Update gold price today April 16, 2025 latest in domestic market

At 10:30 a.m. on April 16, 2025, the gold price today, April 16, 2025, made a strong breakthrough in the domestic market, bringing the price of SJC gold bars to over 111 million VND/tael in the selling direction. By the end of the trading session, major brands announced significant price increases, creating great attraction for investors and consumers. The gold market is more vibrant than ever, reflecting strong interest from all sides.

At Saigon Jewelry Company (SJC), the price of SJC gold bars was recorded at VND108.5 million/tael for buying and VND111.0 million/tael for selling, a sharp increase of VND3.0 million/tael in both directions compared to the previous day. The gap between buying and selling prices was maintained at VND2.5 million/tael, showing that the market is very busy.

DOJI Group quoted SJC gold bars at VND106.8 million/tael for buying and VND109.8 million/tael for selling. Compared to yesterday, the price increased by VND1.3 million/tael for buying and VND1.8 million/tael for selling. The difference between buying and selling prices remained at VND3.0 million/tael, reflecting the cautious but optimistic sentiment of investors.

Bao Tin Minh Chau also recorded the price of SJC gold bars at a similar level, with 106.8 million VND/tael for buying and 109.8 million VND/tael for selling, up 1.3 million and 1.8 million VND/tael respectively. The gap between buying and selling prices was 3.0 million VND/tael, showing consensus in the upward price trend in the market.

PNJ Company announced the price of SJC gold bars at 106.8 million VND/tael for buying and 109.8 million VND/tael for selling, up 1.3 million and 1.8 million VND/tael respectively. For PNJ 9999 plain gold rings, the price reached 105.8 million VND/tael for buying and 108.8 million VND/tael for selling, up 3.0 million and 2.8 million VND/tael. The difference between buying and selling gold rings remained at 3.0 million VND/tael, in line with the general trend.

Mi Hong offers SJC gold bars at VND106.5 million/tael for buying and VND108.5 million/tael for selling, a slight increase of VND0.3 million/tael in both directions. The buying-selling price gap is VND2.0 million/tael, lower than other major brands, but still reflects an upward trend.

Phu Quy listed the price of SJC gold bars at VND106.2 million/tael for buying and VND108.8 million/tael for selling, up VND1.4 million and VND2.8 million/tael, respectively. The difference between buying and selling prices reached VND2.6 million/tael, showing the flexibility in pricing of this brand.

At the same time, the price of 9999 Hung Thinh Vuong round gold rings at DOJI reached 106.0 million VND/tael for buying and 109.5 million VND/tael for selling, an increase of 2.8 million VND/tael for buying and 2.5 million VND/tael for selling compared to the beginning of the day. The difference between buying and selling prices is 3.5 million VND/tael, reflecting the heat of gold rings on the market.

Bao Tin Minh Chau announced the price of gold rings at 106.5 million VND/tael for buying and 109.5 million VND/tael for selling, up 2.4 million VND and 2.5 million VND/tael respectively compared to the morning. Notably, the difference between buying and selling prices narrowed to 0.1 million VND/tael, showing strong competition in this segment.

The latest gold price update table today, April 16, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 108.5 | ▲3000 | 111.0 | ▲3000 |

| DOJI Group | 106.8 | ▲1300 | 109.8 | ▲1800 |

| Red Eyelashes | 106.5 | ▲300 | 108.5 | ▲300 |

| PNJ | 105.8 | ▲3000 | 108.8 | ▲2800 |

| Vietinbank Gold | 111.0 | ▲3000 | ||

| Bao Tin Minh Chau | 108.5 | ▲3000 | 111.0 | ▲3000 |

| Phu Quy | 106.2 | ▲1400 | 108.8 | ▲2800 |

| 1. DOJI - Updated: April 16, 2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 108,500 ▲3000 | 111,000 ▲3000 |

| AVPL/SJC HCM | 105,500 ▲500 | 108,000 ▲500 |

| AVPL/SJC DN | 105,500 ▲500 | 108,000 ▲500 |

| Raw material 9999 - HN | 105,600 ▲2600 | 107,900 ▲2300 |

| Raw material 999 - HN | 105,500 ▲2600 | 107,800 ▲2300 |

| 2. PNJ - Updated: April 16, 2025 10:30 - Time of the source website - ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 105,800 ▲3000K | 108,800 ▲2800K |

| HCMC - SJC | 106,800 ▲1300K | 109,800 ▲1800K |

| Hanoi - PNJ | 105,800 ▲3000K | 108,800 ▲2800K |

| Hanoi - SJC | 106,800 ▲1300K | 109,800 ▲1800K |

| Da Nang - PNJ | 105,800 ▲3000K | 108,800 ▲2800K |

| Da Nang - SJC | 106,800 ▲1300K | 109,800 ▲1800K |

| Western Region - PNJ | 105,800 ▲3000K | 108,800 ▲2800K |

| Western Region - SJC | 106,800 ▲1300K | 109,800 ▲1800K |

| Jewelry gold price - PNJ | 105,800 ▲3000K | 108,800 ▲2800K |

| Jewelry gold price - SJC | 106,800 ▲1300K | 109,800 ▲1800K |

| Jewelry gold price - Southeast | 105,800 ▲3000K | |

| Jewelry gold price - PNJ 999.9 Plain Ring | 105,800 ▲3000K | 108,800 ▲2800K |

| Jewelry gold price - Kim Bao Gold 999.9 | 105,800 ▲3000K | 108,800 ▲2800K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 105,800 ▲3000K | 108,800 ▲2800K |

