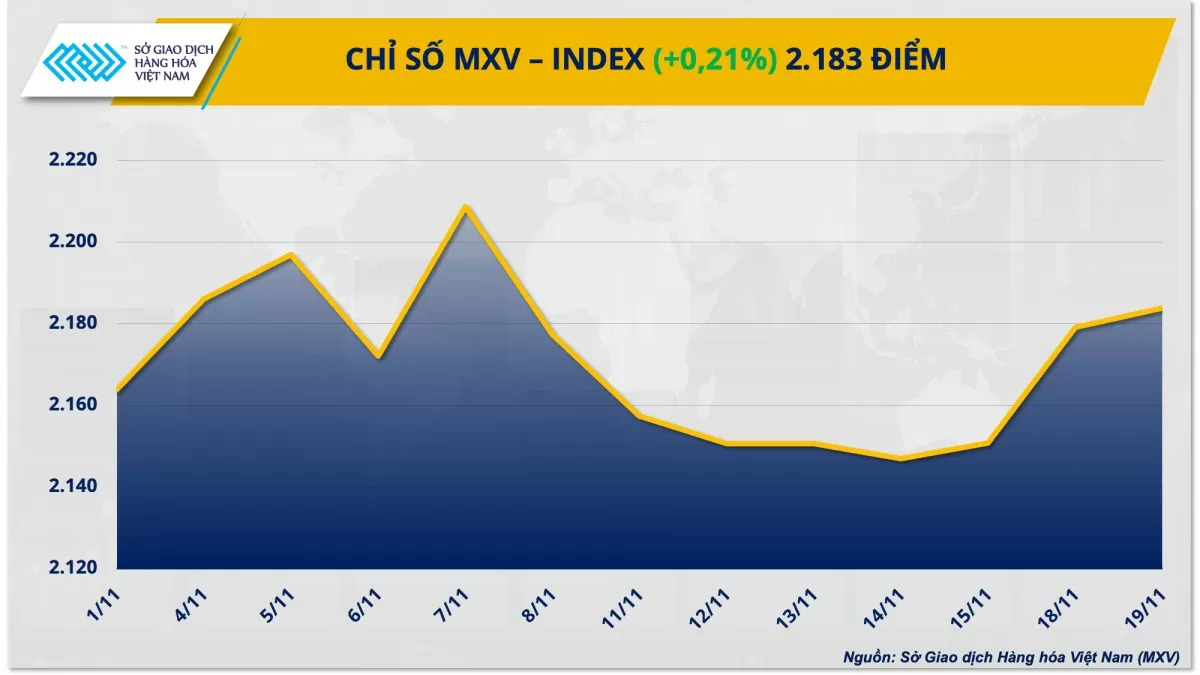

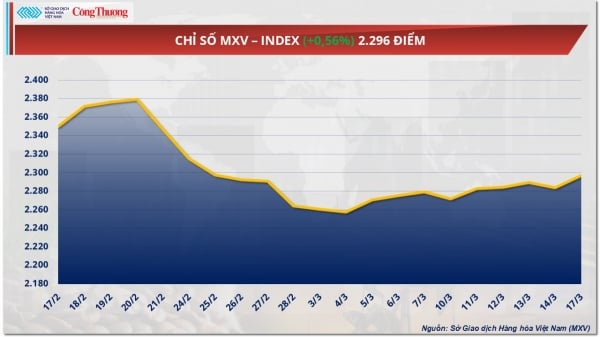

According to the Vietnam Commodity Exchange (MXV), buying power dominated the world raw material market in the trading session on November 19.

