Mr. Nguyen Duy Hung, Chairman of SSI Board of Directors - Photo: SSI

SSI Chairman: "That's personal feeling"

The above hot question was raised at the annual general meeting of shareholders of SSI Company held this afternoon, April 18. When Mr. Nguyen Duy Hung, Chairman of the Board of Directors of SSI, read this question, the shareholders below exclaimed.

"I am not self-employed, what I post on my personal Facebook is my personal feelings. But we certainly never say one thing and do another," Mr. Hung said.

On April 3, after US President Donald Trump announced reciprocal tariffs on 180 economies , of which Vietnam was subject to a 46% tax rate, the stock market immediately reacted negatively, with stocks being sold off widely.

Vietnam's stock market had its "fierce" trading session in history on April 3 when 517 stocks fell, of which 263 hit the floor, causing the VN-Index to lose 88 points.

Closing the session on April 4, VN-Index decreased by 19.17 points to 1,210.67 points. However, the decline has not stopped. After the holiday, on April 8, VN-Index decreased by 77.88 points, equivalent to 6.43% to 1,132.79 points.

Opening the session on April 9, stocks fell another 50 points, but thanks to bottom-fishing demand, the VN-Index ended the session down only 38.49 points, to 1,094.3 points.

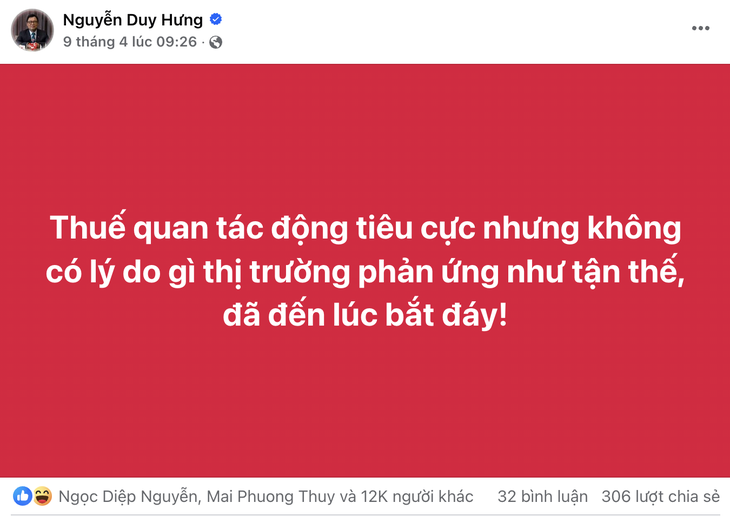

Status line of SSI Chairman Nguyen Duy Hung posted on the morning of April 9 - Screenshot

In this April 9 session, SSI Chairman Nguyen Duy Hung posted a status on his personal page when the market had just opened for less than 30 minutes: "Tariffs have a negative impact but there is no reason for the market to react like it's the end of the world, it's time to catch the bottom."

After Mr. Hung posted this status, many investors reacted because they did not believe the market would stop falling.

However, on the night of April 9, the US announced a 90-day suspension of reciprocal tariffs on more than 75 countries. On April 10, the stock market reversed 180 degrees with hundreds of stocks "soaring". Purple covered the market but "white on the sell side", making many investors regret not being able to catch the bottom in time.

After increasing by 74.04 points on April 10, at the close of April 11, VN-Index increased by another 54.12 points, to 1,222.46 points. On April 12, green continued to spread, VN-Index increased by more than 18 points.

At the close of today's session, April 18, VN-Index closed at 1,219.12 points. Compared to the bottom on April 9, VN-Index has increased by more than 124.8 points.

How to respond to trade war?

Responding to shareholders about how SSI will respond when a trade war occurs, SSI chief economist Pham Luu Hung said SSI's view is that there is currently a trade war.

"People will understand that countries devalue their currencies to gain advantages in trade and boost exports. But this is an issue that needs to be reconsidered. In Vietnam, the main growth drivers come from domestic sources such as consumption and public investment," Mr. Pham Luu Hung replied.

Mr. Nguyen Duy Hung added that Vietnam, with a population of 100 million, consumes without debt and buys with cash, so if a currency war occurs, it is expected that it will not be affected much.

He also said SSI did not change its 2025 business plan.

"The business plan was built from November 2024 and started giving numbers in December 2024, before the US tariff event. Looking back at the market, the negative is that foreign investors withdrew a lot, but the Government also had very strong support moves.

With the commitments from the Government, there is no reason for SSI to change its 2025 plan. With the first quarter figures, we are also confident in completing the target," Mr. Hung emphasized.

Source: https://tuoitre.vn/chu-tich-ssi-len-tieng-khi-co-dong-cam-than-dot-roi-ho-bat-day-qua-chuan-20250418211843141.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)