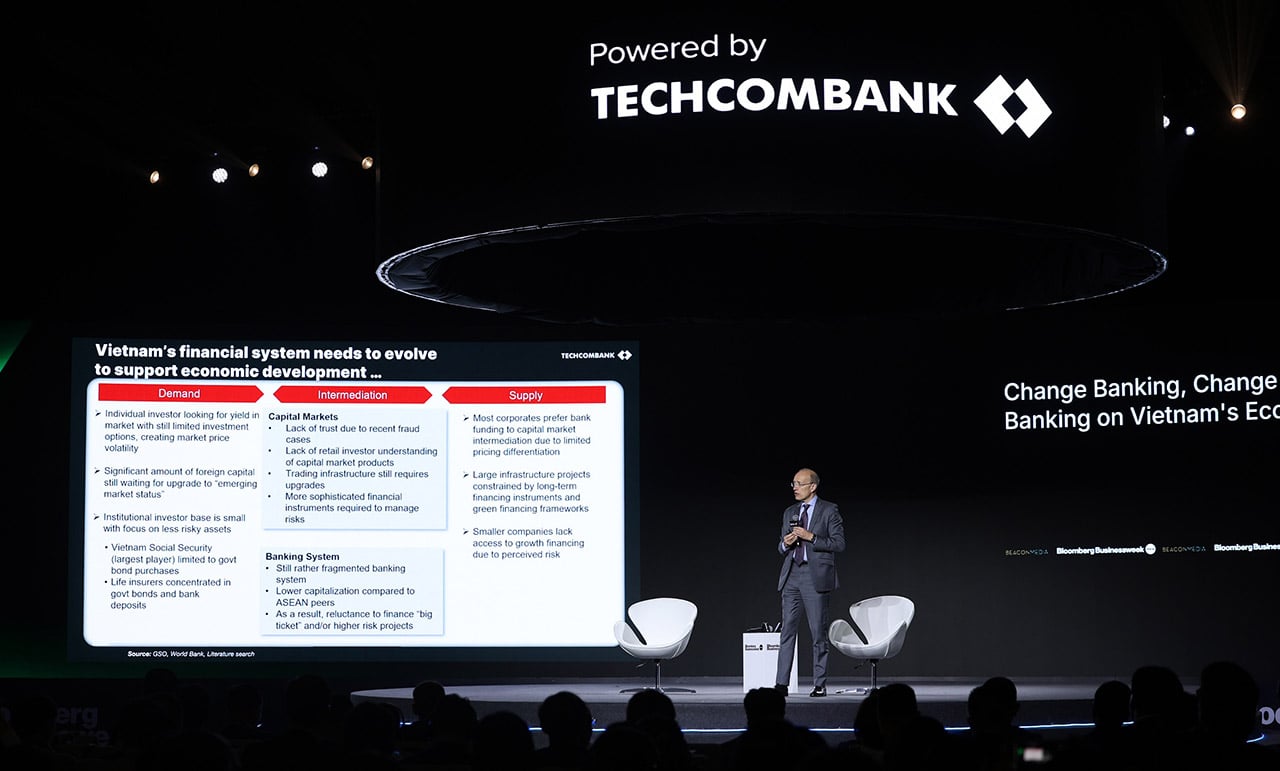

Mr. Jens Lottner, CEO of Techcombank, speaks at Vietnam Investment Summit 2024.

