The yuan is increasingly popular globally but it is difficult to break through and threaten the USD when it still relies on bilateral transactions involving China.

Data from the People's Bank of China (PBOC), the central bank, showed that the outstanding balance of all domestic currency swap transactions was 115.08 billion yuan ($15.78 billion) at the end of June, about 6 billion yuan higher than the end of March. The second quarter of this year marked the fourth consecutive quarter of such currency swap outstanding balance increasing.

A currency swap is an agreement between two central banks to exchange their currencies with an interest rate. This allows one country's central bank to obtain foreign currency liquidity from the other central bank, often to finance bilateral trade and direct investment.

The PBOC has signed currency swap agreements with the central banks of about 40 countries and regions, more than half of which are participants in the Belt and Road Initiative. For example, the China-Argentina currency swap agreement allows the Central Bank of the Argentine Republic (BCRA) to receive RMB from the PBOC in exchange for an equivalent amount of Argentine pesos.

China and Argentina first signed a currency swap agreement worth 70 billion yuan ($10.3 billion) in 2009 and expanded it to 130 billion yuan in 2018. Thanks to this channel, Argentina has paid $1.7 billion of its recently due $2.7 billion debt to the International Monetary Fund (IMF) in yuan.

In April, the Argentine government announced it would start paying for Chinese imports in yuan to preserve its dwindling dollar reserves, further boosting the PBOC's efforts to increase global use of the "red dollar."

Yu Yongding, an economist at the Chinese Academy of Social Sciences, said the currency swap arrangement has potential benefits because it could further internationalize the yuan. If Argentine companies borrow in yuan and use it to buy products from China, it would boost the currency’s use abroad.

Beyond the currency swap route, the yuan has made further inroads as a global currency this year as countries like Russia and Brazil have increased their use of the currency amid a shortage of US dollars.

China is also stepping up efforts to build financial infrastructure to support cross-border renminbi payments, such as establishing renminbi clearing banks in overseas markets. It is also expanding its Cross-Border Interbank Payments System (CIPS).

In February, the PBOC and Brazil signed an agreement to establish yuan clearing, authorizing the Brazilian branch of the Industrial and Commercial Bank of China to implement it. The following month, a Brazilian bank controlled by the Bank of Communications of China became the first South American bank to directly participate in CIPS.

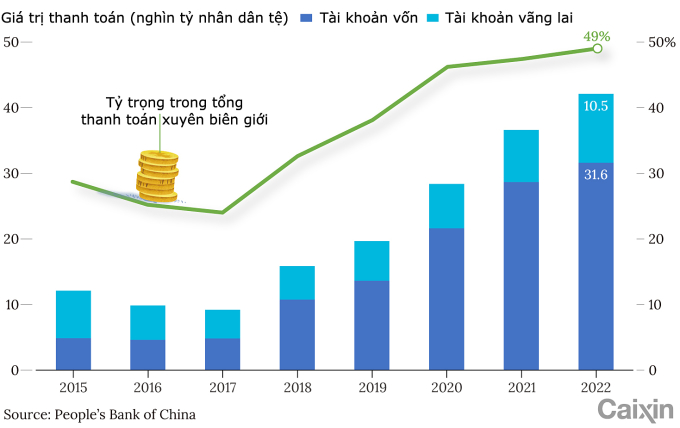

Peng Wensheng, chief economist at China International Capital, said a multipolar international monetary system is emerging as the greenback loses some of its absolute advantage. Last year, 49 percent, or 42.1 trillion yuan ($6.1 trillion), of China’s cross-border payments were made in yuan. Of this, 10.5 trillion yuan was made through the current account, mainly for goods and services.

Cross-border payments in renminbi over the years. Graphic: Caixin

With growing purchasing power and large-scale imports of goods, the world's second-largest economy has been actively promoting yuan-based commodity pricing in recent years.

Shao Yu, chief economist at Orient Securities, said the logic was quite similar to “petrodollars,” the US dollar’s status as the currency of choice in international oil trading since the 1970s. “The yuan aims to be pegged to a basket of commodities, not just oil,” he said.

In 2021, China recorded 405.5 billion yuan in cross-border trade settled in yuan for major commodities such as crude oil, iron ore, copper and soybeans, up 42.8% year-on-year. In March, China National Petroleum Corporation paid for its first yuan-denominated gas purchase from TotalEnergies (France).

