Soybean and corn oil are two “rising stars”

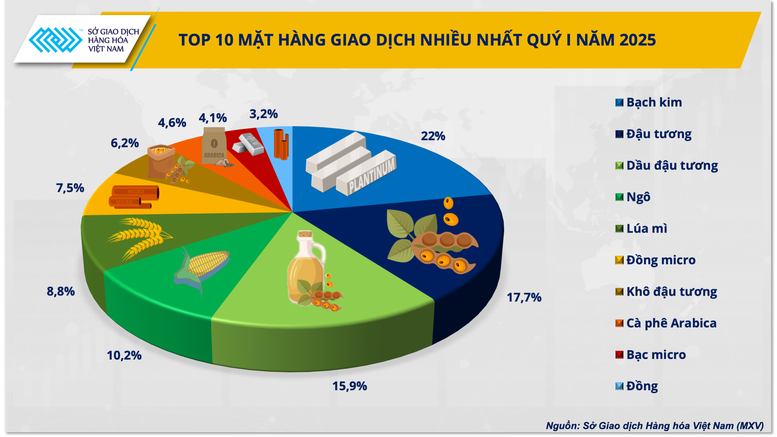

Since April 8, platinum has increased in price for 7 consecutive sessions and is currently attracting strong buying power from investors. According to MXV, in the first quarter of this year, platinum is still the most traded product in Vietnam, accounting for 22% of the trading volume on the entire Exchange.

According to Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV, in the first quarter of this year, cash flow poured into the precious metal group as investors sought safe havens due to the risk of a US economic recession and escalating US-China trade tensions. In addition, the market is facing the risk of a deficit for the third consecutive year. A report from the World Platinum Investment Council (WPIC) also estimated that the deficit in 2025 will reach 848,000 ounces, an increase of 309,000 ounces compared to the previous forecast. Global supply is expected to decrease by 4%, to about 7 million ounces, marking the second lowest level since 2013, mainly due to prolonged weakness from both recycling and mining activities.

Coming in second and third, closely following platinum, are soybeans and soybean oil, accounting for 17.7% and 15.9% respectively. Thus, soybean oil has become a “rising star” when it has overtaken wheat.

The big surprise is the appearance of corn in the fourth position with a weight of 10.2%, reflecting the change in investment trends. Other familiar items such as wheat, copper, soybean meal, Arabica coffee and silver still hold the leading positions in the rankings.

In the coming time, experts believe that raw material prices will fluctuate even more strongly. Therefore, it is likely that the order of the ranking of commodities traded in the world will change.

Recently, on April 15, US President Donald Trump requested government agencies to conduct an investigation into critical minerals imported into the US. This investigation will be the basis for the US government to impose new tariffs on imported minerals. This is also the legal basis that Mr. Trump used in his first term to impose a 25% tax on aluminum and steel imported into the US. A similar investigation into imported copper in February and an investigation into imported pharmaceuticals and chips in the near future also cited this law. According to the decree, market activities with all critical minerals, including cobalt, nickel and 17 rare earths - will be studied to consider imposing tariffs. Therefore, according to MXV, in the near future, metal products will become the focus of market transactions and items such as micro copper, micro silver or copper will probably account for a higher proportion in the top 10 most traded products.

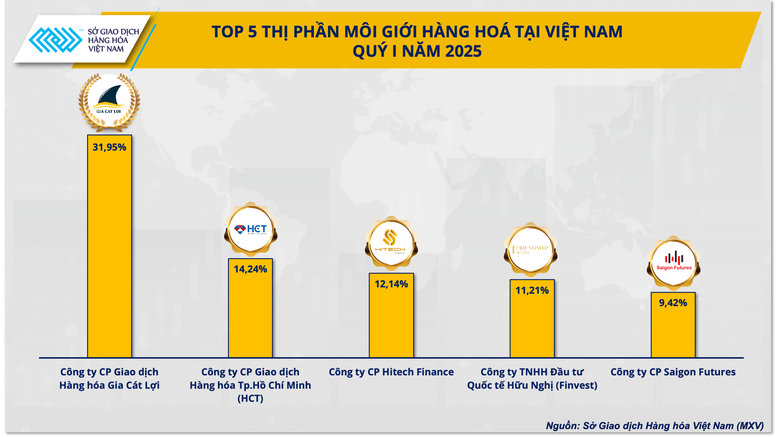

Gia Cat Loi continues to hold the leading position in the commodity brokerage race.

According to data from MXV, the market share rankings in the first quarter of this year did not have many changes in the top 5 commodity brokers. Gia Cat Loi Commodity Trading Joint Stock Company still maintained the leading position with a market share of 31.95%. This success comes from the strategy of developing a wide network with the largest system of offices and branches in the country, helping Gia Cat Loi firmly consolidate its number one position in the commodity brokerage market for many consecutive quarters.

In second place, Ho Chi Minh City Commodity Trading Joint Stock Company (HCT) recorded a market share of 14.24%, down sharply from 18.2% last year. This decline shows the increasing competitive pressure in the leading group, while also creating conditions for other businesses to narrow the gap.

Notably, Hitech Finance Joint Stock Company has made great strides in increasing its market share from 5.2% in 2024 to 12.14% in the first quarter of 2025 to rise to third place. This is the strongest growth rate in the top 5, demonstrating the effectiveness of its development strategy focusing on expanding its customer network, improving the quality of investment consulting and taking advantage of developments in the commodity market, especially in highly liquid commodities.

On the other hand, Friendship International Investment Company Limited (Finvest) still holds the fourth position despite its market share decreasing from 14.7% to 11.21%. Finally, Saigon Futures Joint Stock Company ranked fifth with 9.42%, down slightly from 10.1% last year.

Evaluating the rankings, Mr. Nguyen Ngoc Quynh said that there were not many changes in the top 5 commodity brokers in the first quarter. However, in the context of strong fluctuations in the world, the commodity market fluctuated significantly according to tariff and trade policies... the leading positions have affirmed the stability of "performance" in the market. In the past time, members have not only competed fairly but also accompanied MXV in building a professional and transparent trading environment through strict compliance with the regulations of the Department, contributing to enhancing the reputation and position of the Vietnamese commodity market on the regional financial map.

Source: https://baochinhphu.vn/khoi-luong-giao-dich-hang-hoa-tiep-tuc-tang-102250417144341546.htm

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the victory over fascism in Kazakhstan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/dff91c3c47f74a2da459e316831988ad)

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

Comment (0)