At the end of the trading week from March 10-17, Arabica coffee prices decreased by 1.87% to 8,316 USD/ton. Robusta coffee prices also decreased by 0.82% to 5,397 USD/ton.

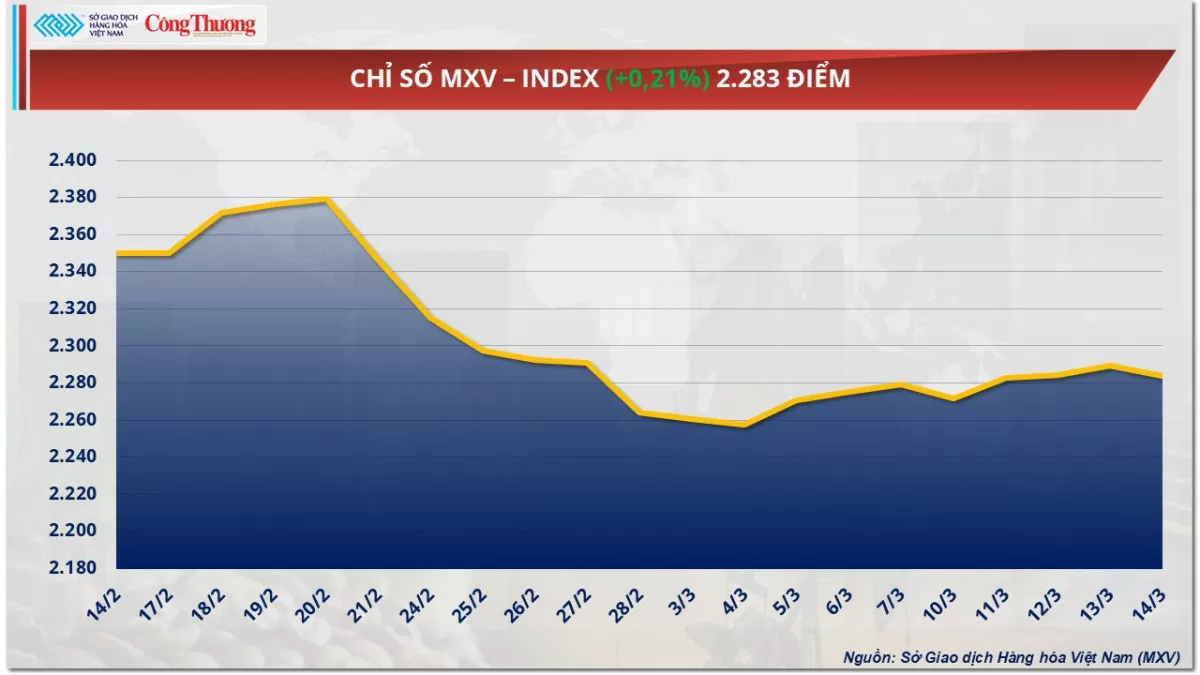

According to the Vietnam Commodity Exchange (MXV), cautious sentiment continued to prevail in the world raw material market in the past trading week. At the close, the MXV-Index increased slightly by 0.2% to 2,283 points. In the metal market, silver prices marked the second consecutive week of price increases, reaching a four-month high. Meanwhile, cocoa prices returned to the $7,867/ton mark - the lowest level in the past four months.

