Gold price today April 15, 2025 in domestic market

Gold price today, April 15, 2025 in the domestic market, surveyed at 7:00 p.m., recorded a strong upward trend across the board, marking a vibrant day for the gold market. Most major brands witnessed significant increases, reflecting positive investor sentiment. Below are details on gold price fluctuations at prominent brands:

The price of SJC gold bars in Hanoi is listed at VND105.5 million/tael (buy) and VND108 million/tael (sell), up VND500,000/tael in both directions. The difference between buying and selling prices remains at VND2.5 million/tael, showing the appeal of SJC gold in the context of market fluctuations.

DOJI Group also recorded similar prices, with SJC gold bars reaching VND105.5 million/tael (buy) and VND108 million/tael (sell), up VND500,000/tael in both buying and selling. The difference between buying and selling prices was kept at VND2.5 million/tael, reflecting the consistency in the market's upward trend.

Mi Hong, one of the brands with the highest buying price, listed SJC gold bars at VND106.5 million/tael (buy) and VND108.5 million/tael (sell), up VND300,000/tael in both directions. The difference between buying and selling prices is VND2 million/tael, attracting the attention of investors.

PNJ announced the price of SJC gold bars in Hanoi, Ho Chi Minh City, Da Nang and the Western region at 105.5 million VND/tael (buy) and 108 million VND/tael (sell), an increase of 500 thousand VND/tael in both directions. PNJ gold alone reached 102.8 million VND/tael (buy) and 106 million VND/tael (sell), an increase of 800 thousand VND/tael and 900 thousand VND/tael, respectively. The difference between the buying and selling prices of PNJ gold is 3.2 million VND/tael, showing the attractiveness of this product line.

Bao Tin Minh Chau listed the price of SJC gold bars at VND105.5 million/tael (buy) and VND108 million/tael (sell), an increase of VND500,000/tael in both directions, with a difference of VND2.5 million/tael between buying and selling prices. This brand continues to affirm its position in the gold bar market.

Phu Quy recorded the price of SJC gold bars at VND104.8 million/tael (buy) and VND108 million/tael (sell), increasing by VND800,000/tael for buying and VND500,000/tael for selling, respectively. The difference between buying and selling prices is up to VND3.2 million/tael, reflecting the brand's unique pricing strategy.

Jewelry gold prices at PNJ also recorded a sharp increase. 999.9 jewelry gold was listed at VND102.8 million/tael (buy) and VND105.3 million/tael (sell), up VND800,000/tael in both directions. 750 jewelry gold (18K) reached VND76.63 million/tael (buy) and VND79.13 million/tael (sell), up VND600,000/tael. 585 jewelry gold (14K) was at VND59.25 million/tael (buy) and VND61.75 million/tael (sell), up VND470,000/tael in both directions, meeting the diverse needs of consumers.

At the end of the gold price session on April 15, 2025, the domestic gold market continued to increase strongly, with increases ranging from VND 260,000/tael to VND 1 million/tael for buying and from VND 260,000/tael to VND 1 million/tael for selling. The price of SJC gold bars at major brands such as Mi Hong, DOJI, and PNJ remained above VND 105 million/tael, affirming its position as a safe asset in the context of global economic instability. Experts say that this upward trend may continue due to investors' psychology of hoarding gold in the face of unpredictable fluctuations.

As of 7:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 103.0 - 105.0 million VND/tael (buy - sell);

Bao Tin Minh Chau listed the price of gold rings at 104.1 - 107.0 million VND tael (buy - sell); increased by 1.5 million VND/tael for buying and increased by 800 thousand VND/tael for selling.

The latest gold price list today, April 15, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 105.5 | ▲500 | 108.0 | ▲500 |

| DOJI Group | 105.5 | ▲500 | 108.0 | ▲500 |

| Red Eyelashes | 106.5 | ▲300 | 108.5 | ▲300 |

| PNJ | 102.8 | ▲800 | 106.0 | ▲900 |

| Vietinbank Gold | 108.0 | ▲500 | ||

| Bao Tin Minh Chau | 105.5 | ▲500 | 108.0 | ▲500 |

| Phu Quy | 104.8 | ▲800 | 108.0 | ▲500 |

| 1. DOJI - Updated: April 15, 2025 19:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 105,500 ▲500 | 108,000 ▲500 |

| AVPL/SJC HCM | 105,500 ▲500 | 108,000 ▲500 |

| AVPL/SJC DN | 105,500 ▲500 | 108,000 ▲500 |

| Raw material 9999 - HN | 102,600 ▲800 | 105,100 ▲1000 |

| Raw material 999 - HN | 102,500 ▲800 | 105,000 ▲1000 |

| 2. PNJ - Updated: April 15, 2025 19:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 102,800 ▲800K | 106,000 ▲900K |

