According to the Vietnam Textile and Apparel Association (Vitas), in 2022, the industry's total export turnover reached 44.4 billion USD, an increase of nearly 10% compared to 2021, but by 2023, the textile and garment industry will face many challenges.

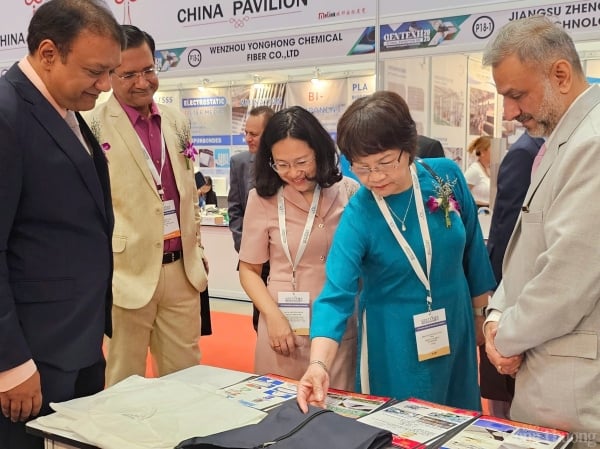

Conference overview

Specifically, the impact of the world and domestic economic situation, including inflation in key markets such as the US and Europe, has caused a decrease in purchasing power, a decrease in orders, high interest rates and exchange rate differences...

Besides difficulties, some bright spots shared by Mr. Vu Duc Giang, Chairman of Vitas, at the 2023 Textile and Garment Industry Summary Conference on the morning of December 16, in Hanoi, are that textile and garment exports to some markets such as Japan, Australia, Russia, India... are still increasing.

Textile and garment enterprises have also opened up a number of new markets in Africa and the Middle East. "This has helped prevent the textile and garment industry's export turnover from falling sharply amid a sharp decline in purchasing power," said Mr. Giang.

