higher than that of Indian shrimp and 30,0000 - 35,000 VND/kg higher than that of Ecuadorian shrimp. Therefore, in terms of shrimp export prices, Vietnam still finds it difficult to compete with other countries if exporting raw shrimp such as whole shrimp, PTO shrimp, PDTO shrimp, PD shrimp meat, etc.

Although Vietnam is selling the most shrimp to the Chinese market, according to Mr. Do Ngoc Tai, this growth is mainly due to China's sharp increase in imports of green lobsters (112 times) and white-leg shrimp (+30%). Mr. Tai believes that in the following months until the end of the year, Vietnam's shrimp exports to China may not increase. The reason is that some countries such as Ecuador, India and Indonesia will focus on exporting to this market, due to the high tax imposed by the United States, so Vietnam's shrimp exported to China will face many difficulties in terms of price, especially whole tiger shrimp and whole white-leg shrimp.

Despite the difficulties, Vietnamese shrimp also has many opportunities to increase its market share in China and the United States. According to VASEP, the Ecuadorian shrimp industry faces significant challenges, including increased inspections and sulfite labeling refusals by Chinese customs, new anti-subsidy duties in the United States, and declining global shrimp consumption.

“In March 2024, China announced that a total of 43 shipments of Ecuadorian shrimp had been rejected in the first two months of the year, mainly due to excessive sulfite content. Since February, China has tightened inspections of shrimp imported from Ecuador, causing shrimp supply to this market to stagnate,” VASEP quoted information.

In the Indian market, a large shrimp production and export factory recently became the focus of a series of allegations related to falsified documents, intentionally shipping antibiotic-positive shrimp to the United States, and mistreating workers.... Following that allegation, there were a series of reactions from importers and the US market towards Indian shrimp.

Sysco, the largest food service company in the United States, immediately stopped buying shrimp from India. The American Shrimp Processors Association (ASPA) filed a petition with the U.S. Customs and Border Protection (CBP) to ban imports of shrimp from India that are allegedly produced with “forced labor,” as required by Section 307 of the Tariff Act of 1930. ASPA also filed a complaint with the U.S. government, arguing that the Indian government’s failure to enforce its most basic labor laws has resulted in subsidies for Indian shrimp producers.

India exported 296,400 tons of shrimp worth $2.47 billion to the US market in 2023, up 215% in value and 125% in volume over the past 10 years. The disadvantages of the Ecuadorian and Indian shrimp industries in the first months of this year may also be an important message for Vietnamese shrimp producers and exporters to be cautious with labor and environmental issues, food safety in the farming - processing - exporting process to markets. However, the impacts on the two shrimp producing countries above are also opportunities for Vietnam's shrimp supply.

Source: https://congthuong.vn/viet-nam-dang-ban-tom-nhieu-nhat-sang-thi-truong-trung-quoc-325483.html

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)