|

| MXV-Index |

Money is pouring into the metal market

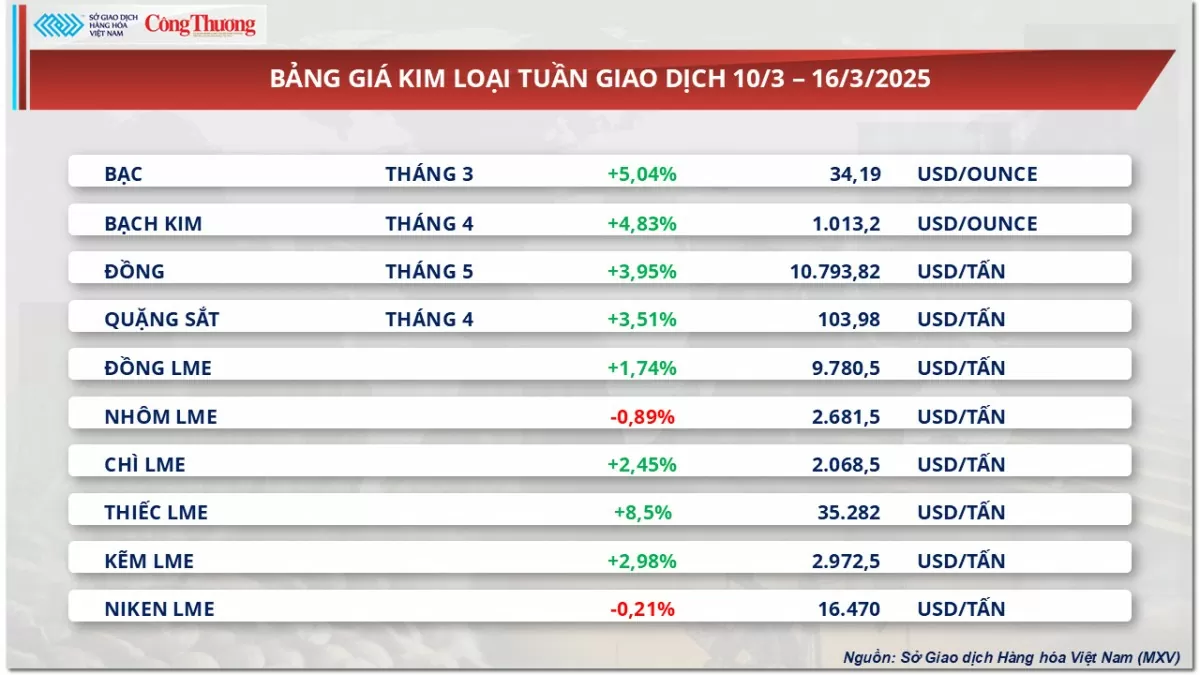

The past trading week witnessed an impressive rally in the metal group, with most commodities recording strong gains. Increased demand for shelter and optimistic expectations about the Chinese economy became the main driving force for the metal price increase.

|

| Metal price list |

Silver prices rose 5.04% to $34.19 an ounce at the end of the week, marking the second consecutive weekly increase and setting a four-month high. Platinum also recorded a strong increase of 4.83% to $1,013 an ounce, up 11% from the beginning of the year.

Money has been pouring into precious metals as fears of a US recession grow and trade tensions escalate. The Trump administration’s tariff hikes could raise production costs, pushing up prices and hurting consumer purchasing power. Manufacturers that rely on imported components are also facing greater cost pressures, increasing the risk of scaling back production and slowing economic growth.

The market is also closely watching US trade policy, as the possibility of reciprocal tariffs, copper tariffs and additional duties on European goods remains open.

In addition, the latest data on the US Producer Price Index (PPI) and Consumer Price Index (CPI) show that inflationary pressures are easing, opening up room for the US Federal Reserve (Fed) to cut interest rates. If the Fed lowers interest rates, the US dollar may weaken, making precious metals such as silver and platinum more attractive to investors.

Not only precious metals, the base metals group also had a good trading week. COMEX copper prices increased sharply by 3.95%, reaching $4.9/pound (equivalent to $10,793/ton) - the highest since late May 2024. Tin prices on the London Metal Exchange (LME) jumped 8.5% to $35,282/ton, while iron ore prices also recorded a 3.5% increase, reaching $103.9/ton.

The main driver behind the base metals rally was the announcement by the People’s Bank of China (PBOC) on March 13 that it would cut interest rates and reserve requirement ratios at appropriate times. This loose monetary policy helps maintain ample liquidity, creating positive sentiment for the commodity market.