At the close, the MXV-Index increased by 0.21% to 2,183 points. Notably, the metal market saw prices of 8 out of 10 commodities increase simultaneously, including platinum, which increased for the fourth consecutive session, and silver recovered from its two-month low. In addition, all 5 energy commodities also recorded positive growth.

|

| MXV-Index |

Platinum prices rise for fourth consecutive session

At the end of yesterday's trading session, the metal price chart was dominated by green, however, most items recorded a rather limited increase, not exceeding 1%. For precious metals, silver prices continued to recover from a 2-month low when they increased slightly by 0.12% to over 31 USD/ounce. Platinum prices also increased by about 0.4% to over 978 USD/ounce, marking the fourth consecutive session of price increase.

|

| Metal price list |

In yesterday's trading session, precious metal prices continued to be supported as the USD's rally slowed down, helping the market gradually stabilize. The Dollar Index, a measure of the greenback's strength against six other major currencies, continued to weaken from a one-year high, closing at more than 106 points, marking the third consecutive session of decline.

In addition, concerns about escalating Russia-Ukraine tensions have also made precious metals, a safe-haven asset, more attractive, thereby supporting the prices of silver and platinum. Specifically, after months of pressure, the Biden administration announced over the weekend that Ukraine could use long-range missiles produced by Washington to carry out attacks targeting Russian territory.

Earlier in September, Russian President Vladimir Putin made clear Russia’s stance that if Western countries agreed to let Ukraine use long-range missiles to attack Russia, it would mean that the US and NATO countries would be directly involved in the Russia-Ukraine conflict. According to experts, this move could worsen US-Russia relations and increase tensions between Russia and Ukraine, which have shown no signs of cooling down.

In base metals, LME aluminium rose 1.42% to $2,644 a tonne, largely supported by concerns about disruptions to raw material supplies. Last week, Alcoa halted shipments of bauxite, an input for aluminium production, from Brazil’s Juruti Port due to a grounded vessel, adding to worries in a market already worried about disruptions to exports from Guinea, a major producer of the metal.

In a related development, BMI, an analysis unit of Fitch Solutions Group, recently forecast that aluminum prices are expected to remain high this year as strong demand outpaces supply. The analysis firm said it expects aluminum demand to grow by 3.2% to more than 70 million tons in 2024, lower than the expected supply growth of 1.9% to more than 70 million tons. Accordingly, BMI analysts raised their forecast for average aluminum prices in 2024 to $2,450 per ton, up from $2,400 per ton in their previous estimate.

