Binance CEO Changpeng Zhao and Coinbase CEO Brian Armstrong lost a combined $1.8 billion when the two companies were sued by the US Securities and Exchange Commission (SEC).

Until last week, 2023 was shaping up to be a great year for crypto billionaires. However, two lawsuits filed by the US Securities and Exchange Commission (SEC) against cryptocurrency exchanges Binance and Coinbase in the past two days have dampened optimism in the market.

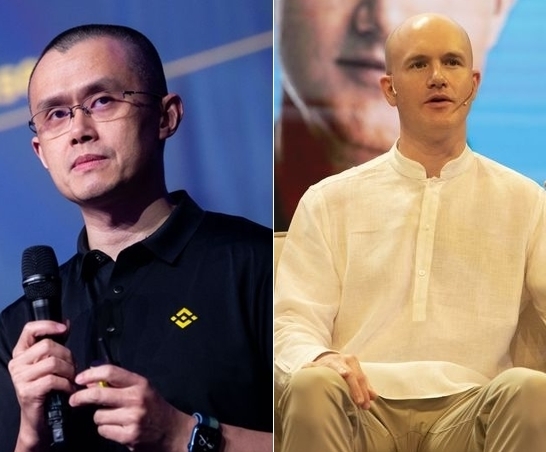

According to the Bloomberg Billionaires Index, Binance CEO Changpeng Zhao (CZ)'s fortune has dropped by $1.4 billion in the past two days, to $26 billion. Coinbase CEO Brian Armstrong's fortune has also dropped by $361 million, to $2.2 billion. The SEC has accused the two companies of violating securities regulations, causing shares of cryptocurrency-related companies and the prices of many tokens to plummet.

Changpeng Zhao (left) and Brian Armstrong. Photo: Bloomberg

This is the next big thing for crypto billionaires, whose combined fortunes have plummeted during the “crypto winter” of 2022. Last year saw the collapse of a series of names, from stablecoin TerraUSD, venture capital fund Three Arrows Capital to Sam Bankman-Fried’s FTX exchange.

But their fortunes rose by $15.4 billion through last week as the price of Bitcoin and other digital assets rebounded. Zhao’s fortune was up 117% before this week’s decline, while Armstrong’s fortune was up 61%. The billionaires on Bloomberg’s list saw a gain of just 9%.

Bitcoin has surged this year on hopes that the US banking crisis will force the Federal Reserve to halt interest rate hikes. Bitcoin investors have long argued that the digital currency will benefit from a low-interest-rate environment and act as a safe haven from the turmoil of traditional finance.

However, that could change as US authorities make it difficult for the industry to operate and for Americans to transact.

In a lawsuit filed on June 5, the SEC accused Zhao and Binance, the world's largest cryptocurrency exchange, of defrauding investors and regulators, misusing user funds, and violating securities regulations. Zhao's assets peaked at $96.9 billion in January 2022.

The SEC continued to sue Coinbase on June 6, sending the company's stock down 12%. In a 101-page report, the SEC did not accuse Armstrong of wrongdoing. However, the agency said Coinbase violated SEC regulations by allowing users to trade tokens that were in fact unregistered securities.

Armstrong now owns 16% of Coinbase, both directly and through funds. He has also been selling Coinbase stock regularly, having sold $27 million worth of stock this year. Coinbase co-founder Fred Ehrsam also saw his fortune drop to $1.1 billion.

Ha Thu (according to Bloomberg)

Source link

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)