Copper prices were also supported by the risk of supply shortages in the US, after the US Department of Commerce announced the possibility of imposing high tariffs on imported copper. This move is intended to encourage domestic production but could limit supply in the market, pushing copper prices up.

Meanwhile, iron ore prices continue to benefit from the prospect of rising demand in China. According to a survey by Mysteel, as of March 13, the average daily hot pig iron output at Chinese steel mills increased for the third consecutive week, reaching 2.31 million tonnes. With the peak construction season starting in March, iron ore demand is expected to continue to increase in the coming period.

Cocoa supply forecast to be in surplus after three years of deficit

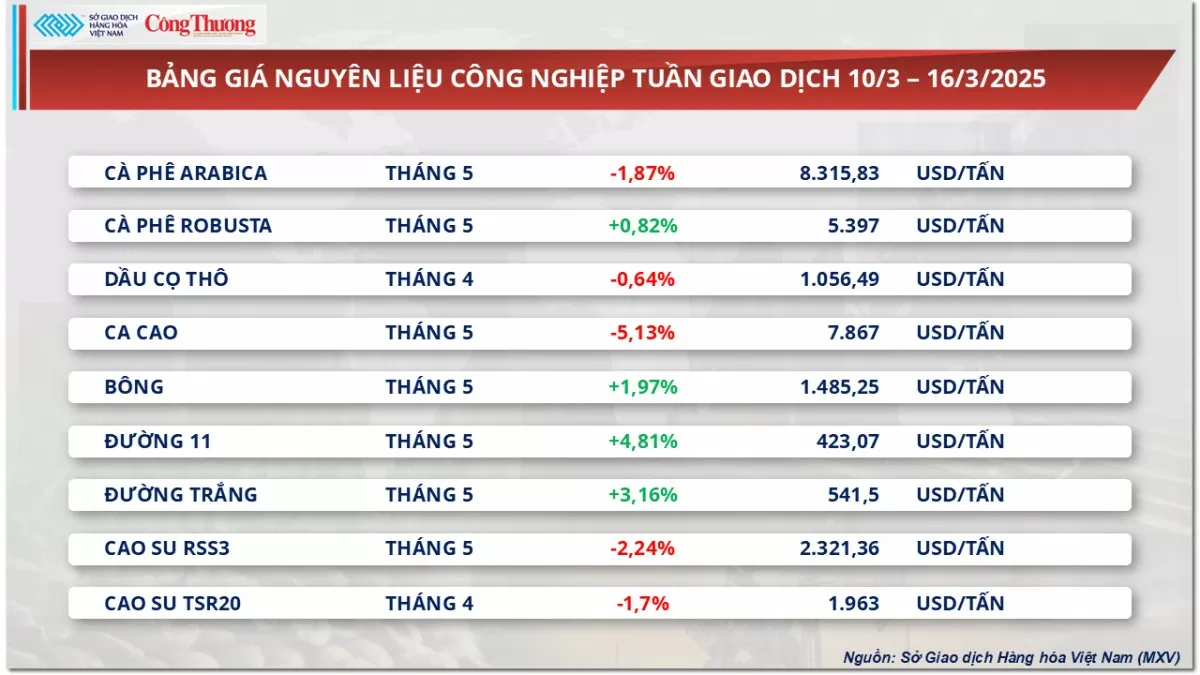

At the end of the trading week from March 10 to March 17, the industrial raw material market was in the red. Notably, the price of cocoa futures for May closed down 3.73% compared to the reference price, down to 7,867 USD/ton - the lowest level in 4 months. Overall, the price of this commodity decreased by 5.13% for the week.

|

| Industrial raw material price list |

In late February, the International Cocoa Organization (ICCO) forecast a global cocoa surplus of 142,000 tonnes in the 2024-25 season, marking the first surplus after three years of deficits due to strong output from West Africa. ICCO also forecasts world cocoa production to increase by 7.8% compared to the previous season, reaching 4.84 million tonnes. In addition, on March 13, cocoa inventories monitored by ICE at US ports recovered to their highest level in more than three months. In addition, positive news about export growth in leading cocoa producing countries such as Ivory Coast and Nigeria also caused cocoa prices to fall sharply.

