Domestic gold price today April 11, 2025

At the time of survey at 4:30 p.m. on April 11, 2025, domestic gold prices maintained an upward trend despite decreasing by more than 1 million VND compared to the morning. Specifically:

DOJI Group listed the price of SJC gold bars at 102.2-105.2 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 102.2-105.2 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 102.5-104.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.8 million VND/tael for both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 102.2-105.2 million VND/tael (buying - selling), an increase of 1.6 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 102-105.2 million VND/tael (buy - sell), gold price increased by 2 million VND/tael in buying direction - increased by 1.6 million VND/tael in selling direction compared to yesterday.

As of 4:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 100.2-103.8 million VND/tael (buy - sell); unchanged in the buying direction - increased 600 thousand VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 100.9-104.5 million VND/tael (buy - sell); increased 200 thousand VND/tael for buying - increased 800 thousand VND/tael for selling.

The latest gold price list today, April 11, 2025 is as follows:

| Gold price today | April 11, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 102.2 | 105.2 | +1600 | +1600 |

| DOJI Group | 102.2 | 105.2 | +1600 | +1600 |

| Red Eyelashes | 102.5 | 104.5 | +1800 | +1800 |

| PNJ | 102.2 | 105.2 | +1600 | +1600 |

| Vietinbank Gold | 105.2 | +1600 | ||

| Bao Tin Minh Chau | 102.2 | 105.2 | +1600 | +1600 |

| Phu Quy | 102 | 105.2 | +2000 | +1600 |

| 1. DOJI - Updated: April 11, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 102,200 ▲1600K | 105,200 ▲1600K |

| AVPL/SJC HCM | 102,200 ▲1600K | 105,200 ▲1600K |

| AVPL/SJC DN | 102,200 ▲1600K | 105,200 ▲1600K |

| Raw material 9999 - HN | 100,000 | 102,900 ▲600K |

| Raw material 999 - HN | 99,090 | 102,800 ▲600K |

| 2. PNJ - Updated: April 11, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| HCMC - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Hanoi - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Hanoi - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Da Nang - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Da Nang - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Western Region - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Western Region - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - Southeast | PNJ | 100,800 ▲900K |

| Jewelry gold price - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 100,800 ▲900K |

| Jewelry gold price - Kim Bao Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Jewelry gold 999.9 | 100,800 ▲900K | 103,300 ▲900K |

| Jewelry gold price - Jewelry gold 999 | 100,700 ▲900K | 103,200 ▲900K |

| Jewelry gold price - Jewelry gold 9920 | 100,070 ▲890K | 102,570 ▲890K |

| Jewelry gold price - Jewelry gold 99 | 99,870 ▲890K | 102,370 ▲890K |

| Jewelry gold price - 750 gold (18K) | 75,130 ▲680K | 77,630 ▲680K |

| Jewelry gold price - 585 gold (14K) | 58,080 ▲530K | 60,580 ▲530K |

| Jewelry gold price - 416 gold (10K) | 40,620 ▲370K | 43,120 ▲370K |

| Jewelry gold price - 916 gold (22K) | 92,220 ▲820K | 94,720 ▲820K |

| Jewelry gold price - 610 gold (14.6K) | 60,660 ▲550K | 63,160 ▲550K |

| Jewelry gold price - 650 gold (15.6K) | 64,800 ▲590K | 67,300 ▲590K |

| Jewelry gold price - 680 gold (16.3K) | 67,890 ▲610K | 70,390 ▲610K |

| Jewelry gold price - 375 gold (9K) | 36,390 ▲340K | 38,890 ▲340K |

| Jewelry gold price - 333 gold (8K) | 31,740 ▲300K | 34,240 ▲300K |

| 3. SJC - Updated: 11/4/2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 102,200 ▲1600K | 105,200 ▲1600K |

| SJC gold 5 chi | 102,200 ▲1600K | 105,220 ▲1600K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 102,200 ▲1600K | 105,230 ▲1600K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,100 ▲1300K | 104,400 ▲1600K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,100 ▲1300K | 104,500 ▲1600K |