| Jewelry gold price - Jewelry gold 999.9 | 105,800 ▲3000K | 108,300 ▲3000K |

| Jewelry gold price - Jewelry gold 999 | 105,690 ▲2990K | 108,190 ▲2990K |

| Jewelry gold price - Jewelry gold 9920 | 105,030 ▲2970K | 107,530 ▲2970K |

| Jewelry gold price - Jewelry gold 99 | 104,820 ▲2970K | 107,320 ▲2970K |

| Jewelry gold price - 916 gold (22K) | 96,800 ▲2740K | 99,300 ▲2740K |

| Jewelry gold price - 750 gold (18K) | 78,880 ▲2250K | 81,380 ▲2250K |

| Jewelry gold price - 680 gold (16.3K) | 71,290 ▲2040K | 73,790 ▲2040K |

| Jewelry gold price - 650 gold (15.6K) | 68,050 ▲1950K | 70,550 ▲1950K |

| Jewelry gold price - 610 gold (14.6K) | 63,710 ▲1830K | 66,210 ▲1830K |

| Jewelry gold price - 585 gold (14K) | 61,010 ▲1760K | 63,510 ▲1760K |

| Jewelry gold price - 416 gold (10K) | 42,700 ▲1240K | 45,200 ▲1240K |

| Jewelry gold price - 375 gold (9K) | 38,260 ▲1120K | 40,760 ▲1120K |

| Jewelry gold price - 333 gold (8K) | 33,390 ▲990K | 35,890 ▲990K |

| 3. SJC - Updated: April 16, 2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 108,500 ▲3000K | 111,000 ▲3000K |

| SJC gold 5 chi | 108,500 ▲3000K | 111.020 ▲3000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 108,500 ▲3000K | 111.030 ▲3000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 108,000 ▲5000 | 110,500 ▲4500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 108,000 ▲5000 | 110,600 ▲4500 |