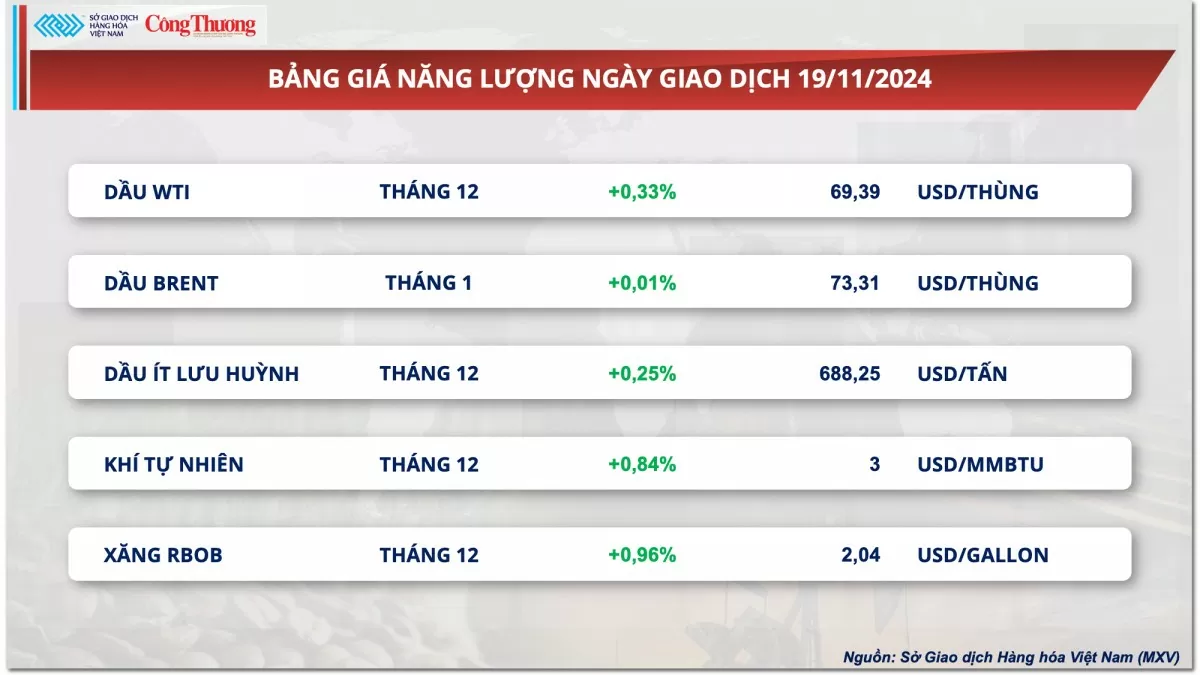

Crude oil market receives mixed news

According to MXV, in the context of the market receiving mixed news, crude oil prices fluctuated quite a bit in yesterday's trading session. However, prices remained green at the close as the market remained concerned about the situation in Ukraine.

|

| Energy price list |

WTI crude oil price recorded a slight increase of 0.33% to reach 69.4 USD/barrel, while Brent crude oil price closed at 73.3 USD/barrel, slightly up 0.01% compared to the reference.

Short-term supply shortages in several major oil producing regions were the main factor driving the bullish sentiment in oil prices yesterday. Norway's Equinor halted operations at the Johan Sverdrup oilfield, Western Europe's largest, due to a power outage. The outage occurred after smoke billowed from an onshore substation that supplies power to the Johan Sverdrup development project. The situation was quickly cleared, but led to a shutdown of the entire field. An Equinor spokesman said work was underway to fix the problem, but it was unclear when production would resume at the field.

In addition, Kazakhstan's Ministry of Energy said that production at the country's largest oil field, Tengiz, has decreased by 28-30% due to maintenance. Current production at the field is only about 61,000-63,000 tons/day. Maintenance is expected to end on November 23.

A drop in Russian oil exports also helped support crude prices. The country’s seaborne oil exports fell 740,000 barrels a day to 2.83 million barrels a day in the week ended Nov. 17, the lowest in four months, according to Bloomberg data.

On the other hand, the unexpected increase in US crude oil inventories has put pressure on and narrowed the price increase. The American Petroleum Institute reported that US crude oil inventories increased sharply by 4.75 million barrels in the week ending November 15, compared to a decrease of 0.77 million barrels a week ago and surpassing analysts' expectations of an increase of 0.8 million barrels.

