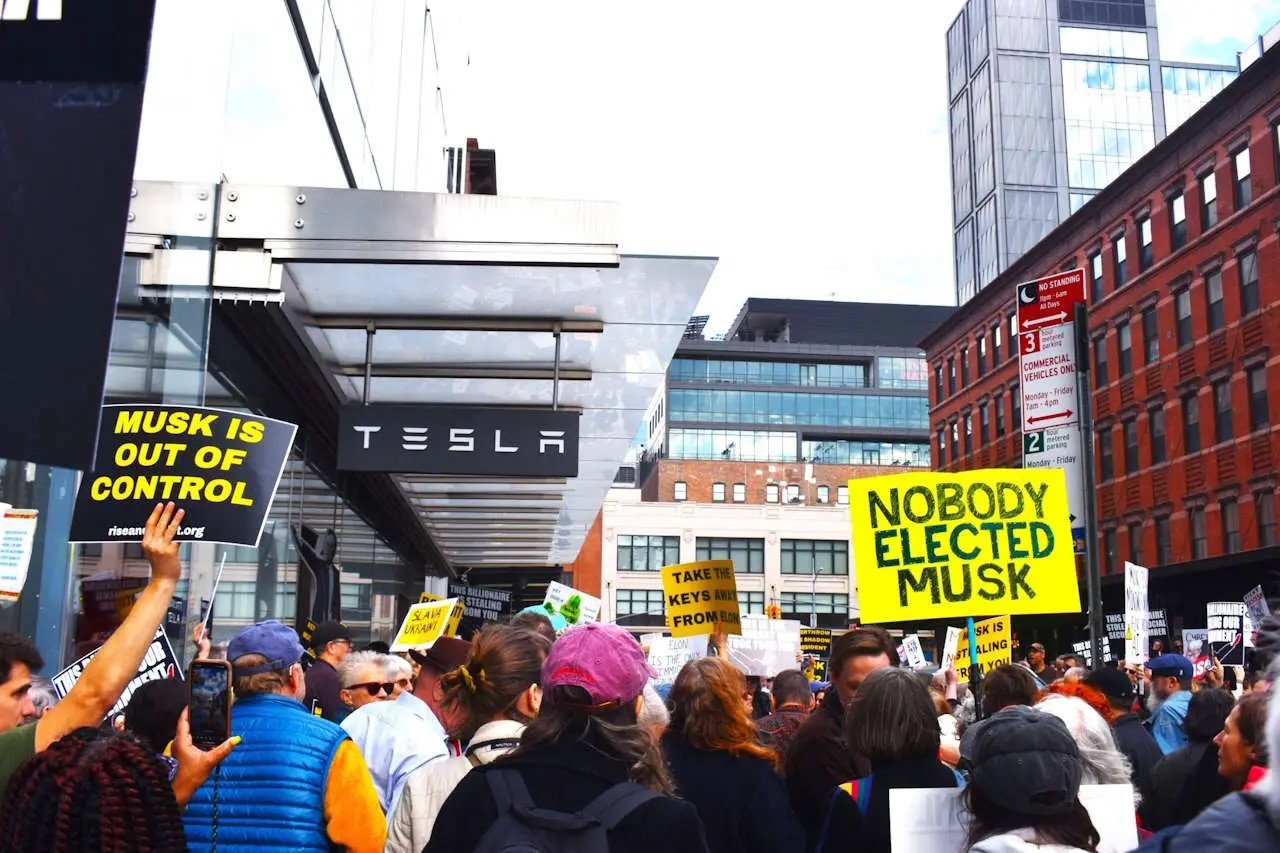

Elon Musk, one of the most prominent figures in American politics today, is facing a wave of discontent not only from government employees but also from investors who have placed their trust in Tesla - the American electric car giant.

Tesla in the eye of the storm

Following the US presidential election, Tesla shares soared 91%, peaking just before Christmas, as investors expected Musk and Tesla to benefit greatly from a second term under Donald Trump – whose campaign Musk had heavily supported financially.

As Trump's biggest donor, Elon Musk has quickly become the most influential figure in the new administration, outranking any other adviser.

He was tasked with heading the Office of Government Efficiency (DOGE), where he pushed through sweeping spending cuts previously approved by Congress, resulting in thousands of federal workers losing their jobs.

But the joy was short-lived. As of March 6, Tesla shares were down 5.6% and have now lost 45% of their value from their December peak, wiping out 96% of their post-election gains.

Since Trump took office and Musk took the helm of DOGE, Tesla shares have fallen a total of 38%. The decline reflects not only Tesla’s internal struggles, but also a shift in how investors view Musk’s role in the Trump administration.

Initially, many expected him to be a low-key adviser, not directly involved in controversial policies. The billionaire has been busy enough running Tesla, SpaceX, Neuralink and X.

The stock price decline stems not only from Musk’s political role but also from the challenges Tesla is facing in the market. Increasing competition from automakers, especially from China, is threatening Tesla’s position.

Chinese companies are not only dominating their domestic market, but are also making a mark in Europe, where electric car sales rose 34% in January, but Tesla sales fell 50%.

In China – Tesla’s second-largest market after the US – sales fell 29% in the first two months of the year. In the US, Tesla sales fell 16% from December to January, although that may be a normal trend after a year-end sales push to meet financial targets.

“His global sales are collapsing,” said Gordon Johnson, a prominent Tesla critic. He blamed competition for the decline in China, while in the West, Musk’s discontent may be to blame. “For whatever reason, he can’t turn things around. We can see that Musk is not going to achieve full self-driving cars. This year could be the year that Tesla’s stock crashes.”

Even bullish investors are starting to waver. “Investors are slowly adjusting their delivery expectations for this year,” said Gene Munster, managing partner at Deepwater Asset Management.

A few months ago, Musk predicted a 20% to 30% increase in deliveries by 2025. But the automaker’s CEO has recently stopped mentioning that target, leading analysts and investors to believe it is no longer feasible.

Important turning point

It’s unclear what could help Tesla revive sales. The stock’s plunge is a stark reminder of the company’s struggles, from fierce competition to Musk’s increasingly controversial public image.

Whether he’s a business genius or a political powerhouse, Musk seems to be at a crossroads: focus on saving Tesla or continue to be deeply involved in the Trump administration. For investors, the answer is no longer as simple as it was during Tesla’s heyday.

Photo: Politico

In addition to concerns that liberals might avoid buying Teslas in response to Musk’s political views, Munster said there’s another concern: Musk appears to be distracted from running Tesla — the company that serves as the foundation for much of his wealth.

“Musk has really rewritten the book on the ability of leaders to wear multiple hats. That used to be considered a no-no,” Munster said, referring to Musk’s role as CEO of not only Tesla but also SpaceX, majority owner of social media platform X, and founder of artificial intelligence company xAI and Neuralink, which is working to implant computer chips into the human brain to control computers. “I think there are natural limits to what he can do. He’s wearing a lot of hats.”

There are also growing concerns that as trade tensions between China and the US escalate, China could target Tesla in retaliation for Musk's role in the Trump administration.

“Beijing can grant or deny favors,” said Isaac Stone Fish, CEO of Strategy Risks, a business intelligence firm. “They have a lot of leverage over Elon Musk and Tesla.”

Source: https://vietnamnet.vn/su-nghiep-chinh-tri-bay-cao-nhung-de-che-kinh-doanh-lao-doc-cua-elon-musk-2378502.html

Comment (0)