Continuing the recovery momentum, in the morning session the market rose nearly 16 points to 1,055 points, in which most of the pillar stocks were increasing strongly, notably HPG, MSN, FPT, SSI, TCB, GVR.

In the bluechip group, only VNM, VIC, VCB, VJC and BCM decreased slightly from 0.14% - 1.7% and HDB stood at reference, the rest all ended the session in green. Another positive point is that liquidity is showing signs of improvement. The total matched value of the two exchanges reached 7,373 billion VND, of which HoSE matched 6,289 billion VND, up 20% compared to yesterday morning.

At the end of the morning session on November 2, VN-Index increased by 15.74 points, equivalent to 1.51% to 1,055.4 points. The entire floor had 422 stocks increasing and only 68 stocks decreasing. HNX-Index increased by 5.88 points, equivalent to 2.81% to 215.54 points. UPCoM-Index increased by 1.69 points, equivalent to 1.95% to 83.29 points.

VN-Index developments on November 2 (Source: Fire Ant).

In the afternoon session, the recovery continued as demand was continuously pushed in. Today's increase regained all the points lost in the first two sessions of the week.

At the end of the trading session on November 2, VN-Index increased by 35.81 points, equivalent to 3.44% to 1,075.47 points. The entire floor had 516 stocks increasing, 81 stocks increasing to the ceiling and 32 stocks decreasing.

HNX-Index increased by 8.32 points, equivalent to 3.97% to 217.97 points. The entire floor had 176 stocks increasing, 31 stocks hitting the ceiling and 39 stocks decreasing. UPCoM-Index increased by 2.27 points to 83.97 points. In particular, the VN30 basket recorded all 30 stocks increasing in price and 2 stocks hitting the ceiling, namely GVR and SAB.

Cash flow in today's session focused mainly on financial and real estate groups, with SSI leading in liquidity, followed by MWG, HPG, DIG, VIX, VND, STB, DXG, NVL, and VHM.

Although MWG recovered after 2 sessions of floor price declines when it increased 5.4% to 37,000 VND/share, foreign investors also fled fiercely, net selling more than 287 billion VND in today's session.

The copper stock group continued to have a positive growth momentum with 12/36 codes hitting the ceiling price, namely VIX, VND, VCI, ORS, FTS, CTS, AGR, VDS, HBS, TVS, CSI, WSS. In addition, the remaining 23/35 codes also increased positively by up to 12%, with no code closing below the reference price.

The chemical group also contributed greatly to the increase with GVR, RDP, DPM, TSC, NHH hitting the ceiling. Many stocks in the raw materials, services, export, and transportation groups also hit the ceiling price such as HSG, IDI, HAH, DPM, ANV, KSB, CMX, NHH, TSC, GIL...

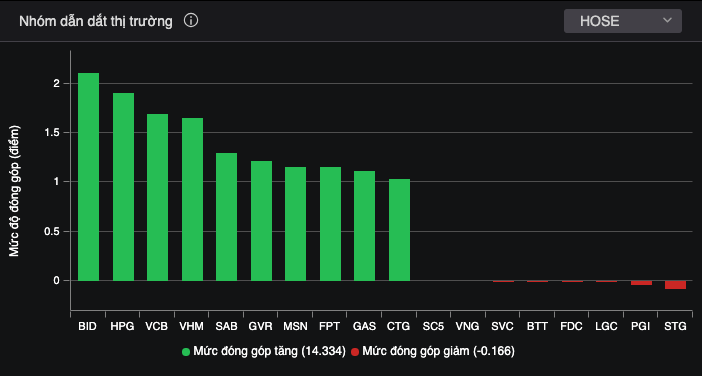

Stocks that move the market.

The total order matching value in the session reached VND23,302 billion, up 10% compared to the previous session, of which the order matching value on HoSE alone reached VND14,637 billion, up 12%. In the VN30 group, liquidity reached VND5,817.8 billion.

Foreign investors continued to net sell with a value of 87 billion VND today.

Among them, the codes that were pushed to sell strongly were MWG 287 billion VND, VHM 103.8 billion VND, VRE 59.4 billion VND, HDB 44.57 billion VND, FUEVFVND 23.3 billion VND,...

On the contrary, the codes that were bought strongly were mainly SHS 127.8 billion VND, HPG 74.8 billion VND, TCB 43.5 billion VND, PDR 37.4 billion VND, DGC 33.16 billion VND...

Source

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)