| HCMC - SJC | 105,500 ▲500K | 108,000 ▲500K |

| Hanoi - PNJ | 102,800 ▲800K | 106,000 ▲900K |

| Hanoi - SJC | 105,500 ▲500K | 108,000 ▲500K |

| Da Nang - PNJ | 102,800 ▲800K | 106,000 ▲900K |

| Da Nang - SJC | 105,500 ▲500K | 108,000 ▲500K |

| Western Region - PNJ | 102,800 ▲800K | 106,000 ▲900K |

| Western Region - SJC | 105,500 ▲500K | 108,000 ▲500K |

| Jewelry gold price - PNJ | 102,800 ▲800K | 106,000 ▲900K |

| Jewelry gold price - SJC | 105,500 ▲500K | 108,000 ▲500K |

| Jewelry gold price - Southeast PNJ | 102,800 ▲800K | - |

| Jewelry gold price - SJC | 105,500 ▲500K | 108,000 ▲500K |

| Jewelry gold price - PNJ 999.9 Plain Ring | 102,800 ▲800K | - |

| Jewelry gold price - Kim Bao Gold 999.9 | 102,800 ▲800K | 106,000 ▲900K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 102,800 ▲800K | 106,000 ▲900K |

| Jewelry gold price - Jewelry gold 999.9 | 102,800 ▲800K | 105,300 ▲800K |

| Jewelry gold price - Jewelry gold 999 | 102,700 ▲800K | 105,200 ▲800K |

| Jewelry gold price - Jewelry gold 9920 | 102,060 ▲800K | 104,560 ▲800K |

| Jewelry gold price - Jewelry gold 99 | 101,850 ▲790K | 104,350 ▲790K |

| Jewelry gold price - 750 gold (18K) | 76,630 ▲600K | 79,130 ▲600K |

| Jewelry gold price - 585 gold (14K) | 59,250 ▲470K | 61,750 ▲470K |

| Jewelry gold price - 416 gold (10K) | 41,460 ▲340K | 43,960 ▲340K |

| Jewelry gold price - 916 gold (22K) | 94,060 ▲740K | 96,560 ▲740K |

| Jewelry gold price - 610 gold (14.6K) | 61,880 ▲480K | 64,380 ▲480K |

| Jewelry gold price - 650 gold (15.6K) | 66,100 ▲520K | 68,600 ▲520K |

| Jewelry gold price - 680 gold (16.3K) | 69,250 ▲540K | 71,750 ▲540K |

| Jewelry gold price - 375 gold (9K) | 37,140 ▲300K | 39,640 ▲300K |

| Jewelry gold price - 333 gold (8K) | 32,400 ▲260K | 34,900 ▲260K |

| 3. SJC - Updated: April 15, 2025 19:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 105,500 ▲500K | 108,000 ▲500K |

| SJC gold 5 chi | 105,500 ▲500K | 108,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 105,500 ▲500K | 108,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 103,000 ▲1000 | 106,000 ▲1000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 103,000 ▲1000 | 106,100 ▲1000 |

| Jewelry 99.99% | 103,000 ▲1000 | 105,500 ▲1000 |

| Jewelry 99% | 100,655 ▲990 | 104,455 ▲990 |

| Jewelry 68% | 68,097 ▲680 | 71,897 ▲680 |

| Jewelry 41.7% | 40,347 ▲417 | 44,147 ▲417 |

Closing price of gold today, April 15, 2025 in the world market

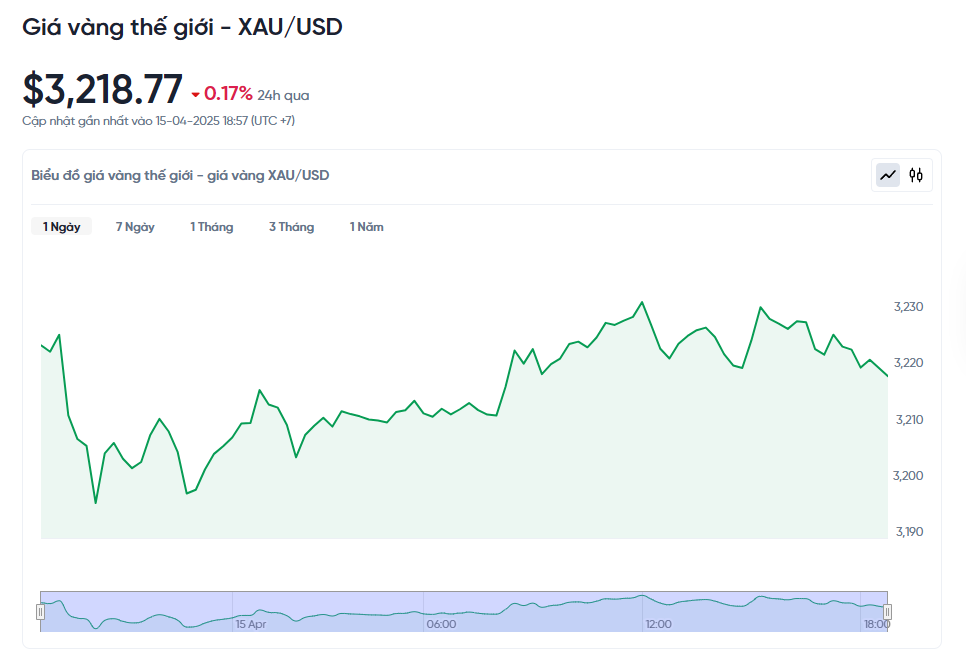

At the time of trading at 7:00 p.m. on April 15, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,218.77 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 101.84 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (105.5-108.0 million VND/tael), the SJC gold price is currently about 6.16 million higher than the international gold price.