Arabica coffee prices closed the trading session on March 14 down 1.87% to $8,316/ton, the lowest level in two weeks. At the same time, Robusta coffee prices also decreased 0.82% to $5,397/ton. However, compared to the reference price last week, Robusta coffee prices increased 0.82% while Arabica coffee prices decreased 1.87%.

Arabica coffee prices are under pressure due to favorable weather forecasts in Brazil. According to Somar Meteorologia, widespread rains are expected in the Minas Gerais region, the country’s largest Arabica growing region, next week, easing drought concerns. Meanwhile, certified Arabica stocks on the New York Stock Exchange increased by 8,652 bags last week to 802,277 bags. Robusta prices, meanwhile, were supported by a drop in ICE-monitored stocks to a one-and-a-half week low of 4,288 lots.

Another factor that could impact the coffee market in the coming time is the US tariff policy. According to the latest information, coffee imported from Mexico may be subject to an additional 25% tax due to this item being excluded from the North American Free Trade Agreement (USMCA).

After two consecutive weeks of decline, sugar prices rose sharply by 4.63% in the trading week amid concerns about tight supplies. Recently, the International Sugar Organization (ISO) raised its forecast for a global sugar deficit in the 2024-2025 crop year to 4.88 million tonnes, nearly double the forecast of 2.51 million tonnes in November 2023. This shows that the market is facing the risk of a supply shortage, in contrast to the surplus of 1.31 million tonnes in the 2023-2024 crop year.

In Brazil, the crop supply agency CONAB also cut its 2024-25 sugar production forecast from 46 million tonnes to 44 million tonnes due to drought and unusually high temperatures. India also saw a decline, with the country’s Sugar and Bioenergy Producers Association cutting its production forecast to 26.4 million tonnes, down from 27.27 million tonnes forecast in January.

