Liquidity exploded, purple remained stable until the end of the day

Right from the first minutes of the session, SHB's chart increased and quickly reached the ceiling price. With a liquidity of over VND 1,993 billion, accounting for over 9% of the total transaction value of the entire HoSE floor, this code became the center of cash flow. The matched volume was over 156.3 million units, 7 times higher than the average of the past year.

According to Mr. Han Huu Hau, VPS Securities Analyst, the "white sell side" phenomenon appearing at SHB at the end of the session reflects strong speculative demand in the context of positive supporting information from businesses. "SHB's plan to increase credit growth by 16%, pre-tax profit of VND14,500 billion and control bad debt below 2% has helped investors have high expectations for the new growth cycle. This is also one of the rare bank codes that maintained purple throughout today's session."

SHB is currently accelerating its expansion plan with total assets expected to exceed VND832,000 billion this year. The bank also aims to increase its charter capital to over VND45,900 billion to strengthen its financial foundation, meet Basel II standards, and move towards Basel III. These targets are considered ambitious but feasible in the context of SHB continuously expanding its network, digitizing services, and restructuring its loan portfolio.

|

| SHB shares have made big waves |

Despite the general market witnessing strong fluctuations in large-cap stocks, especially VIC and VHM, which were sold off heavily in the afternoon session, SHB still maintained its maximum growth momentum, becoming the code that provided the most support to the main index. Specifically, SHB contributed 0.85 points to the overall increase of 1.87 points (+0.15%) of VN-Index.

Mr. Nguyen Minh Duc, Director of Market Strategy at Alpha Capital Securities Company, commented: "In the context of VIC hitting the floor and dragging the index down by nearly 5 points, the fact that SHB and mid-range banks such as VPB, MBB, VIB... are able to maintain green is very positive. It shows that cash flow is not withdrawing from the market but is circulating between specific industry groups and stocks."

During the whole session, HoSE recorded a trading value of over VND21,600 billion, slightly down from the previous session but still maintained at a high level. Notably, the market breadth was clearly positive with 321 stocks increasing/136 stocks decreasing. The proportion of stocks increasing over 1% was also very high, with over 150 stocks recording an increase of over 2%, concentrated in the securities, real estate, logistics and banking groups.

VN30-Index closed up slightly by 0.25% but most bluechips weakened significantly in ATC. 25/30 VN30 codes were adjusted at least 1% from the peak of the day. SHB was the only code that maintained its ceiling increase until the end of the session.

This development shows that market sentiment is still quite stable despite the general index being under pressure from the "pillar squeeze". According to analysts from Mirae Asset, the index is no longer an accurate measure of market health, but rather a selection of opportunities among stocks.

Derivatives suddenly fluctuate strongly, need to monitor basis and large positions

The derivatives market today also recorded strong fluctuations in the ATC session, when nearly 9,800 F1 contracts were closed, causing the basis to widen by -16.2 points. However, in the previous 15 minutes, the basis remained stable despite the decline of VIC and VHM, indicating that there may have been transactions betting on the recovery of the underlying market in the following sessions.

The short-term strategy suggested by experts is to prioritize buying stocks with good price strength, less affected by the index. "Strong fluctuations are opportunities to accumulate good fundamental stocks at reasonable prices. SHB is a typical example of a stock with clear internal support and not much dependent on traditional pillars," Mr. Duc shared.

In addition to SHB, the market also recorded a good recovery from stocks such as VIX, VND, SSI - which benefited from increased liquidity. Meanwhile, the real estate group including KBC, NVL, DXG... traded actively and recorded strong increases. This shows that cash flow continues to look for opportunities in industry groups with supporting information or attractive valuations.

Source: https://thoibaonganhang.vn/dong-tien-do-manh-vao-shb-keo-vn-index-giu-sac-xanh-163031.html

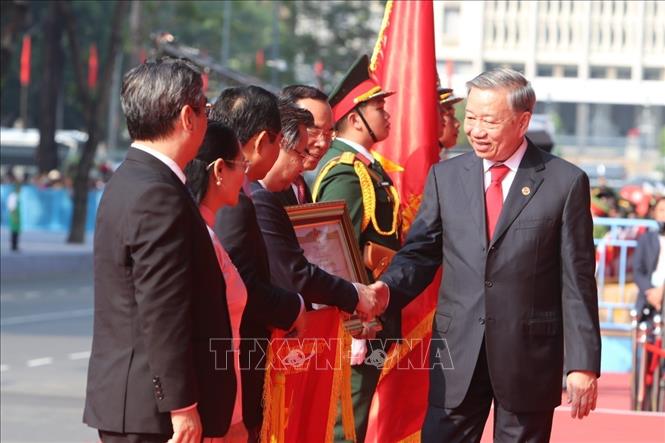

![[Photo] Mass parade to celebrate 50 years of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/825e459ee2f54d85b3a134cdcda46e0d)

![[Photo] Panorama of the parade celebrating the 50th anniversary of the Liberation of the South and National Reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/affbd72e439d4362962babbf222ffb8b)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] "King Cobra" Su-30MK2 completed its glorious mission on April 30](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/5724b5c99b7a40db81aa7c418523defe)

Comment (0)