The US decided over the weekend to temporarily hold off on imposing tariffs on products like smartphones and computers, despite President Trump’s warnings that tariffs would be imposed at some point. The decision came shortly after he announced a 90-day global tariff delay. Still, many people are worried about the state of the US economy, sending the dollar to a three-year low against other major currencies. It’s like seeing a store with big discounts but still not buying because you’re afraid something might be wrong.

The weaker dollar has given Asian currencies like India and China some breathing room. But experts say people are still sensitive to any news related to tariffs and trade. Abhishek Goenka, director of a financial advisory firm, explained that if global sentiment continues to deteriorate, developing-country currencies could suffer, just as bad weather dampens markets.

Meanwhile, President Trump appears to have ordered immediate tariff negotiations with South Korea, Japan and India, confirmed by South Korea’s acting president, Han Duck-soo, on Monday. These talks could have a major impact on trade between countries, like when you negotiate prices at a market – everything depends on how the two sides negotiate.

In India, currency traders expect the rupee to trade between 85.70 and 86.70 this week, a week shortened by a holiday. They also expect China’s currency to weigh on the rupee in the same way a big neighbor can affect the neighborhood. In addition, the yield on the 10-year Indian government bond fell slightly to 6.4445 percent on Friday, and is expected to be between 6.40 percent and 6.45 percent this week. Put simply, it’s a figure that shows how much you can earn if you lend money to the government by buying its bonds.

The Reserve Bank of India (RBI) cut its key interest rate by 0.25% last week for the second time in a row, and it has changed its approach to signal that it may cut rates further in the future. It's like a store cutting prices to attract customers. Economists say rates could fall further because they're worried about weak economic growth, but fortunately, commodity prices, such as food and gasoline, are relatively stable, keeping things from getting too expensive. Sachin Bajaj, an expert at Axis Max Life, said the global economy is unpredictable, which could slow India's growth, but domestic prices are manageable, like when you keep your family budget steady even when your neighbors are struggling.

In short, it’s all about balancing growth and prices. Lowering interest rates is a way to encourage people to spend and invest more, but it needs to be done carefully so as not to create bigger problems, like adding spices to a dish – just enough is good, but too much is bad.

Gold price forecast tomorrow 4/16/2025

Gold price forecast for April 16, 2025: Gold may continue to rise, but be careful of unexpected fluctuations. If you are not familiar with economics and are curious about the gold price on April 16, 2025, think of it simply like this: The world gold price just hit a record high of 3,222 USD/ounce on the afternoon of April 15, but then decreased slightly by 20 USD compared to the previous day. This is like when you see a beautiful item increase in price sharply, then decrease a bit because everyone competes to buy and then sell. In Vietnam, this world gold price is equivalent to about 101.1 million VND/tael, an unprecedented high, attracting the attention of many people.

The reason for the increase in gold prices is that many people in the world are worried, they sell stocks and put money into gold for safety, just like you put money in a safe when you see the situation is not stable. At the same time, the US dollar - the world's main currency - is weakening, only 99.6 points, the lowest level in more than 2 years, so more people choose to buy gold. However, experts warn that the price of gold is rising rapidly, and if there is good news from the US or China about taxes, the price may suddenly decrease, just like when the buying fever cools down.

Domestically, the gold price on April 16, 2025 often follows the world price, so SJC gold may increase further tomorrow morning, possibly up to 107 - 109.5 million VND/tael, an increase of about 500 thousand VND compared to today. Some people are selling gold to make a quick profit, to cool down the market, but with the world situation still unstable, gold is still a safe place to keep money for a long time. A famous expert, Mr. Mike McGlone from Bloomberg, said that the gold price has just started to increase and could reach 4,000 USD in the future, because the US economy is in trouble, causing many people to choose gold over other investments. He likened gold to a "solid house" in the midst of an economic storm, and the current small fluctuations are just an opportunity to buy.

In summary, the price of gold on April 16, 2025 is forecasted to increase slightly, but you should keep a close eye on it because the price can change unexpectedly. Think of gold as a big wave – although it has its ups and downs, it is still rising, and this is an interesting time to observe the market!

Source: https://baodaknong.vn/gia-vang-ngay-15-4-2025-gia-vang-trong-nuoc-lap-ki-luc-moi-gia-vang-the-gioi-tiep-tuc-giam-249512.html

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

Comment (0)