| Jewelry 99.99% | 101,100 ▲1300K | 103,900 ▲1400K |

| Jewelry 99% | 99,071 ▲586K | 102,871 ▲1368K |

| Jewelry 68% | 67,009 ▲152K | 70,809 ▲952K |

| Jewelry 41.7% | 39,680 ▼216K | 43,480 ▲583K |

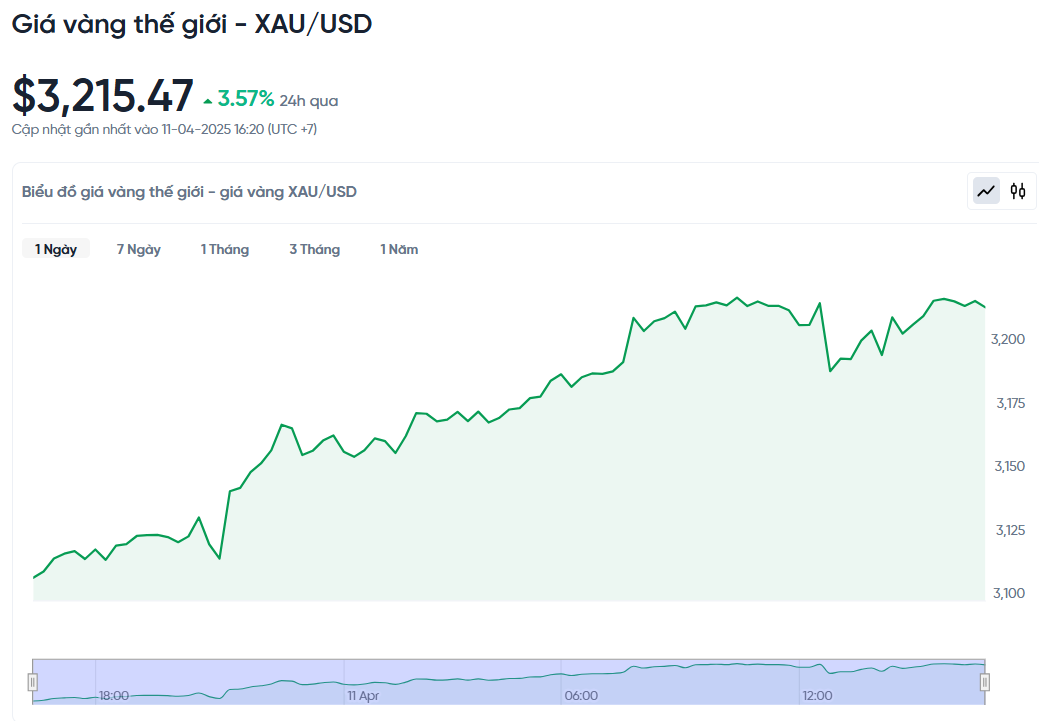

World gold price today April 11, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,215.47 USD/ounce. Today's gold price increased by 111 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (25,880 VND/USD), the world gold price is about 101.38 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.82 million VND/tael higher than the international gold price.

The world gold price has risen above the important threshold of 3,200 USD/ounce for the first time. The main reason is the weakening USD and economic concerns due to the escalating trade war. It reached a record high of 3,219.84 USD in the trading session. This week alone, the gold price has increased by more than 5%. Meanwhile, the price of gold futures in the US also increased by nearly 2%, to 3,233.8 USD.

According to Alexander Zumpfe, precious metals trader at Heraeus Metals (Germany), gold is benefiting from many factors: the risk of recession is increasing, bond yields are rising sharply and the US dollar continues to depreciate. All of these make gold a tool to hedge against risks and protect against inflation.

US President Donald Trump abruptly suspended tariffs on several countries just hours after they were due to take effect. However, he increased tariffs on Chinese imports in retaliation for similar moves by Beijing. But the decision did little to ease business concerns about the negative impact of the trade war and the US administration’s inconsistent enforcement.

The dollar index fell to a decade low, making gold, which is priced in the greenback, cheaper for foreign investors. Gold prices have been on a tear since last year, hitting new records and rising nearly 21% so far this year, driven by economic uncertainty, strong demand from central banks and flows into gold exchange-traded funds.

"We believe that gold prices still have room to grow. In an optimistic scenario, the target could reach $3,400 - $3,500/ounce in the coming months," said Giovanni Staunovo, an analyst at UBS.

Data released Thursday showed U.S. consumer prices unexpectedly fell in March. Markets are awaiting producer price index (PPI) data for further clues on the Federal Reserve's monetary policy. Many investors now expect the Fed to start cutting interest rates in June and could cut them by a total of 1 percentage point by the end of 2025.

Besides gold, silver prices rose slightly by 0.4% to $31.31 an ounce, while platinum rose by 0.7% to $944.35. Palladium also rose sharply by 1.9% to $925.43.

Gold Price Forecast

More and more traders believe the US Federal Reserve will cut interest rates in May, with the probability reaching 55%, according to the FedWatch tracker.

If this happens, it would create favorable conditions for gold prices to rise further, as low interest rates typically make the precious metal more attractive relative to other yielding assets.

Gold is being viewed as a hedge against uncertainty, especially as tariff tensions could add to inflationary pressures and push bond yields higher, said TD Securities expert Bart Melek.

He also warned that if the trade war drags on, the US dollar could gradually lose its central role in the global trading system, which would further strengthen gold's position.

Nikos Tzabouras, senior market analyst at Tradu.com, said that gold is regaining its image as a safe haven amid volatile markets. He said that the upward trend is still strong and does not rule out the possibility that gold will set new price peaks in the near future.

However, Tzabouras also noted that if the US reaches trade agreements with its partners, the appeal of gold could decline. Additionally, if the Fed cuts interest rates but the US dollar recovers strongly, this could put pressure on gold prices again.

WisdomTree commodity strategist Nitesh Shah stressed that the world is entering a period of uncertainty with unpredictable developments in the trade war.

He predicts that gold prices could continue to rise and reach $3,600 an ounce within the next year. In a worse case scenario, if risks continue to increase, gold prices could reach $4,000 an ounce.

Source: https://baonghean.vn/cap-nhat-gia-vang-chieu-11-4-2025-gia-vang-trong-nuoc-va-the-gioi-duy-tri-da-tang-du-giam-so-voi-buoi-sang-10294913.html

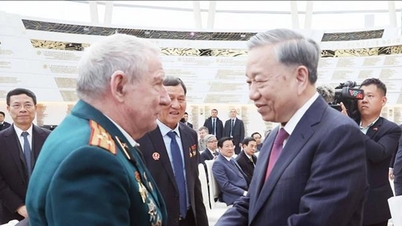

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

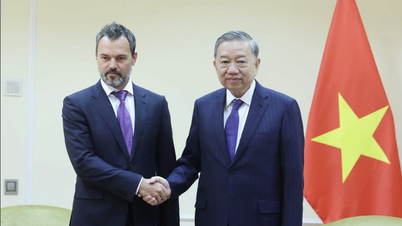

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)