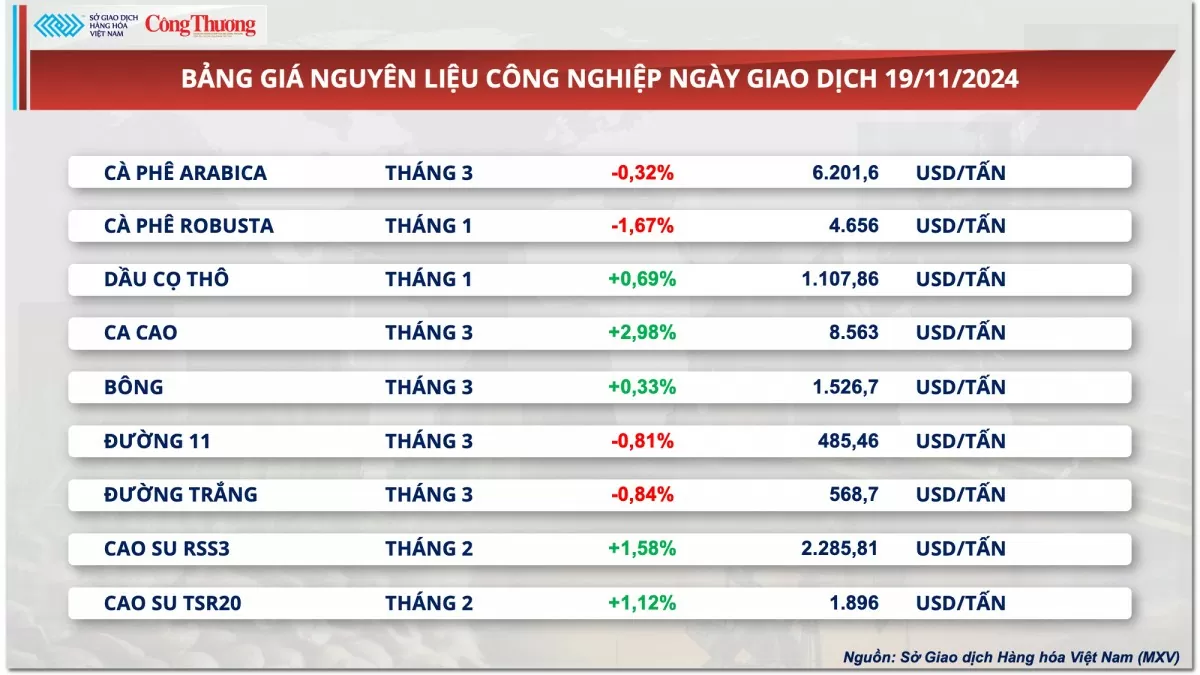

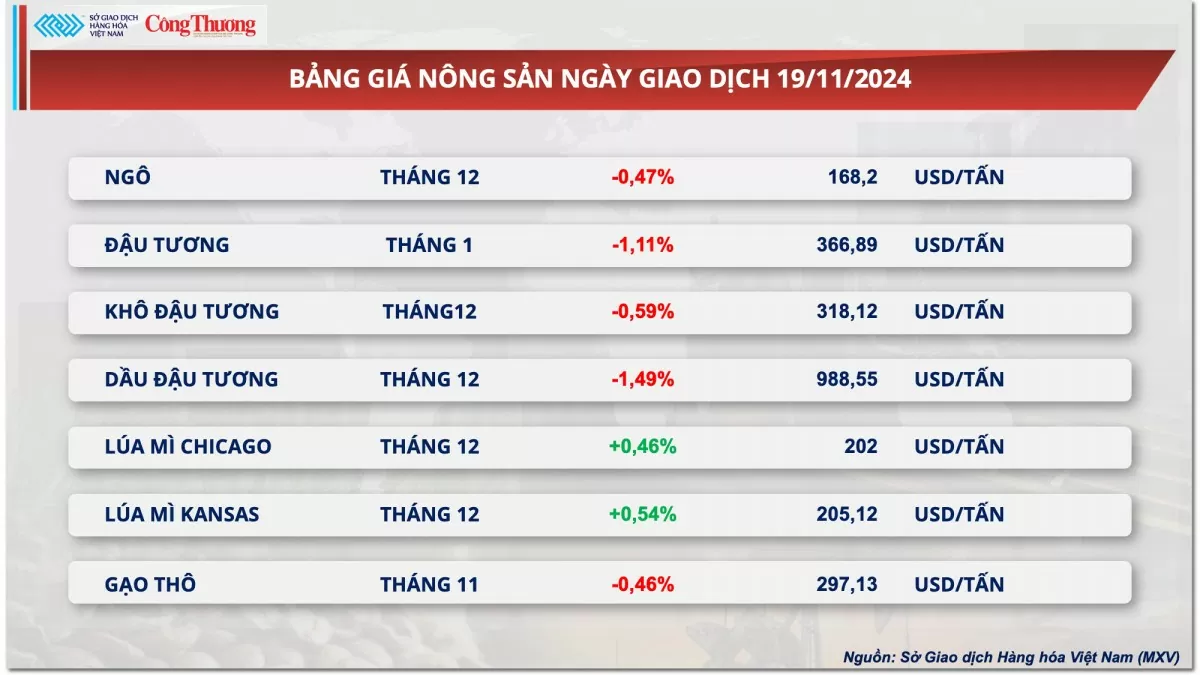

Prices of some other goods

|

| Industrial raw material price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2011-sac-xanh-bao-phu-thi-truong-kim-loai-va-nang-luong-359805.html

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)