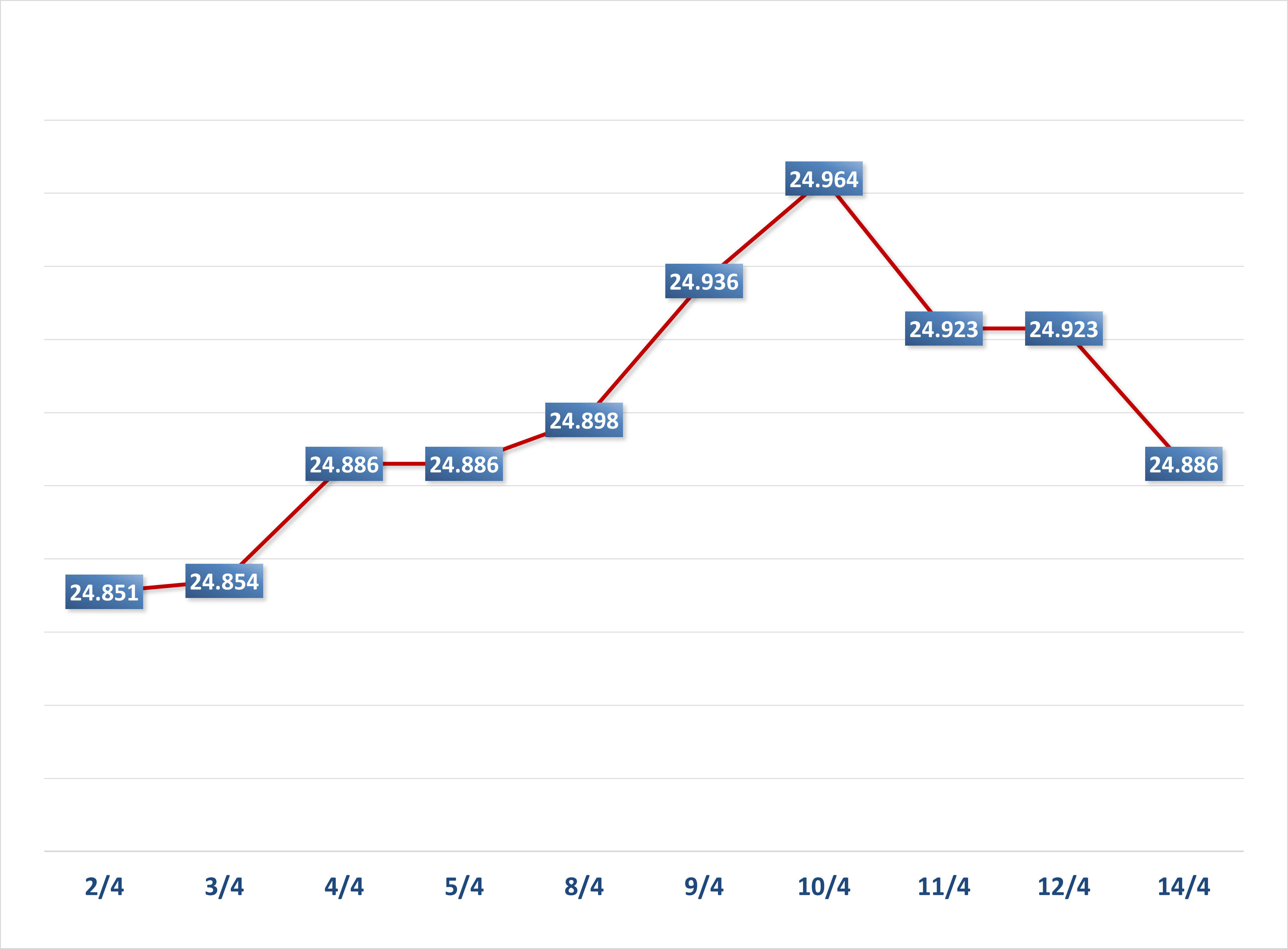

Vitas assessed that in general, the Vietnamese textile and garment industry continues to recover, with the decline in export value gradually narrowing in the second half of the year, looking towards 2024 with the hope of recovery, with a forecast of a gradual "warming" of the market.

Thanks to the efforts of businesses, exports in 2023 will reach about 40.3 billion USD. The whole industry aims to reach 44 billion USD in export turnover in 2024, an increase of 9.2% compared to 2023.

Gradually move towards high value-added production methods

According to Mr. Tran Thanh Hai, Deputy Director of the Import-Export Department (Ministry of Industry and Trade), compared to the years 2020 - 2021 and the whole year 2019 before the Covid-19 pandemic, this year's textile and garment export turnover has recovered, tending to surpass the period before the Covid-19 pandemic.

Vietnam's textile and garment industry has made a breakthrough in terms of markets and export products with 104 export markets, including new markets such as Africa, Russia, and Muslim countries. This shows that Vietnam's textile and garment industry has gradually reduced its dependence on large markets.

However, Vietnam's textile industry is competing with Bangladesh. While the neighboring country has adopted green transformation early, Vietnam's textile industry is still in the early stages of transformation.

"The Vietnamese textile and garment industry needs to proactively source green and recycled materials, gradually increase the proportion of recycled fibers in fabric products as well as organic fibers for new products; invest in technology, control well from raw materials to product design, product development and production organization...", Mr. Hai commented.

To prepare for the market recovery period, textile and garment enterprises are trying to cut production costs and retain their workforce by all means.

According to Vitas, in preparation for the market recovery period, textile and garment enterprises are making efforts to cut production costs and retain their workforce by all means. This not only prepares resources for the order recovery period but also affirms the stability of domestic production as a competitive factor with other countries.

Vitas Chairman emphasized that the development orientation of Vietnam's textile and garment industry is to gradually move towards production methods that bring higher added value. Furthermore, by 2035, the main contribution to textile and garment export value will come from exporting products with Vietnamese brands. To carry out this transformation, strong determination from enterprises in sustainable production, greening and digital transformation is needed...

Source link

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)