Fintech plays a very important role. Assessing investor behavior, Mr. Jens Lottner, General Director of Techcombank (HoSE: TCB) said that in the period of 2020 - 2021, investor confidence was quite positive and they were still optimistic about the future, even during the Covid pandemic. However, in 2022 - 2023, our country had ups and downs. "However, I believe that investors will continue to be optimistic". "The middle-class income will continue to grow and there is still room for further expansion. TCB's services will be further promoted, focusing on providing what customers need most, meeting their financial and non-financial needs". "We can learn from surrounding markets, such as the Thai market. Many services and products that have been seen in Thailand will be seen in Vietnam. We all agree that Vietnam's growth rate is very fast compared to other countries," added Mr. Jens Lottner. According to Mr. Jens Lottner, Fintech plays a very important role. Especially in awakening traditional banks to always keep up with technological developments: "I believe that in the future, Fintech startups and traditional banks will have harmony and resonance between the two sides to strengthen each other's strengths." Banks are the driving force for economic development . According to Mr. Jens Lottner, just 18 months ago, investors were very concerned about political stability in Vietnam and China's policies. But then, they saw and observed how the Vietnamese Government encouraged the economy to include the private sector and was very supportive of investors. In the current context, Vietnam needs to prepare for many different scenarios of economic development.

Mr. Jens Lottner assessed that with the current legal framework, there is enough room to create and diversify investment products.

“Personally, I believe that we are the place to produce the products that the world needs. From there, we must attach to low-cost production. Vietnam is currently a great destination for those needs. Of course, when the economy grows, the banking and finance sector is the driving force for that development,” Mr. Jens Lottner shared. Of course, when investing, it is necessary to look more broadly from the context of business management to the context of national management operators, to calculate whether investing here is effective or not. The role of Techcombank in the development of Vietnam Techcombank's General Director believes that if you want to differentiate and be competitive compared to competitors, you need to identify your own advantages. Techcombank has capacity and technology, but is still limited in terms of human resources. With the current human resources, we must focus on training, how to upgrade consulting capacity to better support customers. Another important thing is how to replicate technology to reach every employee, and from there to every customer. Empowering employees, especially consultants who directly deal with customers, is an important aspect that banks should focus on. Vietnamese people will get richer and more and more people will have more money to invest. Techhcombank must find a way to approach this group and build trust with them. Talking about how to diversify investment tools in Vietnam, Mr. Jens Lottner said that when investment channels are limited, the asset market (lacking diversity) becomes unstable and easily creates bubbles. "However, I think with the current legal framework, we have enough room to create and diversify products. In particular, securities companies need to create more differentiated products to meet the needs and risk appetite of more investors." "Product development needs to be customer-centric and we must pay attention to how to manage risks appropriately. At this time, we should also focus on creating investment funds to promote the domestic economy and how to connect these funds with international investors; in this, there must be a combination of the private and the State to develop legal frameworks. We need to be creative to solve problems so that we can create more diverse investment products, including cryptocurrencies for example," the TCB General Director concluded.

Vietnam Investment Summit 2024 just took place in Ho Chi Minh City with the co-organization of Techcombank.

Banks connect with supporting factors for the economy in 2025 At the event, Ms. Nguyen Hoai Thu, CEO of Securities Division of VinaCapital Fund Management JSC, also said that the driving force for economic growth in 2025 will be different from the previous 2 years. Accordingly, production and export will no longer be the main driving force but will mainly come from public investment. In addition, the Government will have appropriate policies to stimulate the real estate market (real estate), helping it recover as before. When the real estate market recovers, it will bring more excitement to consumers, thereby indirectly helping domestic consumption grow. “Vietnam's resilience is much better than other countries, for example, after 2 years of Covid, growth is still positive and the economy still receives FDI while many other ASEAN countries have negative growth. I believe that GDP growth of 6.5% in 2025 is feasible, the target of 8% is a bit ambitious and the Government may introduce many new policies in the following months to achieve this growth rate,” Ms. Thu added. Mr. Nguyen Duc Hoan, General Director of ACB Securities Company (ACBS), acknowledged that the Government is drastically streamlining the apparatus, improving the administrative apparatus to create policy mechanisms for domestic enterprises and the investment environment, attracting FDI to Vietnam. To achieve GDP growth of 7-8%, it is necessary to improve infrastructure (public investment), and the Government is currently doing so very drastically. Source: https://baodautu.vn/techcombank-tham-gia-vao-ky-nguyen-dau-tu-moi-d232019.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)