Currently, commercial banks and e-wallets are urgently asking customers to update biometric data in 2024.

According to Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NHNN of the State Bank of Vietnam (SBV), payment accounts and bank cards that have not completed biometric authentication before January 1, 2025 will have to temporarily suspend online transactions (payments, money transfers, deposits) or withdrawals at ATMs...

Currently, commercial banks and e-wallets are urgently asking customers to update their biometric data in 2024. This is the next step of the banking industry after Decision 2345/QD-NHNN on implementing safety and security solutions in online payments and card payments on implementing biometric authentication for money transfer transactions over 10 million VND and total transaction value over 20 million VND/day.

The above solutions of the State Bank aim to enhance the security of online payments, prevent fraudulent and deceptive acts of cyber criminals. In particular, these solutions will contribute to limiting the situation of buying, selling, renting, borrowing accounts, accessing links of unknown origin, downloading fake applications, revealing personal information, electronic banking passwords, OTP codes, etc. Thereby, reducing the situation of users having their money in their accounts stolen.

Information from the Payment Department - State Bank of Vietnam shows that after implementing Decision 2345, the number of fraud cases decreased by 50% compared to the average of the first 7 months of 2024, the number of accounts related to fraud decreased by 72%.

The growth rate of cashless payment channels in Vietnam has often reached double digits in recent times. On the contrary, Vietnam is also "famous" as a lowland of cybercrime and fraud. Countries around the world are also having headaches because of cybercrime. According to statistics reported by the Ministry of Public Security, online fraud accounts for 57% of all cybercrimes in the world, and this type is increasing in scope, scale and sophisticated tricks. Fraudsters thoroughly exploit new technologies, especially artificial intelligence (AI), causing thousands of billions of dollars in damage each year. In 2023, telecommunications and online fraud caused a loss of 1,026 billion USD, equivalent to 1.05% of global GDP...

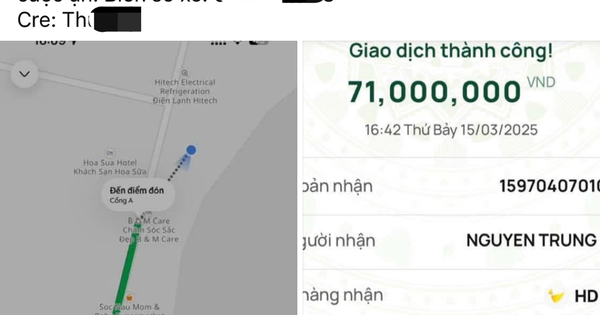

The "war" between financial institutions and cybercriminals can be said to be very difficult to end. Because technology is always changing, cybercriminals often change their methods and tricks of fraud in a more sophisticated way. For example, the banking industry's biometric authentication solutions are effective in eliminating fake accounts, spam accounts, the situation of renting and borrowing accounts for fraud... but have not yet handled the situation of deepfake (using AI to create fake images, videos to create faces, voices impersonating users) to commit fraud. Criminals can still find loopholes to crack, fake human biometric signs to appropriate assets, causing damage up to tens, hundreds of billions of VND...

Therefore, when applying biometrics, users also need to be proactive and vigilant, constantly updating new fraud tricks to avoid them. Fraudsters often target vulnerable groups such as the elderly and those who lack technological knowledge, so they need solutions from management agencies to support them. Along with investing in technology and enhancing security, banks need to propagate and warn customers about fraud tricks and suspected fraudulent accounts.

Source: https://nld.com.vn/tang-cuong-bao-mat-chan-lua-dao-196241206212750352.htm

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)