Domestic gold price today

Early afternoon of July 13 , today's SJC 9999 gold price increased by 150 thousand VND/tael in both buying and selling compared to the morning.

The price of 9999 gold was updated by Saigon Jewelry Company Limited (SJC) at 13:48 and the price of 9999 gold was listed by Doji Jewelry Group at 13:55 as follows:

| Buy | Sell | |

| SJC Hanoi | 66,800,000 VND/tael | 67,420,000 VND/tael |

| SJC HCMC | 66,800,000 VND/tael | 67,400,000 VND/tael |

| SJC Danang | 66,800,000 VND/tael | 67,420,000 VND/tael |

| Doji Hanoi | 66,700,000 VND/tael | 67,350,000 VND/tael |

| Doji HCMC | 66,650,000 VND/tael | 67,150,000 VND/tael |

SJC and DOJI gold price list updated early afternoon July 13

Early morning of July 13 , SJC gold price 9999 today increased by 50 thousand VND/tael in both buying and selling compared to the end of yesterday's trading session.

The price of 9999 gold was updated by Saigon Jewelry Company Limited (SJC) at 8:51 a.m. and the price of 9999 gold was listed by Doji Jewelry Group at 8:51 a.m. as follows:

| Buy | Sell | |

| SJC Hanoi | 66,650,000 VND/tael | 67,270,000 VND/tael |

| SJC HCMC | 66,650,000 VND/tael | 67,250,000 VND/tael |

| SJC Danang | 66,650,000 VND/tael | 67,270,000 VND/tael |

| Doji Hanoi | 66,550,000 VND/tael | 67,200,000 VND/tael |

| Doji HCMC | 66,600,000 VND/tael | 67,100,000 VND/tael |

SJC and DOJI gold price list updated early morning July 13

At the end of the trading session on July 12, the domestic 9999 gold price was listed by SJC and Doji Gold and Gemstone Group in the following order of buying and selling:

SJC Hanoi: 66,600,000 VND/tael - 67,220,000 VND/tael

Doji Hanoi: 66,550,000 VND/tael - 67,200,000 VND/tael

SJC HCMC: 66,600,000 VND/tael - 67,200,000 VND/tael

Doji HCMC: 66,550,000 VND/tael - 67,050,000 VND/tael

The central exchange rate on July 13 announced by the State Bank was 23,758 VND/USD, down 14 VND compared to yesterday. The USD price at commercial banks this morning (July 13) was traded around 23,440 VND/USD (buy) and 23,810 VND/USD (sell).

