|

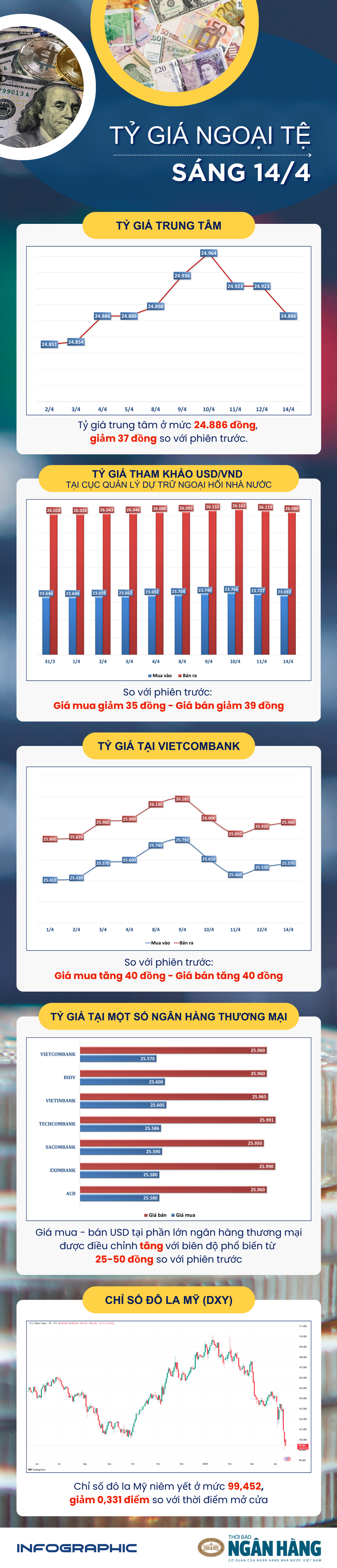

The US dollar continued to fluctuate near a three-year low at the start of the trading week after a volatile week due to the market's negative reaction to tariff policies from the Trump administration.

Currency markets remained relatively stable after the White House announced tariff exemptions for some electronics, including smartphones and computers imported mainly from China. However, Donald Trump said over the weekend that the measure would not last, further unsettling investors.

“Tax policy has been handled haphazardly, creating great uncertainty,” said Tony Sycamore, a market analyst at IG. “The storm clouds have not yet cleared.”

The greenback rose 0.09% against the Swiss franc to 0.8155 francs per dollar, after hitting a decade low last Friday.

Meanwhile, the euro rose 0.3% to $1.1389 after rising 3.6% last week and hitting a three-year high on Friday. The common currency’s gains reflect a search for alternative safe-haven assets amid waning confidence in the dollar.

“There is a possibility that the euro will trade at $1.20 by late July, early August,” forecasts expert Tony Sycamore.

The shift away from US assets is becoming a clear trend. “The market is reassessing the structural attractiveness of the US dollar as a global reserve currency and is undergoing a rapid process of de-dollarization,” said George Saravelos, global head of foreign exchange research at Deutsche Bank.

The most obvious sign, according to the expert, is the “continuous and simultaneous collapse” in the US currency and bond markets. Last week, the market witnessed a sharp sell-off in US Treasury bonds as hedge funds fled their underlying positions. The yield on the US 10-year government bond is currently at 4.47%, after recording the largest increase in borrowing costs in decades.

Elsewhere, the Japanese yen rose 0.58 percent to 142.71 yen per dollar.

Similarly, the British pound rose 0.14% to $1.3105.

The Australian dollar extended gains, rising 0.03% to $0.6291 after gaining more than 4% last week.

The New Zealand dollar also recorded a 0.24% increase to $0.5838.

In Asia, the offshore yuan fell 0.17 percent to 7.2941 yuan per dollar. The currency hit a record low on the international market last week, while the onshore yuan also fell to its lowest level since 2007 due to the impact of US-China trade tensions.

Source: https://thoibaonganhang.vn/sang-144-ty-gia-trung-tam-giam-37-dong-162715.html

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Infographic] Hanoi's GRDP in the first quarter of 2025 increased by 7.35%](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/66feaaa99ed54246ad6dd043687416fd)

Comment (0)