Meanwhile, the further opening of China’s capital markets is boosting the global popularity of the yuan in investment. Last year, China’s cross-border yuan payments amounted to 31.6 trillion yuan, up 10% from 2021.

The currency is also gaining traction in Russia. Yuan-denominated bonds took off in Moscow last year, with several Russian giants such as aluminum producer United Rusal International and gold producer Polyus issuing large-scale yuan bonds to attract investors.

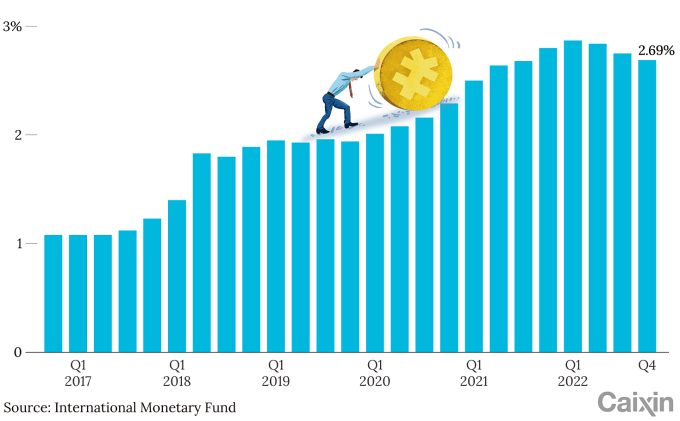

Share of foreign exchange reserves in yuan. Graphic: Caixin

According to the International Monetary Fund (IMF), the yuan's share of global currency reserves ranks fifth after the US dollar, the euro, the Japanese yen and the British pound. By the end of 2022, its share will reach 2.69%, up from just over 1% in 2016.

As central banks, especially those of developing countries including oil producers in the Middle East, look to diversify their foreign currency reserves, the yuan is a “relatively high-quality and stable option,” as there are not many non-Western currencies to choose from, according to a major Chinese bank branch in Russia.

CIPS had 79 direct participants as of the end of March, up from 75 at the end of 2021. Many of them are overseas branches of large Chinese companies. The number of indirect participants rose from 1,184 to 1,348 over the same period, with about 75% based in Asia.

But the road to internationalizing the yuan is not without its challenges. CIPS is still far behind SWIFT, which has more than 11,000 connected institutions. Industry insiders say China’s tight capital controls have long hampered efforts to internationalize the yuan, making it difficult to erode the dollar’s dominance. The European chairman of a major Chinese bank said the dollar’s biggest competitors are the euro and digital currencies, not the yuan.

“In terms of foreign exchange reserves, diversification away from the US dollar does not mean diversifying into the renminbi but towards the Korean won, the Singapore dollar, the Swedish krona, the Norwegian krone and other non-traditional reserve currencies,” said Eichengreen, a professor of economics and political science at the University of California, Berkeley.

In addition, efforts by Chinese banks to establish a yuan clearing system through overseas branches could encourage small and medium-sized trading companies to use the yuan more. However, this would do little to help the red currency gain favor with large companies given the unrivaled dominance of the US dollar in global trade, according to Alessandro Golombiewski Teixeira, an economic adviser to former Brazilian President Dilma Vana Rousseff.

The renminbi's internationalization index stood at 2.86 in the first quarter of 2022, up from 2.8 at the end of 2021, but still far behind the US dollar's 58.13, the euro's 21.56, the pound's 8.87 and the Japanese yen's 4.96.

The yuan is still a long way from becoming a major global currency, according to scholars. It may be gaining momentum, but it is still in its early stages. Zhang Liqing, director of the Center for International Finance Research at the Central University of Finance and Economics, said it would be difficult to make a breakthrough in internationalizing the yuan based on trade between China and other countries.

The internationalization of the currency will not move to the next level until it is widely used as a third-party currency in global trade, Zhang said, when entities from two countries other than China use the yuan to settle transactions, just like the US dollar.

There is no shortcut for any currency to become a global currency in the long term. Success must come from a foundation of open capital markets; stable, well-functioning financial markets; and a strong legal system, according to an expert at the Bank for International Settlements (BIS).

Phien An ( according to Caixin )

Source link

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)