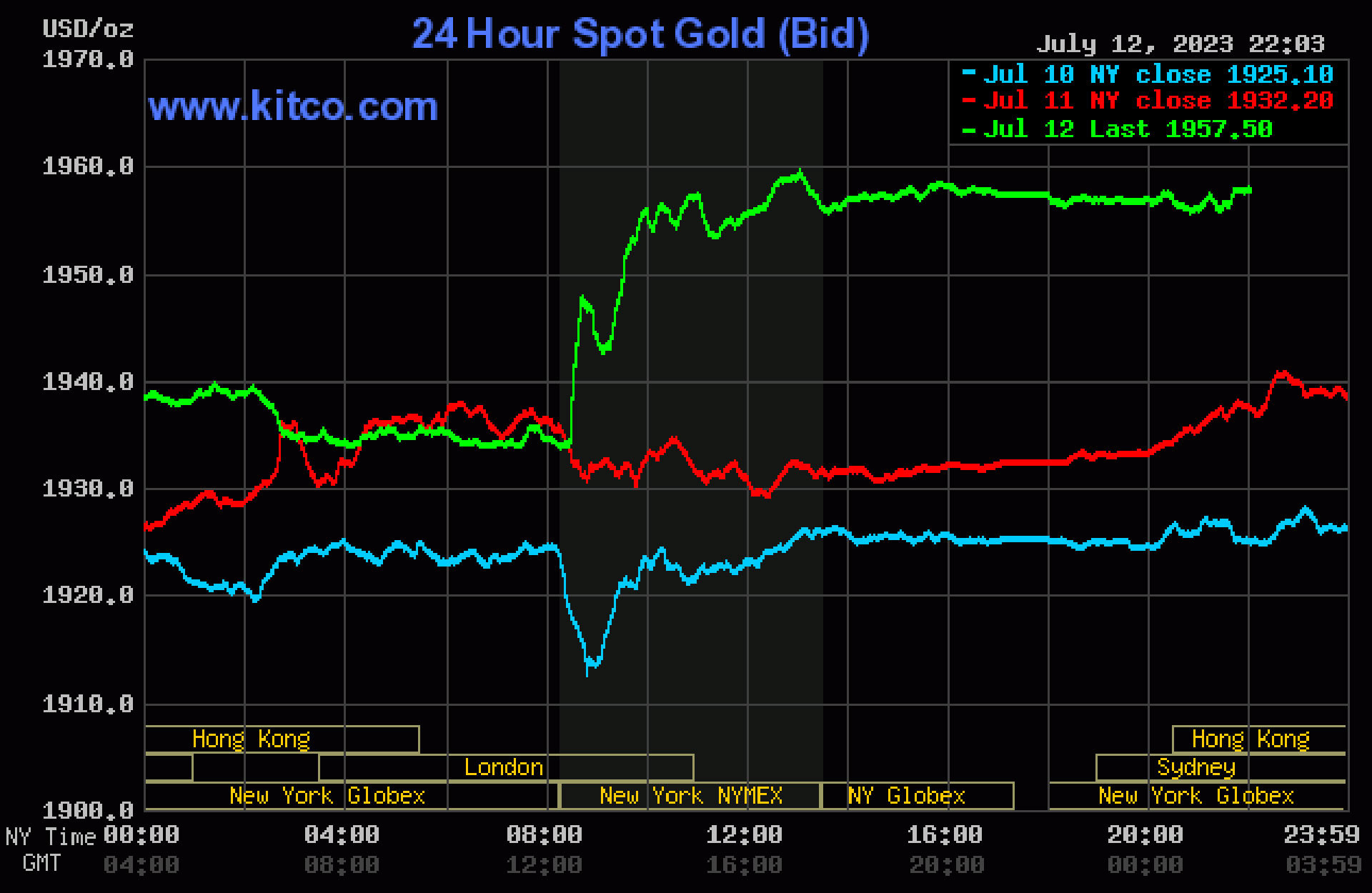

International gold price today

At 9:04 a.m. today (July 13, Vietnam time), the world spot gold price stood at around 1,957.6 USD/ounce, up 22.6 USD/ounce compared to last night. The price of gold futures for August delivery on the Comex New York floor was at 1,963.4 USD/ounce.

On the night of July 12 (Vietnam time), the world spot gold price stood at around 1,935 USD/ounce. Gold for August delivery on the Comex New York floor was at 1,956 USD/ounce.

The world gold price on the night of July 12 was about 6.1% higher (111 USD/ounce) than at the beginning of 2023. World gold converted to the bank USD price was 56.2 million VND/tael, including taxes and fees, about 10.8 million VND/tael lower than the domestic gold price as of the end of the afternoon session on July 12.

Gold rose mainly due to the decline of the US dollar. The DXY index (measuring the greenback's performance against a basket of six major currencies) fell from 103 points last week to 101.4 points now.

US bond yields also fell to their lowest level in more than a week.

The US dollar weakened as European currencies gained and many people reduced their holdings of the currency as the US monetary tightening cycle neared its end.

In fact, the US may still have two more interest rate hikes, but the pressure on regulators is no longer as great. Inflation is no longer as intense as before. Core inflation in the US in June is forecast to fall from 5.3% to 5%, although it is still significantly higher than the 2% target of the US Federal Reserve (Fed).

Gold Price Forecast

There is currently a 90% chance that the Fed will raise interest rates by another 25 basis points at its policy meeting on July 25-26. The Fed is expected to reverse monetary policy in 2024.

One factor that has put pressure on the USD recently is that the market is leaning towards the possibility that the Fed will just raise interest rates one more time and then stop.

The market is waiting for clearer policy signals from the Fed. Will the US central bank keep interest rates high for a long time if inflation persists?

For now, investors are waiting to see if the Fed will raise interest rates twice more this year or just tighten once more.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)