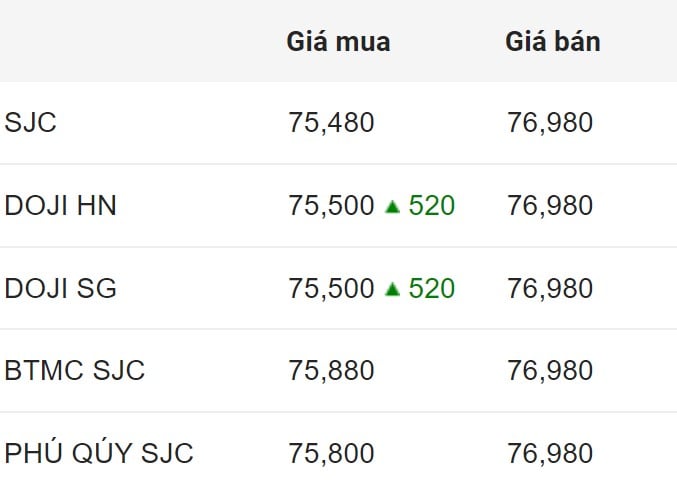

Update SJC gold price

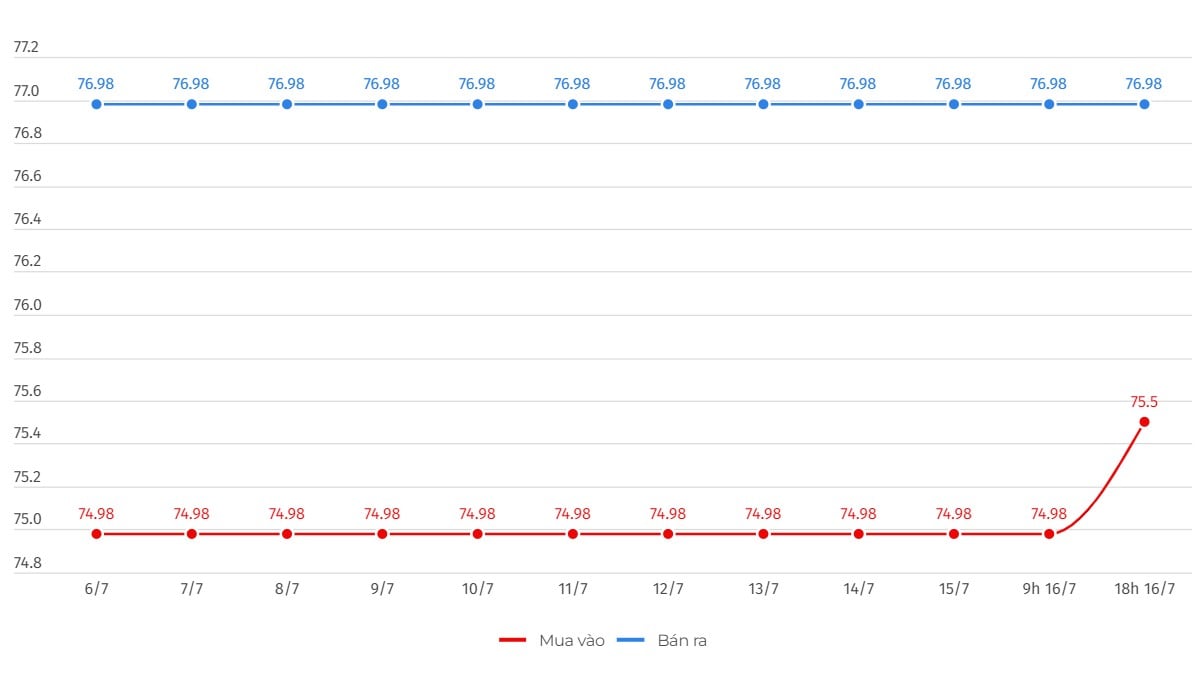

After a long period of sideways movement, this afternoon the price of SJC gold bars at DOJI adjusted up 520,000 VND/tael for buying and remained unchanged for selling.

This fluctuation has caused the difference between buying and selling gold bars at this unit to decrease to 1.48 million VND/tael. This also helps reduce the risk of loss for investors.

Price of round gold ring 9999

As of 6:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 76.25-77.50 million VND/tael (buy - sell); an increase of 50,000 VND/tael in both directions.

Saigon Jewelry Company listed the price of gold rings at 75.45-76.85 million VND/tael (buy - sell); an increase of 300,000 VND/tael for buying and 200,000 VND/tael for selling.

Bao Tin Minh Chau listed the price of gold rings at 76.18-77.48 million VND/tael (buy - sell); increased by 500,000 VND/tael for both buying and selling.

