Bitcoin hit a new high, US stocks returned to record levels and the US dollar strengthened, making this past week a bustling period for investors.

The S&P 500 hit its 17th record high of the year this week on March 12, as investors shrugged off higher-than-expected consumer price increases and welcomed a cooling in some categories like food prices.

However, US stocks began to cool midweek on renewed concerns about inflation. The latest producer price index released on March 14 showed US wholesale inflation rose 1.6% in February, the fastest pace in months, due to a spike in energy prices.

"We're seeing a trend that's moving away from where people were hoping it would go, especially when the Fed has a clear intention to see inflation cool," said Ken Tjonasam, investment strategist at Global X.

As a result, the Dow Jones Industrial Average fell 191 points, or 0.5%, at the close of trading on Friday (March 15), while the S&P 500 and Nasdaq fell 0.7% and 1%, respectively. All three major indexes ended the week lower.

Traders on the floor of the New York Stock Exchange. USA on February 7. Photo: Reuters

The U.S. stock market will be driven by economic data and corporate events next week. The Federal Reserve begins its two-day policy meeting on March 19. Investors expect the Fed to keep interest rates unchanged this month and begin cutting in June or July.

Investors will also be closely watching the latest summary of economic projections, which will include a chart of interest rate expectations for the next few years from each member of the Federal Open Market Committee. Wall Street will also be analyzing a slew of new housing market data from the Census Bureau, the National Association of Home Builders and the National Association of Realtors.

Several major corporate events also have the potential to make an impact. Nvidia will host its global AI developer conference from March 18 to 21, with a keynote address from CEO Jensen Huang. Also related to AI, Super Micro Computer will be added to the S&P 500 index before the market opens next week. The stock has gained 276% this year.

But U.S. stocks weren’t the only investment that enjoyed a surge this week. The cryptocurrency market was abuzz as Bitcoin hit an all-time high of $73,750 on March 14.

According to Reuters, the most common reasons given for Bitcoin's recent price surge are the US Securities and Exchange Commission's approval in January of Bitcoin ETFs, as well as expectations that central banks will cut interest rates.

But by the end of the day on March 16, Bitcoin had cooled off quickly, falling about 7.7% from its peak. "Bitcoin has a history of being very volatile after hitting a record high," said Matt Simpson, senior market analyst at City Index.

Unlike traditional stock markets, the cryptocurrency market lacks regulations that limit the influence of influential individuals or institutions with concentrated holdings, said Joshua Chu, chief risk officer at financial engineering firm Invess. “This allows whales to make significant trades, causing cascading effects and rapid price movements,” he said.

Still, Bitcoin prices are nearly 60% higher than at the start of the year, supported by a crypto mania driven by inflows into US-traded crypto products and traders remaining optimistic about the prospect of lower global interest rates by year-end.

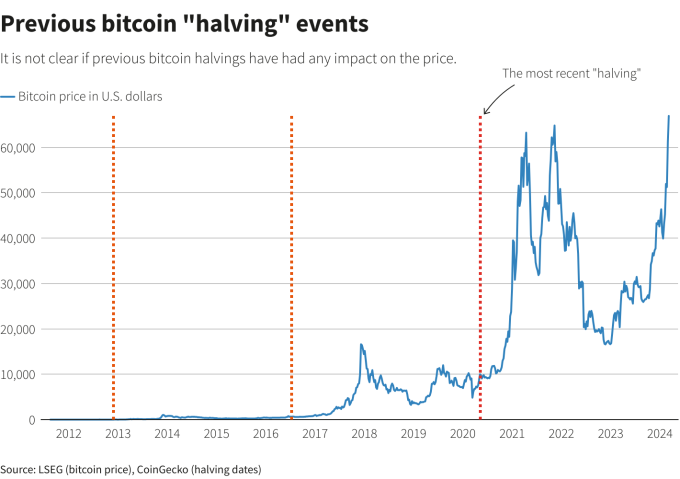

Bitcoin price movements (blue) and the "halvings" that have taken place. Graphics: Reuters

Bitcoin's price is expected to fluctuate in the near future following the next "halving" which will take place in April 2024. Occurring every four years, the "halving" is an event when the number of new Bitcoins created through the bitcoin mining process is reduced by half, making the supply scarcer until it reaches a maximum of 21 million Bitcoins. There are currently 19 million Bitcoins issued.

In the cryptocurrency world, there are also many different views on the impact of "halving" on the future price of Bitcoin. Some believe that scarcity will increase the price of Bitcoin, following the law that the lower the supply of an item, the higher the price will be when demand does not decrease or increase.

Others argue that any impact from the upcoming “halving” is already priced into the current price. The supply of Bitcoin to the market also depends largely on cryptocurrency miners. But the sector is opaque, with inventory data a mystery. If miners sell their reserves, that could put downward pressure on prices.

In addition to stocks and Bitcoin, the US dollar also had a strong week. The dollar index, which tracks the greenback against six major currencies, reached 103.43, with a weekly gain of 0.7%, the biggest since mid-January. The dollar rose on a series of data showing the US economy is still stable, signaling that the Fed may keep interest rates high for longer or reduce the number of rate cuts planned this year.

Eugene Epstein, head of North American investments at Moneycorp, said there is nothing to suggest the Fed has the wherewithal to be dovish ahead of next week's meeting. "That's why we're seeing Treasury yields rise and the dollar strengthen," he said.

Phien An ( according to Reuters, CNN )

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)