| Jewelry 99.99% | 108,000 ▲5000 | 110,000 ▲4500 |

| Jewelry 99% | 104,910 ▲4255 | 108,910 ▲4455 |

| Jewelry 68% | 70,957 ▲2860 | 74,957 ▲3060 |

| Jewelry 41.7% | 42,024 ▲1676 | 46,024 ▲1876 |

Update gold price today April 16, 2025 latest on the world market

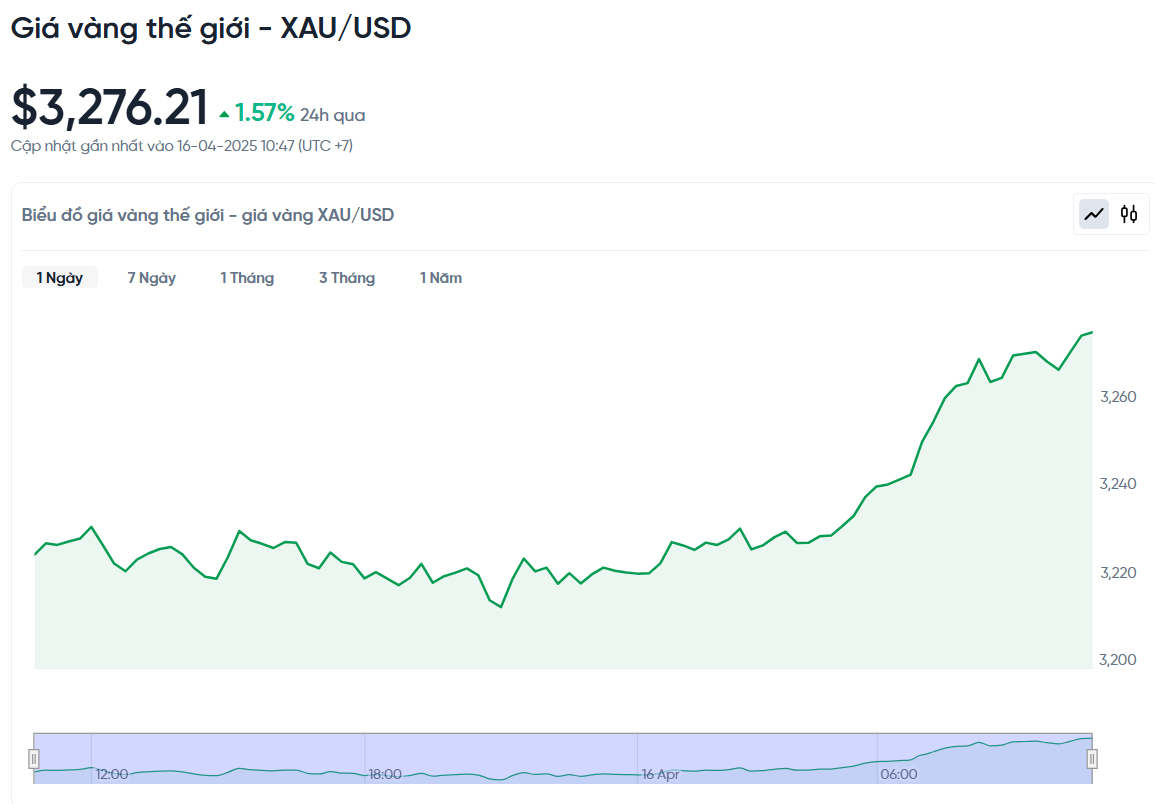

At the time of trading at 10:46 a.m. on April 16, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,276.21 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 103.66 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (108.5-111.0 million VND/tael), the SJC gold price is currently about 7.3 million higher than the international gold price.

On April 16, 2025, the price of gold today, April 16, 2025, on the US market recorded a slight increase of 0.4%, reaching 3,240.40 USD per ounce. Experts say that investors are waiting for a major event to orient the market, but at present, gold still retains its strong appeal. In the context of the world facing many political and economic uncertainties, gold continues to be a safe choice to protect assets, something that anyone can see when the situation becomes unpredictable.

A key factor driving gold prices today, April 16, 2025, is the weakening of the US dollar. As the value of the US dollar falls, gold becomes more attractive to those using other currencies, as they can buy gold at a more reasonable cost. In addition, economic policies in the US, such as plans to impose tariffs on imports such as pharmaceuticals and semiconductors, are creating concerns. This makes many people seek gold as a reliable shelter to preserve capital.

In terms of monetary policy, the market is expecting the US Federal Reserve (Fed) to cut interest rates in June, after a pause in January. Forecasts suggest that interest rates could fall by around 1% this year. When interest rates are low, holding cash or savings is no longer attractive, because returns are reduced. In this context, gold emerges as an ideal investment channel, because it is not much affected by interest rates and retains its value well during volatile times.

Attention is now focused on Fed Chairman Jerome Powell’s speech on Wednesday, which could shed light on the direction of interest rates, which could have a big impact on gold prices today, April 16, 2025. If interest rates continue to fall, gold prices are likely to rise further, as many will favor gold over other assets that are affected by interest rates.

In addition to gold, precious metals such as silver, platinum and palladium also had their own fluctuations. Silver prices fell slightly, while platinum and palladium increased. However, gold still led the interest due to its role as a safe asset in times of uncertainty. Since the beginning of 2025, gold prices have increased by more than 23%, continuously setting new records, showing that its appeal is not showing any signs of cooling.

News, gold price trends today April 16, 2025 domestic and world gold prices

April 16, 2025, gold prices today April 16, 2025 continue to be strengthened thanks to its role as a safe asset in the context of volatile global markets. Concerns about new tariff policies from US President Donald Trump make investors uncertain about trade prospects, while the USD is losing value. These factors make gold an attractive destination, helping to protect assets against economic and political risks.

Jim Wyckoff of Kitco Metals said the gold market is waiting for a major event to set a new direction, but for now the trend remains positive. Demand for gold as a safe haven remains strong. Commerzbank also pointed out that the weakening of the US dollar is causing many to turn to gold as a reliable alternative when the US dollar no longer holds its dominant position.

In the Chinese market, gold prices today, April 16, 2025, are very exciting. Domestic gold prices continue to set records, with large capital flows into gold ETFs and the country's Central Bank continuously buying. However, the high gold price has reduced the demand for imports and jewelry gold. According to Ray Jia from the World Gold Council, March 2025 saw gold prices peak both domestically and internationally, with investment purchasing power increasing sharply despite the somewhat stagnant jewelry market.

Geopolitical tensions, from US trade policy to the situation in the Middle East and Ukraine, have added to the appeal of gold. A weak US dollar and large inflows from ETFs have continued to push gold higher. Investors are now looking ahead to a speech by Fed Chairman Jerome Powell on Wednesday, as interest rate information could have a significant impact on gold prices today, April 16, 2025.

Gold prices are forecast to continue rising in the week of April 14-20, possibly even reaching new highs. Experts from Kitco News believe that this trend is supported by expectations that the Fed will cut interest rates from June 2025, along with the global instability that has not cooled down. Strong buying power from central banks and ETFs is also a big driving force.

However, with prices having increased by one and a half times in more than a year, gold prices today, April 16, 2025, may face profit-taking pressure, leading to temporary fluctuations. Technically, gold is heading towards the $3,300/ounce mark, but if it falls, the $3,100/ounce level will be a solid support. With current developments, the gold market promises to be more active in the coming days.

Source: https://baodaknong.vn/gia-vang-hom-nay-16-4-2025-gia-vang-trong-nuoc-dat-ky-luc-moi-111-trieu-vang-the-gioi-tang-manh-249565.html

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)