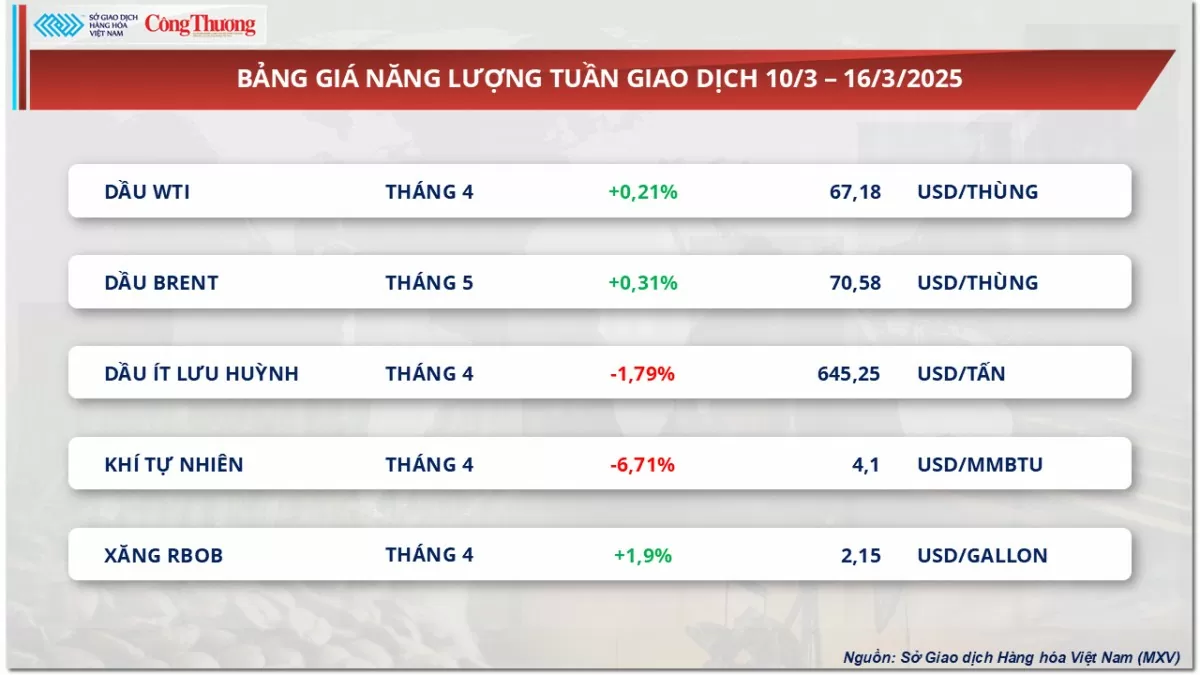

Prices of some other goods

|

| Energy price list |

|

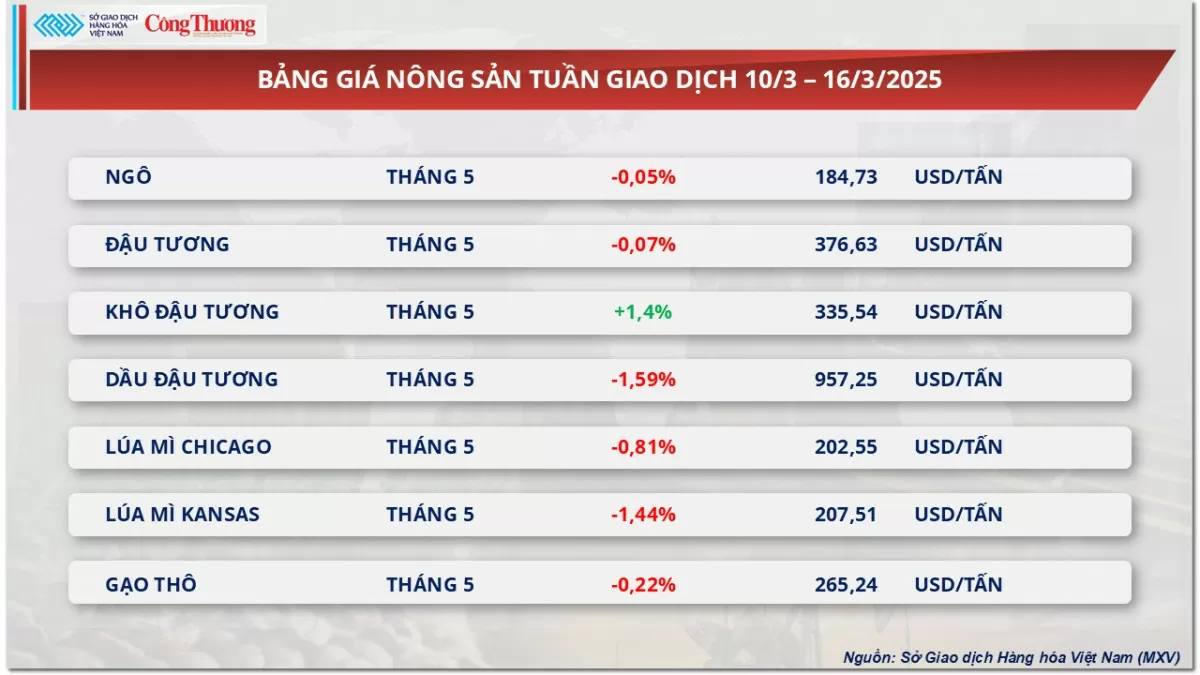

| Agricultural product price list |

Source: https://congthuong.vn/gia-ca-phe-arabica-giam-xuong-muc-8316-usdtan-378584.html

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)