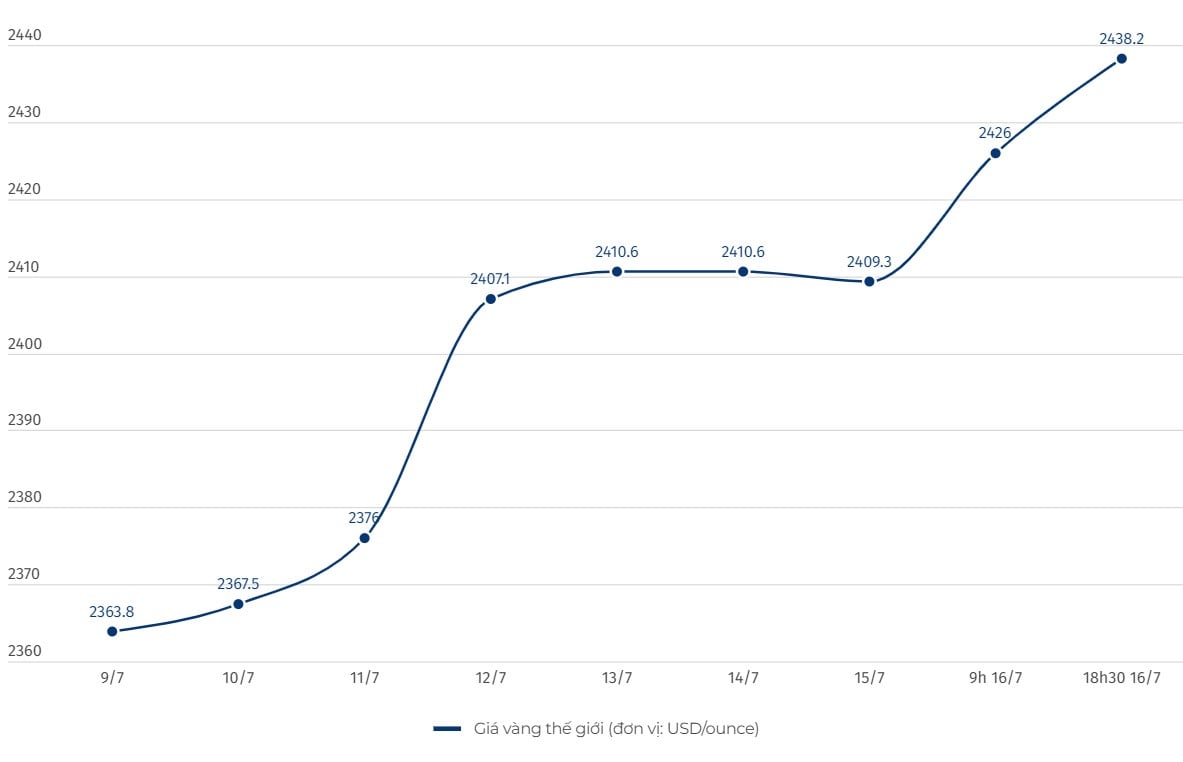

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 6:30 p.m. today, the world gold price listed on Kitco was at 2,438.2 USD/ounce, up 20.2 USD/ounce.

Gold Price Forecast

World gold prices increased despite the rise in the USD index. Recorded at 6:30 p.m. on July 16, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.977 points (up 0.1%).

According to Kitco, while market attention is focused on China's gold demand, ANZ bank forecasts that gold demand in India will remain strong this year, possibly pushing gold prices to $2,500/ounce by the end of the year, even though gold prices have already reached record highs.

As one of the world’s largest consumers of gold, India is seeing a significant increase in gold imports, even as the precious metal has hit a record high of over $2,450 an ounce. ANZ reports that India’s gold imports in the first five months of this year rose 26% year-on-year to 230 tonnes.

According to a report from ANZ, the movement between gold demand and price has been remarkable. Although gold prices are at record highs, demand remains strong.

Experts note that while previous price increases were often accompanied by a decline in demand, this “sensitivity” has been decreasing over the past year. This indicates that gold demand is resilient to price fluctuations in India. Therefore, the forecast suggests that India could continue to be one of the key drivers of gold price stability in the near term.

Federal Reserve Chairman Jerome Powell participated in a live interview at the Economic Club of Washington, DC on Monday afternoon. The new stance from the Fed is strongly supporting gold prices.

Federal Reserve Chairman Jerome Powell has indicated that the central bank is moving closer to cutting interest rates, citing increased confidence in cooling inflation. The announcement marks a significant shift in the Fed's stance on monetary policy.

“As long as gold holds above $2,401.40-$2,405.60 an ounce, I am extremely bullish,” said Julia Cordova, founder of Cordovatrades.com. “My upside target is $2,582.50 an ounce.”

After a slow start on Monday morning, gold began to see some buying. David Morrison, senior market analyst at Trade Nation, said he also sees growing potential for gold.

Source: https://laodong.vn/tien-te-dau-tu/cap-nhat-gia-vang-chot-phien-167-vang-mieng-bat-ngo-tang-rui-ro-giam-bot-1367200.ldo

Comment (0)