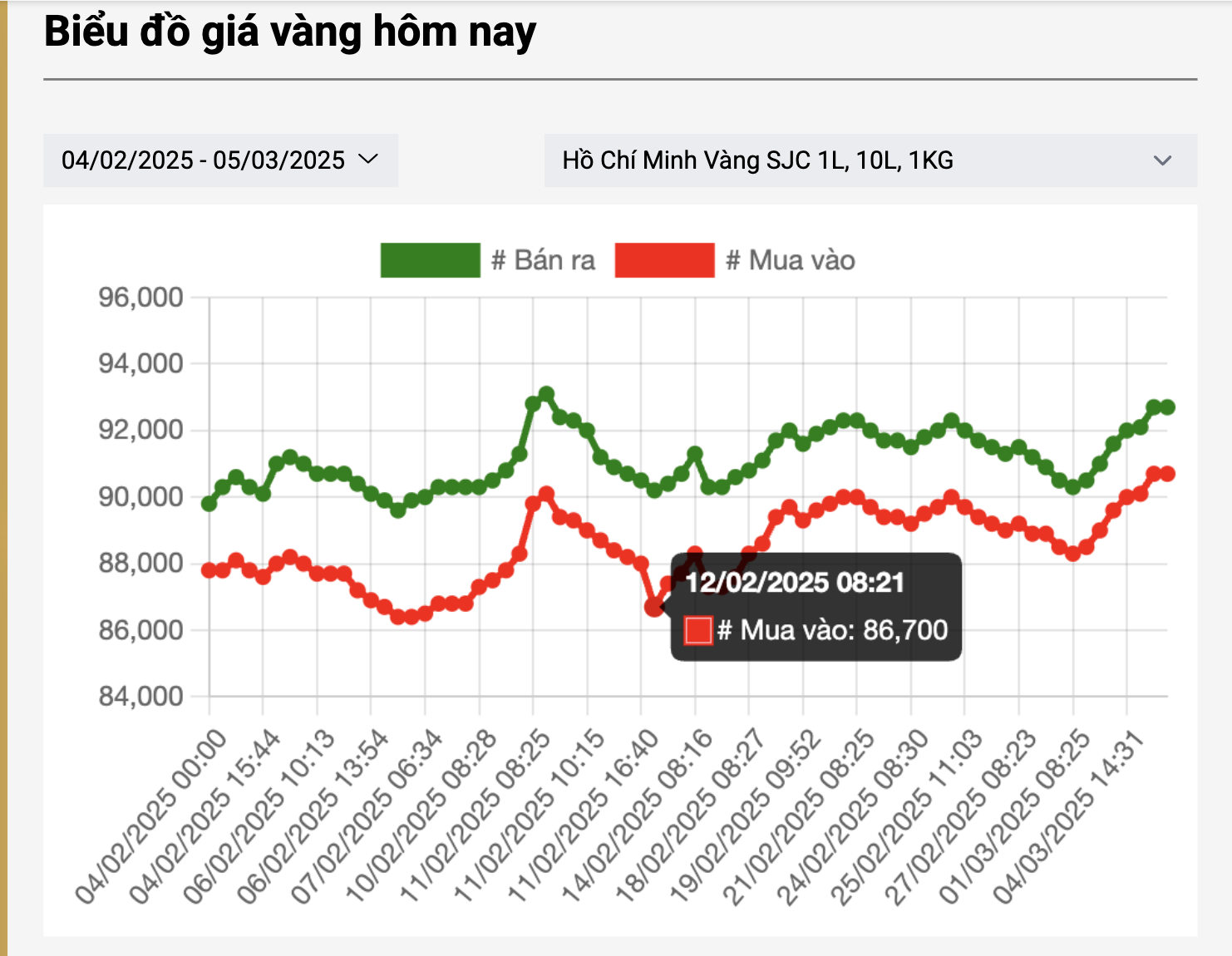

(NLDO) – The price of SJC gold bars and gold rings both reached a new peak, exceeding 92 million VND/tael as demand for gold increased while supply was limited.

On the afternoon of March 5, the price of SJC gold bars was listed by SJC, PNJ, and DOJI companies at 90.7 million VND/tael for buying and 92.7 million VND/tael for selling, maintaining a record level in recent weeks.

During the day, Mi Hong Company pushed the price of SJC gold bars to a record level, 93.7 million VND/tael (selling price), before decreasing back to 92.3 million VND/tael in the afternoon.

Gold prices have been increasing continuously since last weekend. In just the past 3 days, each tael of SJC gold bar has increased by about 3 million VND/tael.

Not only gold bars, the price of gold rings and jewelry of all kinds also increased rapidly. The companies SJC, PNJ, DOJI traded gold rings at 90.7 million VND/tael for buying and 92.6 million VND/tael for selling, the highest level in history.

If calculated from the beginning of 2025 until now, the price of SJC gold bars has increased by about 8 million VND/tael and 99.99 gold rings have increased by about 9 million VND/tael.

The prices of SJC gold bars and gold rings have both skyrocketed amid the continuous rise in world prices. Speaking to a reporter from Nguoi Lao Dong Newspaper on the afternoon of March 5, gold expert Nguyen Ngoc Trong analyzed that the prices of SJC gold bars and gold rings have skyrocketed in recent days due to increased demand but scarce supply.

Like gold rings, the demand for buying gold rings is increasing but some brands like PNJ are no longer available; companies like SJC and DOJI are selling a small amount of gold.

Domestic gold prices continue to increase sharply

"The supply of raw gold for the production of gold rings is limited as the management agency tightens invoices and strictly controls the origin. Currently, no business has been licensed to import raw gold to produce gold bars. Because the scale of the gold market is not large, even a slight increase in demand from the market can push up the price of gold," said Mr. Trong.

Many people said they increased their gold purchases as they expected the world gold price to continue to increase due to instability in the international market related to the conflict in Ukraine; and the US tariff policy applied to countries such as Canada, Mexico and China.

According to analysts, one of the factors driving the world gold price to increase strongly again is the demand for gold from central banks of various countries.

According to statistics in January 2025, the total global gold reserves increased by 18 tons, continuing the trend of large gold purchases in 2024. Last year, central banks bought a total of 1,045 tons of gold. This gold purchase is considered an important strategy to respond to increasing geopolitical risks.

SJC gold bar price fluctuates continuously in recent days

Gold expert Tran Duy Phuong stated that in the first half of 2025, the gold price is likely to continue to increase with a zigzag upward trend, possibly reaching $3,000/ounce or $3,100/ounce. Because at least in the first half of this year, the factors supporting the gold price still exist and have not been completely resolved, such as the conflict in Ukraine or the central banks of many countries will continue to cut interest rates...

In the medium and long term, Mr. Nguyen Ngoc Trong predicts that gold prices may go down when factors affecting prices have been reflected in the past.

Currently, the world gold price converted according to the listed exchange rate is about 90.4 million VND/tael.

Source: https://nld.com.vn/vi-sao-gia-vang-mieng-sjc-vang-nhan-nhay-vot-196250305171703504.htm

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

Comment (0)